Income to Drive Near-Term Returns

As we enter the later stages of the cycle and capital appreciation declines, investors will rely on income to provide stability, argues Situs RERC President Ken Riggs.

By Ken Riggs

Commercial real estate is an attractive investment and is increasingly entering the mainstream for investors. CRE offers many benefits, including lower volatility and diversification relative to stocks and bonds. Situs RERC predicts that steady economic growth and strong CRE fundamentals will support current prices in the market and the sector will provide stable risk-adjusted returns in 2018.

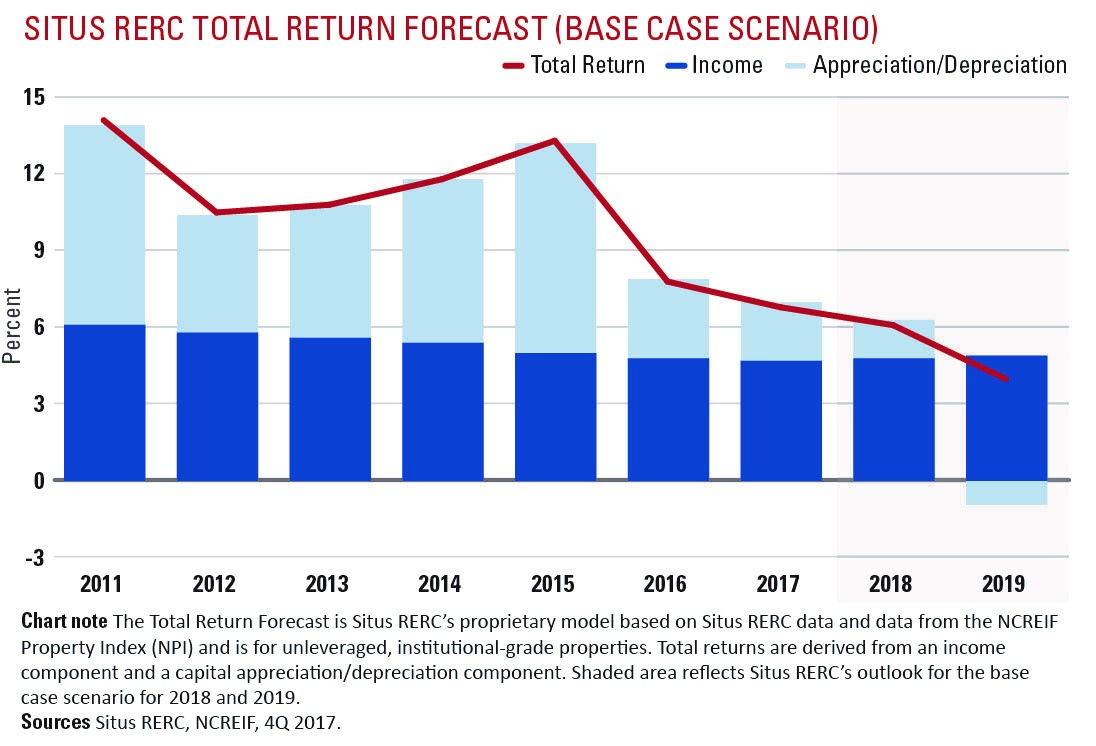

Despite this, investors need to come to terms with some emerging realities. Capital appreciation, which has been the major driver of total returns over the past cycle, is slowing down. Situs RERC predicts that appreciation returns will continue to decelerate and flatten out for at least the next two years, potentially turning slightly negative by the end of 2019.

The industry’s bullish run has been on the back of low cap rates and strong fundamentals, such as rent growth, high occupancy and steadily declining unemployment. As the economy is operating at near full employment, occupancies will continue to show strength, given the supply constrains thus far, except for the apartment sector, which is seeing rental growth decelerate. CRE transaction volume is down and Situs RERC is beginning to see cap rate compression stall or reverse course. As prices flatten or decline, on average—due to rising interest rates and the nature of expansion cycles that must come to an end—income is expected to continue being the greatest driver of total return, while capital appreciation decreases and cash flow stabilizes. This has always been the case for real estate, where most of return is in the income component.

Income’s Importance

Situs RERC expects the relatively safe and steady income component of CRE will be the main source of returns and can help investors through economic rough patches and market volatility. Even in an economic downturn, the income component of CRE returns is relatively stable, especially compared to other traditional investment alternatives. And given the wildly fluctuating returns for other asset classes, investors seem content with the steady source of income.

Based on Situs RERC’s historical going-in cap rates, we see that the income component for CRE has been stable for most property types over the past several years. However, we are nearly nine years into the economic recovery; assuming that positive economic conditions persist over the next few months, it will become the second-longest recovery in U.S. history. The real estate market is cyclical in nature and a correction is likely to be on the horizon, although it is likely a couple of years out.

Though narrowing, 2017 spreads between required pre-tax yield rates (IRRs) and the 10-year Treasury were healthy, near 600 basis points, as we reach the market’s peak and the 10-year Treasury spikes upward. We would like to note that the direction of interest rates is a critical factor that could quickly change the dynamics of all mainstream asset classes, including real estae.

The low interest rates have been a catalyst for the soaring prices witnessed since the last recession, and this is very evident in the coastal markets. While the 10-year Treasury rate remains exceptionally low from a historical perspective, it has increased roughly 40 bps since the beginning of the year. Additionally, the Federal Open Market Committee (FOMC) is expected to raise the short-term interest rate this week, which may cause long-term interest rates to rise again. As rates rise, and investment yields on bonds improve, demand for real estate will likely soften. This could lead to losses for investors, especially those who are locked in to long-term leases that do not factor in a cushion for unexpected rate hikes.

Nonetheless, if political uncertainty and market volatility continues throughout 2018, real estate will likely be the best source of stability for investors. However, these investors still need to face market realities: The double-digit total CRE returns appear to be a thing of the past as capital appreciation continues its downward slide, at least for the next several years.

You must be logged in to post a comment.