Increasing Rates Lead to Decreasing Leverage

Upward pressure on U.S. Treasuries and the likelihood of future interest rate hikes are impacting investor returns. Here's how, according to CBRE Vice President Brandon Smith.

By Brandon Smith

Given all of the rosy data released during the week of the State of the Union, the last event anyone expected on the first Monday of February was the largest one-day point decline on record. This is after the market absorbed a decent core inflation number (1.5 percent), a very optimistic message from the President and a strong jobs report that exceeded expectations. While most economic fundamentals remain strong, this stock market correction is directly linked to recent movement in the bond market. Borrowing cost for real estate owners has increased but the impact hasn’t effected asset prices. Fortunately, investor demand for real estate mortgage-backed securities is strong, which is pushing spreads lower.

Given all of the rosy data released during the week of the State of the Union, the last event anyone expected on the first Monday of February was the largest one-day point decline on record. This is after the market absorbed a decent core inflation number (1.5 percent), a very optimistic message from the President and a strong jobs report that exceeded expectations. While most economic fundamentals remain strong, this stock market correction is directly linked to recent movement in the bond market. Borrowing cost for real estate owners has increased but the impact hasn’t effected asset prices. Fortunately, investor demand for real estate mortgage-backed securities is strong, which is pushing spreads lower.

Upward Pressure on US Treasuries

The 10-year U.S. Treasury has increased by over 50 basis points (bps) in the past three months, reaching as high as 2.86 percent. The two-year U.S. Treasury rose to 2.18 percent, and has increased 60 bps over the last three months, to decade highs for that index. As the difference between the two indices narrows, the odds that a recession occurs increases.

A number of factors are driving this upward pressure on rates:

- Headline GDP came in at a weaker-than-expected 2.6 percent last month—not quite hitting the 3 percent forecast. However, underlying data was strong so rates moved higher regardless. The 2.4 percent saving rate in December hit a 12-year low for this cycle, as high asset prices and the prospect of lower taxes enticed consumers to spend more. So, the market expects GDP to push higher.

- Some investors see a potential for an increase in infrastructure spending on top of the $1.5 trillion in tax cuts enacted in December, which would boost activity in an economy already experiencing robust growth.

- There will be additional government gridlock as Congress debates, among other items, increasing the debt ceiling. Once that is resolved, the Treasury will announce the net debt issuance will be double what is was in 2017. More supply means higher bond yields.

- The Fed remains committed to its decision to reduce its $4.2 trillion balance sheet, while continuing to increase rates this year. The balance sheet reduction alone will have an effect equivalent to raising interest rates by an additional percentage point. And now the Fed funds futures market suggests a 24 percent chance that the Fed lifts rates four or more times this year, which would put LIBOR at 2.50 percent.

- The January jobs report showed that wages are up 2.9 percent—the highest level since 2009. Wage growth will drive inflation, and the Fed is indicating they will respond to inflation aggressively. This was the latest data point that pushed the 10-year U.S. Treasury above 2.85 percent on a Friday and the market responded with a record four-digit drop in the stock market on Monday.

The bond market responded accordingly and the bond yields retreated by 16-plus bps as investors went running to safe-haven investments.

Rising Rates Effect on Leverage

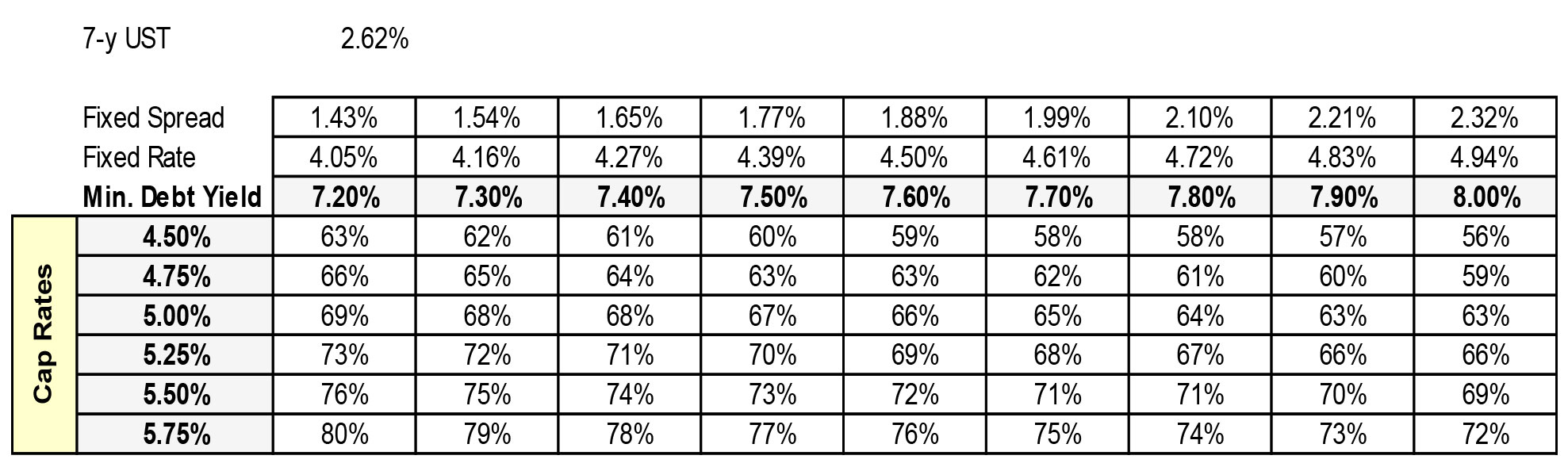

Due to the rise in treasury rates, we’ve seen Fannie Mae and Freddie Mac maximum leverage loans sizing in the 7.5 percent to 7.6 percent debt yield range. This is up from a 7.2 percent debt yield for 80 percent loan-to value (LTV) loan sizing just a few months ago. This increase in rates, and therefore higher sizing debt yields, has resulted in a leverage reduction of about 3 percent to 5 percent from three months ago due to higher interest rates. The chart below shows LTV ratios are based on a debt service coverage ratio of 1.25x (lowest sizing constraint) for seven-year, fixed-rate product. For floating rate loans, the sizing constraint will use the same methodology and generate similar proceeds. For example, at a 7.2 percent debt yield, a 5.0 percent cap rate deal would have been at 69 percent LTV three months ago; today that’s 66 percent to 67 percent LTV.

You must be logged in to post a comment.