How Walkability Impacts CRE Markets

A new report by Smart Growth America shows how walkable urban areas impact office, retail and other CRE asset types across the nation.

Walkable urban places have been attracting buzz for years. And as a groundbreaking new study shows, walkability has close ties to the prospects for investment and development, impacting pricing and tenant satisfaction.

According to the report, commissioned by the non-profit group Smart Growth America, office space in walkable urban areas commands an average 44 percent premium in pricing. Retail space registers a 41 percent premium, a weighted average which has stayed unchanged since 2019.

That reflects the distinctive character of walkable urban areas, defined as comprising a variety of real estate property types, such as office, retail, industrial, multifamily and single-family housing. Other key components are one-of-a-kind civic sites, such as museums or sports venues, within an approximately half-mile radius.

Walkable urban areas and drivable suburban locations constitute “two entirely different ways of building,” said Chris Leinberger, co-founder & managing director of Places Platform LLC and lead author of the report, Foot Traffic Ahead, Ranking Walkable Urbanism in America’s Largest Metros 2023. “Everything about it changes from your site acquisition to your financing, your construction types, your marketing, your management.”

Counting all property types (office, retail, for-sale homes and multifamily rentals), the highest-ranking metropolitan regions for walkability are New York City, Boston, Washington, D.C., Seattle, Portland, San Francisco, Chicago and Los Angeles. The lowest two are San Antonio and Las Vegas. These scores, the walkability of urban places, impact commercial real estate’s prices as well as location and tenant satisfaction.

To measure walkability and rank metropolitan areas, the study draws on data from research partners Yardi Matrix, Rocktop Partners LLC and the American Enterprise Institute Housing Center’s Walkable Oriented Development database, as well as additional sources.

Where foot traffic meets CRE’s footprint

In the 35 metropolitan areas measured, office real estate has the highest share among commercial real estate product types in walkable urban places—42.1 percent. For commercial real estate, retail averages the next highest concentration at 18.5 percent.

Through the rankings of each region’s walkable urbanism, office space and retail space follow differing trends. The more walkable an urban place, the higher the concentration of office space in the area. Retail, however, is more randomly dispersed in terms of its walkable urban shares despite how a region ranks.

- Level 1: In metro regions with the highest level of walkable urbanism, 38 percent to 73 percent of office inventory in these metro regions is in walkable locations. These regions include New York City, Boston, Portland, San Francisco and mostly walkable urban cities on coasts with the exception of Chicago. The link between these places? An easily accessible, easily navigable and relatively affordable transit system. Limited urban sprawl, a general environmental awareness and the building of rail networks and commuter transit options.

- Level 2: In the next group, between 33 percent and 51 percent of office inventory is in walkable locations, along with 6 percent to 30 percent of retail. Included are the Pittsburgh, Philadelphia, Miami, Austin, Texas, Denver and Houston metropolitan areas, which have seen a re-emergence of walkable neighborhoods. Due to the expanding hybrid work model, it is expected that some of these neighborhoods will see more local-serving retail and businesses in the years to come, rather than office space.

READ ALSO: What Will Retail Look Like in 2023?

- Level 3: Columbus, Ohio, Nashville, Tenn., Baltimore, Detroit and the Dallas-Fort Worth metropolitan areas fall into level three, lower-middle walkable urbanism. These areas are working on redeveloping walkability or implementing these systems for the first time. Here, office spaces are some 24 percent to 37 percent as a percentage of the entire market range for walkable urban shares. Retail ranges from 1 percent to 11 percent.

- Level 4: In urban areas with the smallest walkable footprint—many of them in the Sun Belt—from 7 to 24 percent of office inventory is in walkable areas, along with 4 percent to 13 percent of retail. This group includes San Diego, Phoenix, Orlando, Fla., Las Vegas and Tampa, Fla.

According to Leinberger, the top seven metropolitan areas, aside from Los Angeles, have produced enough walkable urban land to allow the market to perform well. Despite high price premiums, these locations offer opportunities for commercial real estate development and investment. Besides Phoenix, which is developing a rail network, the bottom seven have not invested in transit systems. Any existing rail stations generally do not offer opportunity for walkable urban development.

Whether commercial real estate investors and developers focus on office or retail, locating these property types in walkable urban areas could change the outcome of that asset’s success. “Office is going to be weak for a decade,” said Leinberger. While some office space will fare better than other, particularly that which is in a walkable urban space, the majority of office owners will likely feel pressure in the upcoming years.

“As far as retail, walkable urban retail, small-scale retail and urbanized chain retail are doing quite well,” said Leinberger. Stores that have adapted to try to get into the walkable urban market can produce smaller scale stores and fit them into walkable urban places. Those that continue to do this, such as Target, will fare extremely well, according to Leinberger. On the flip side, retailers such as Walmart that continue to go on the fringe and look for larger lots will fare in a less robust retail market segment.

Price premiums

The study also explores the price differences for properties in walkable urban places and drivable suburban locations, shown in the study via calculated combined rent premiums for office and retail properties compared to everywhere else in that region. In every region surveyed, office space in walkable urban locations commands a premium. The office premium in Boston is 83 percent for walkable urban areas; 56 percent in Chicago, 105 percent in New York City, 36 percent in San Francisco and 37 percent in Los Angeles.

Retail premiums, however, vary across the board with some markets showing discounts in walkable urban areas. In San Francisco the premium for retail in walkable urbanism is 41 percent, in Washington 107 percent and 27 percent in Chicago. Yet Portland shows an 11 percent discount.

Why are some of these price premiums so high? According to the report, walkable urban places were largely resilient to the pandemic, showing that people continue to prefer to occupy commercial real estate in these areas. However, there were exceptions in some office-dominated downtown spaces.

“Office, we know, is where the pandemic hurt real estate the most,” said Leinberger. “We probably have anywhere from 20 percent to 40 percent too much office in the system right now. That adjustment is going to take years.”

While there has been a lot of conversation surrounding office–to–residential conversion, Leinberger believes that due to the difficulty of these conversions, the pain of an excess supply of office space will remain for years. To justify a conversion to residential, prices need to significantly fall from where they were in 2019. Contrastingly, retail will likely ebb and flow.

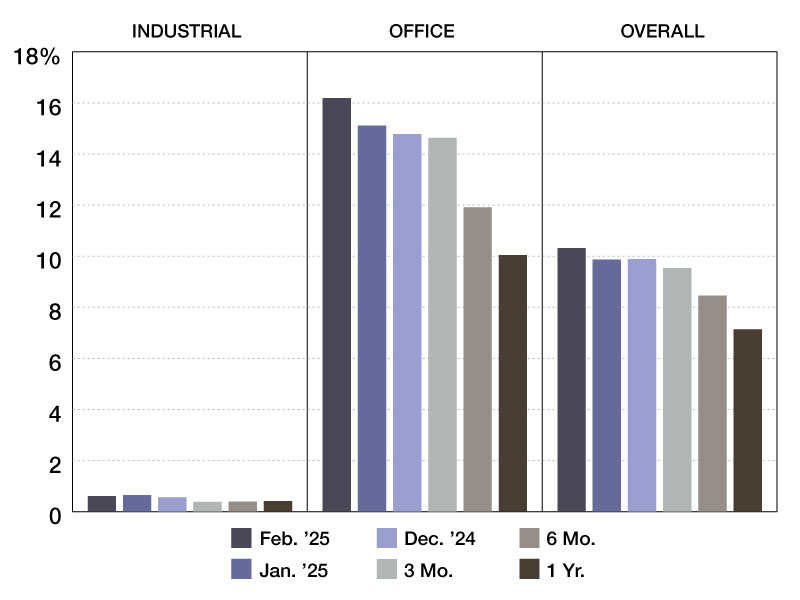

For general commercial real estate, premiums have decreased since 2018 in 26 of the 35 markets. However, they are still far above non-walkable urbanism prices. Office premiums, although decreasing in 21 of the 35 metropolitan areas since the pandemic, have remained high. While commercial real estate pricing largely dropped as a result of the pandemic, including in walkable spaces, property in WalkUps and walkable neighborhoods still leases and sells at a premium.

Yet, despite the popularity of walkable urbanism, it accounts for a relatively small footprint. “The places that we are identifying, these walkable urban places, whether they be contributing to the economy or whether they just be bedroom communities, they are 1.2 percent of the 35 metros and their land mass,” said Leinberger. “They generate 19 percent of the GDP in the country, not just in the 35 metros, and 6.8 percent of the U.S. population.”

Future of walkable urbanism

However, for more people to reap the benefits walkable urban places bring, our nation must set aside more space for this type of development. Leinberger believes the key to expanding walkable urban places is upzoning. “We estimate that in 98.8 percent of our metropolitan areas it’s illegal to build walkable urban development.”

That, he contends, would spark a huge increase in development activity. Development potential in suburban town centers and strip retail corridors, should the land be upzoned, would skyrocket while simultaneously driving down pricing. The more area that is rezoned for walkable urban development, the less expensive the land will be, driving down prices for every property category and easing the affordability crisis the U.S. is currently facing.

“The COVID pandemic and the recession that it caused turned out to be a bump in the road,” said Leinberger. “Most of the press came out in 2020 and 2021 saying ‘Our cities are dead’ for the fourth time in 40 years. There was a bump in the road that mostly affected office-dominated walkable urban places, but that’s a small fraction of the total walkable urbanism.”

You must be logged in to post a comment.