Industrial Demand Slips, But Avoids a Slump

Here's what to expect next, according to JLL’s latest report.

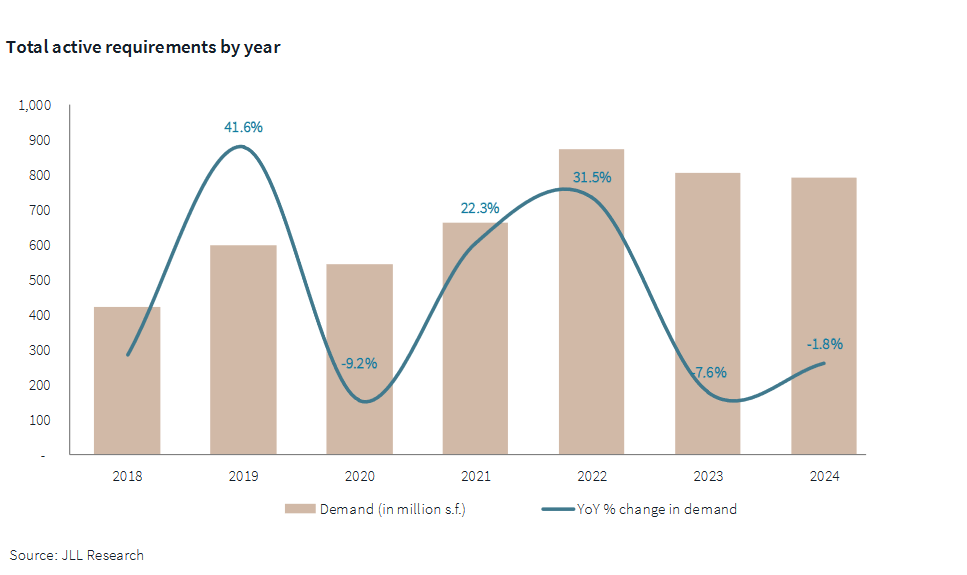

Overall demand is down slightly in the U.S. industrial real estate sector as tenants become more cautious and focused on cost control, according to JLL’s 2024-2025 industrial tenant demand study, which puts the decline in industrial requirements at 1.8 percent compared with a year ago. The report says that current requirements are 792.2 million square feet nationwide.

That is a reduction, but not as much (so far this year) as during 2023, when active requirements were down 7.6 percent compared with the year before. But even that figure represents more of an adjustment than a slump, since active space requirements ballooned during 2021 and 2022, up 22.3 percent and 31.5 percent year-over-year, according to JLL data.

“We expected there to be a deeper fall in demand compared to last year,” JLL Global Head of Industrial Research Mehtab Randhawa told Commercial Property Executive.

That tends to indicate that while the pandemic-inspired boom may be over, it hasn’t been followed by a complete bust, but rather an adjustment. When the boom ended, that left occupiers with a dawning realization of higher costs for space, among other squeezes on the industry, so deliberations on leasing are taking longer, Randhawa pointed out.

Tenants are still actively looking for industrial space, but they are also taking more time in doing so, weighing their relatively limited choices carefully, the report explained. Also, the path from inquiries to signed leases is resulting in fewer deals, despite significant interest in space. Many potential deals are simply falling through without reaching completion.

“There’s been a slowdown in decision-making,” Randhawa said. “Rents are expensive, land is expensive to build, and there’s been a reset happening to their entire global supply chain network. So they’re reevaluating their portfolios.”

While overall demand has slowed or come to a complete halt in some cases, there is, however, higher confidence that space requirements will eventually result in actual deals.

Thus, current market conditions don’t amount to a slump, since underlying demand remains robust. A number of factors are sustaining demand, such as the construction machinery and materials subsector, whose growth is partly fueled by federal infrastructure investments and sustainable building initiatives. Though perhaps not inking deals for space with the same gusto as during the pandemic, traditional retailers are also still demanding industrial space.

That is also true for manufacturing facilities, which account for 15.6 percent of overall industrial requirements, up 20 percent compared with a year ago, and totaling 123.9 million square feet so far in 2024. The figure is not only up for the year, but positively mushrooming since the pre-pandemic era—up more than 354 percent compared with 2018.

The pandemic dislocated world supply chains and forced U.S. companies to rethink where they make goods, and how they get them to market. Reshoring trends and supply chain restructuring are prompting manufacturers to establish or expand facilities, spurring further demand, the report says.

READ ALSO: Why Things Are Looking Up for Ports, Supply Chains

The trend is expected to continue, JLL predicted. Next year, manufacturing facilities will account for over 19 percent of space demand. As recently as 2020, that figure was only 4.9 percent.

Regarding the expansion of manufacturing in North America, and the expansion of space for those facilities, Randhawa noted that there will be much more such demand in the coming years.

“These are longer-term facilities,” she said. “They aren’t like warehouses and distribution buildings, which you can build in 10 to 12 months. Some of the industrial facilities take years, and there are different life cycles for each of these projects. Some users are still in scouting mode, looking for the next location where they can plant their flag.”

Industrial demand shifts to the Midwest, Great Lakes

There is also a geographical shift underway in the industrial market, the report posited, especially as manufacturing takes up a greater share of space requirements. Some markets have an edge due to a number of factors.

“Key markets such as Chicago, Dallas-Fort Worth and Phoenix are experiencing substantial manufacturing demand, driven by factors including land availability, power resources, labor accessibility and advanced manufacturing capabilities,” the report noted.

Regionally, there is an ongoing demand migration toward the central U.S.—namely, the Midwest and Great Lakes region, as more than a quarter of expansion requirements are in that region. According to JLL, this part of the country offers a number of competitive advantages to space users, such as a strong existing workforce, access to power and water, and a robust rail infrastructure.

You must be logged in to post a comment.