How Will Coronavirus Impact US Commercial Real Estate Sector?

A CBRE report looks at possible economic ripple effects in the U.S. from the spreading outbreak and explores which sectors could be affected the most.

A new CBRE Research report aims to answer the question on everyone’s minds: how will the coronavirus impact the U.S. commercial real estate? According to the report, the hospitality, retail and industrial sectors are the property types that could be affected at least in the short term by the fallout from the ongoing coronavirus (COVID-19) outbreak. But the firm’s researchers don’t expect a long-term impact on the U.S. economy at this time.

READ ALSO: New NAIOP Report Tallies CRE’s Contribution to US Economy

“If the coronavirus outbreak is relatively contained sometime in March, impacts on the U.S. and most commercial real estate sectors will be noticeable in the near term but less substantive over the year, with a net drag on U.S. GDP growth of between 5 and 15 basis points,” Richard Barkham, global chief economist & head of Americas research, CBRE, told Commercial Property Executive.

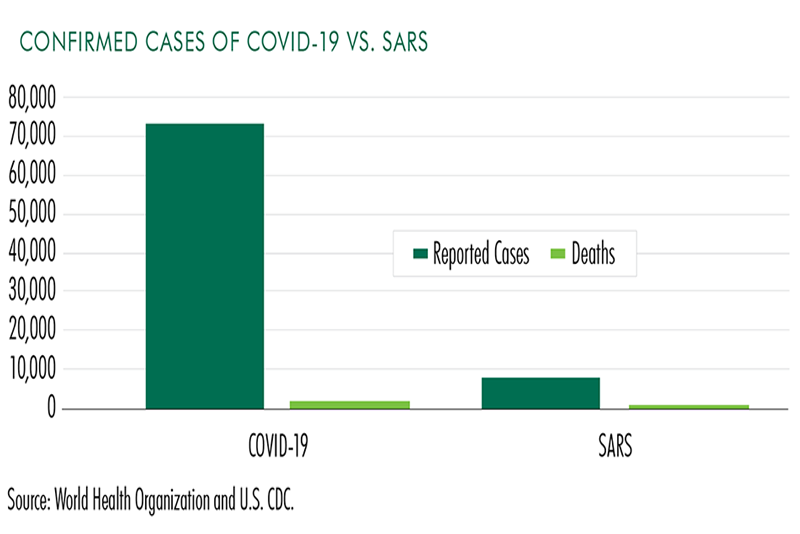

Since the COVID-19 outbreak was first reported in December, more than 73,000 cases have been confirmed, with more than 1,870 deaths as of Feb. 18, mostly in China. While global health experts had predicted the virus would peak in Wuhan, China, in mid-to-late February, it is now expected it won’t peak until sometime in March.

CBRE notes hotels and some retail centers in markets frequently visited by Chinese tourists, such as San Francisco, Los Angeles and New York City, could see at least a modest reduction in demand. “A rebound in Chinese tourism is expected by year-end but impacts to hotel demand and room rates will reverberate beyond 2020,” Barkham said.

Those short-term impacts could become more of a problem, however, if fear of infection causes a reduction in discretionary business and leisure travel. Hotel operations could see significant disruption if large meetings and conventions are postponed or cancelled. If Chinese travel becomes limited in the longer term, it could affect hotel demand into 2021, the report stated.

In trying to determine how the coronavirus will impact the U.S. commercial real estate sector, CBRE looked back at the SARS epidemic in 2003, when about 8,100 people were infected and 774 died over a seven-month period. During the SARS outbreak, U.S. tourist arrivals dropped from about 400,000 in 2001 to less than 300,000 in 2003. It rebounded to more than 400,000 two years later. Tourism to the U.S. has increased substantially since then. CBRE states U.S. visits by Chinese tourists are now 13 times more than they were in 2002. China is now the largest consumer of U.S. travel services including airlines and hotels. California, New York and Nevada see the most visits by Chinese tourists, particularly Los Angeles, San Francisco and New York City. Still it’s important to note that Chinese travel to the U.S only accounts for 0.16 percent of U.S. GDP and the Chinese account for about 4 percent of international travelers to the U.S., according to CBRE.

Possible industrial impacts

Another key difference when looking at potential economic impacts from COVID-19 versus SARS is that China accounted for just 4 percent of global GDP during the SARS outbreak compared to 16 percent today. But China accounts for 20 percent of global manufacturing output and is a crucial part of the world’s supply chain. That could eventually impact U.S. supply chains if imports to the U.S. slow down due to the Chinese manufacturing system being shut down for a longer period. High-value industries like autos and electronics could see broader problems if the virus continues to spread.

“The primary impact to the industrial market will likely be felt by manufacturers that export to China, though overall demand for industrial space will likely not be affected,” Barkham added.

While China is much more integrated into the global economy today than it was during the SARS epidemic, CBRE notes global property fundamentals are strong and anticipated levels of growth should be enough to sustain the current economic conditions even when factoring in COVID-19 impacts. A clearer picture should emerge in March as to whether the virus outbreak will have a short-term versus long-term effect on the global and U.S. economy, according to CBRE.

You must be logged in to post a comment.