I.CON Special Report: Industrial Flexes Muscles Amid Rapid Change

Expect fewer mega-deals but abundant demand for development and investment.

By Paul Rosta

Jersey City, N.J.—Rapid change, opportunity and steady demand: those forces shaping the industrial real estate sector were cited frequently at I.CON, the annual conference sponsored by NAIOP last week in Jersey City, N.J.

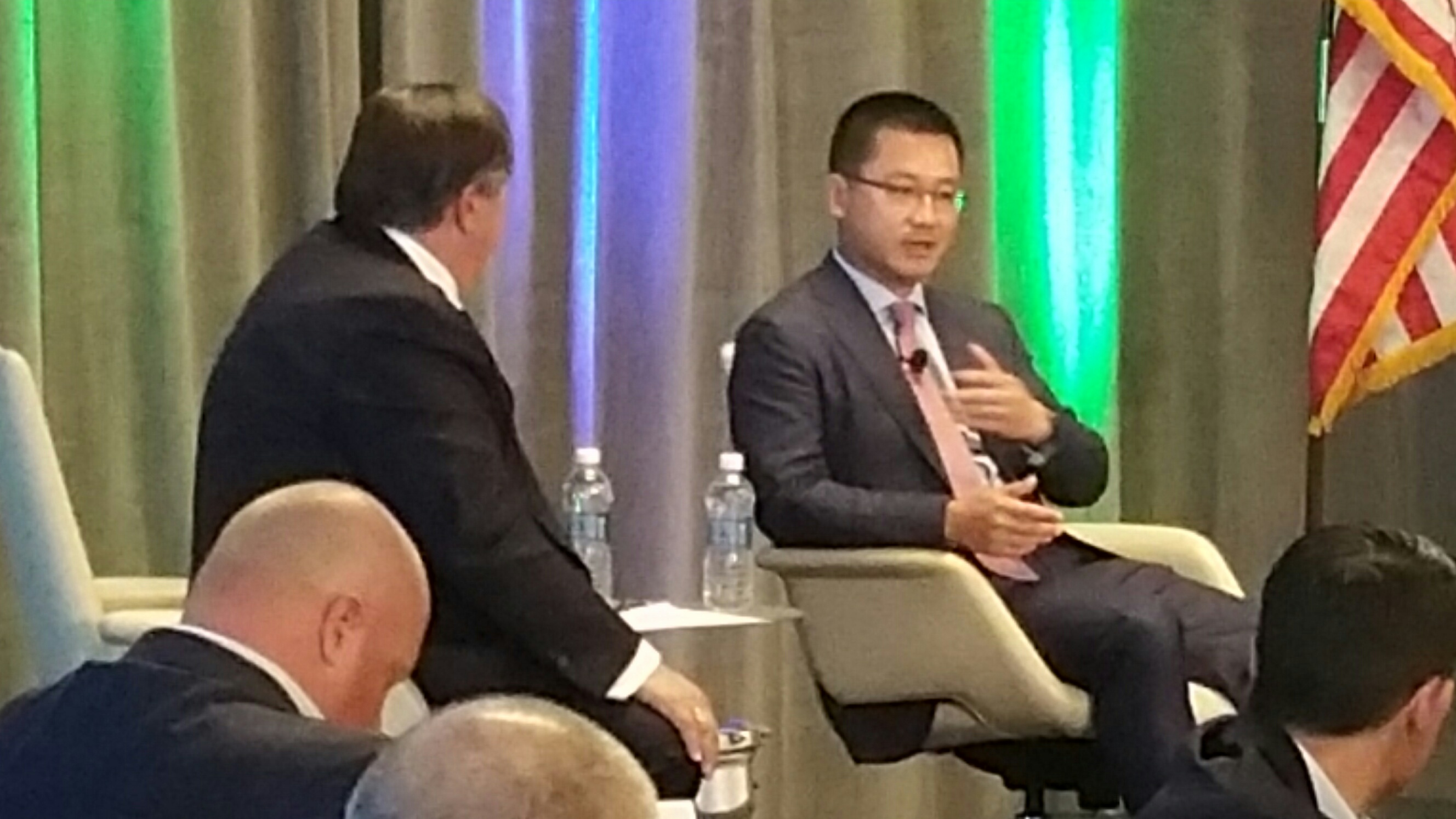

Left to right, Chris Caton of Prologis, Cushman & Wakefield’s John Morris and Clark Machemer of the Rockefeller Group discuss industrial real estate trends at I.CON.

“This cycle’s uncertain,” noted Chris Caton, senior vice president & global head of real estate research at Prologis Inc. During a Thursday afternoon session on industrial real estate cycles, Caton noted that such trends as consolidation, institutional ownership and e-commerce have been among the sector’s most influential trends. E-commerce, in particular, is spurring an outsized share of industrial development, and Caton characterized demand facilities related to e-commerce as being in only the second inning.

In response, developers are expanding speculative construction, noted John Morris, executive managing director & industrial services lead for the Americas at Cushman & Wakefield Inc. The signs are hard to miss. At 6.1 percent, the national industrial vacancy rate is at a 30-year low and 220 basis points under the 10-year historical average, according to the firm’s research. E-commerce is clearly a leading factor, accounting for 45 percent of industrial absorption over the past three years.

As of the first quarter this year, spec projects under construction totaled nearly 110 million square feet, equivalent to about 62.5 percent of the total under construction, according to Cushman & Wakefield research. Although the spec pipeline is robust, other signs suggest that development is under control, Morris pointed out. For instance, the gap between spec and build to suit is considerably less than in 2007, when spec projects accounted for more than 80 percent of development. And the volume of new product that has come on line since 2010—about 566 million square feet—is 27 percent less than the total from 2004 to 2009.

On a related note, Caton pointed out that last year’s 175 million square feet of deliveries translated into only about 1.3 percent of existing stock, a considerably smaller share than in other periods of the past 15 years.

View from the Top

The audience of 600-plus real estate professionals also heard perspectives from the architect of one of the industrial sector’s boldest strategies. “I think the U.S. is somewhere that offers the best risk-adjusted returns,” said Ming Mei, CEO of Global Logistics Properties Ltd., during the Thursday afternoon keynote session. Last year the Singapore-based firm vaulted into second place among owners of U.S. industrial properties on the strength of buying a 58 million-square-foot portfolio from Industrial Income Trust and a 55 percent stake in IndCor Properties, a former Blackstone affiliate that had been acquired by GIC, Singapore’s sovereign wealth fund, for $8.1 billion.

Asked by Craig Meyer, president of JLL’s industrial brokerage in the Americas, to sum up what GLP is looking for, Mei replied, “Anything from a build-to-suit to a speculative building in a good market with strong demographics.” Especially attractive, he added, are metro areas with populations of at least 1 million.

Mei speculated that mega-deals on the scale of those orchestrated by GLP will be scarce for a while, but he still expects to see transactions of a respectable size. “I think we’ll see a few $100 million to billion-dollar portfolios out there.” Elaborating later on that Mei added, ““This year and next year, there will be a couple of portfolios up for grabs, either (via) IPOs or private sales.”

You must be logged in to post a comment.