Industrial Demand Builds Inland

Accelerated absorption kept vacancies low and rents growing, while development continued its shift toward markets with greater land availability, the latest CommercialEdge report shows.

Industrial real estate’s position remains strong. CommercialEdge’s April industrial report shows rents continue to expand, as strong absorption has kept vacancies compressed even as development rapidly moves forward in most markets. Increasing port traffic has led to considerable growth in coastal markets like Los Angeles, but the overall impact of increasing demand stretches further inland, as industrial users pursue lower price points in smaller, accessible metros.

Rents averaged $6.52 per square foot nationwide, a 4.4 percent increase year-over-year through March. Coastal markets with limited inventory and available land commanded the highest rents, with Orange County’s average of $11.11 per square foot topping the list of major metros. Many markets further inland were less costly but continued to heat up: Nashville, which averaged just shy of $5 per square foot, registered rent growth of 6.6 percent over the year.

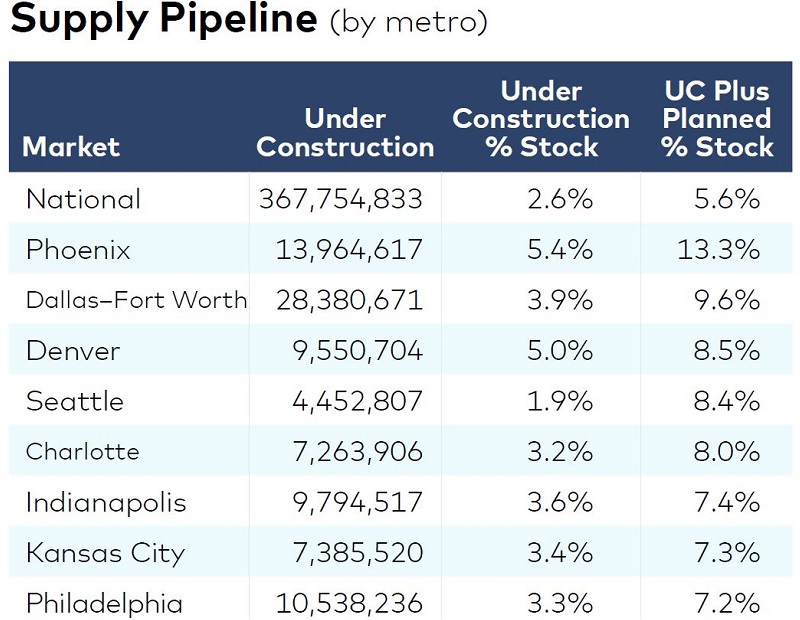

Vacancy averaged 6.1 percent nationwide, even as industrial development has pushed forward: 60.5 million square feet already delivered this year through March, following nearly 300 million square feet of new inventory added last year. Deliveries will continue to climb throughout the year, with close to 370 million square feet under construction and another 418.1 million square feet in planning stages. Development activity was highest in markets with growing demand and few limitations on land availability: Dallas-Fort Worth had 28.4 million square feet of industrial space underway, and Phoenix and Memphis, Tenn., had a respective 14.0 million and 12.2 million square feet under construction.

CommercialEdge reported $8.1 billion in industrial transactions for the first three months of the year. Although this falls short of the same period in 2020, when deals totaling $10.9 billion closed, pricing per square foot has soared, averaging just north of $110 per square foot, a 29.1 percent increase year-over-year. The Los Angeles market led the country in overall volume, with $775 million closed, though pricing was the highest in New Jersey, where sales averaged $277 per square foot.

Read the full CommercialEdge report.

You must be logged in to post a comment.