Industrial Keeps Trajectory

Distribution space in coastal markets remains scarce in the face of heightened, sustained demand, CommercialEdge’s latest report shows.

CommercialEdge data as of September 2021

The industrial market continues to shine, according to the latest CommercialEdge report, with strong, positive signs across the board. While operations within the sector are facing serious challenges in terms of bottlenecks, with major backlogs at all major ports, this has not translated into any serious impact on demand for distribution space.

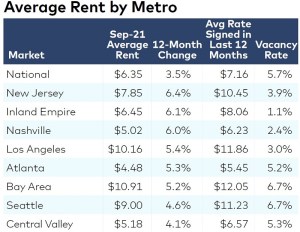

Rents averaged $6.35 per square foot nationwide in September, a 3.5 percent increase over the year. Tenants signing new leases paid an average premium of $0.81 per square foot. The highest year-over-year rent growth occurred primarily in port markets, which also saw the largest premiums on new leases. New Jersey’s rents increased by 6.4 percent $7.85 per square foot, with new tenants paying an average of $2.60 per square foot extra on new commitments.

National vacancy fell 20 basis points from August to 5.7 percent in September, with the lowest rates in coastal markets near ports and in a select number of Midwestern distribution hubs. The Inland Empire had the lowest vacancy nationwide by a large margin. At 1.1 percent, the market’s vacancy continued to fall by 10 basis points from the previous month. Indianapolis reported the second-lowest rate, at 2.3 percent. The market’s central location and low costs have drawn significant demand for space. With more than 13 million square feet has delivered since the beginning of 2020, however, rent growth remained muted at 1.3 percent year-over-year.

Industrial development is moving forward at a rapid pace nationwide: Developers had already added 217.3 million square feet year-to-date through September. Another 507.5 million square feet was under construction, equal to 3.2 percent of inventory, and deliveries for the year are expected to surpass the 300 million-square-foot mark. Dallas-Fort Worth had the most active pipeline, with 36.5 million square feet underway, though Phoenix continued to surge, with 26.6 million square feet under construction, or 9.9 percent of inventory—the highest proportion across the country.

Investors continued to seek out industrial opportunities: This year through September, $41.7 billion in transactions closed, well on track to surpassing last year’s record investment volume of $47.1 billion. Sales prices, too, are on the rise, averaging $108 year-to-date, 23 percent higher than the 2020 figure. Los Angeles had the highest investment volume, with $3.3 billion closed through the end of the third quarter, averaging $211 per square foot.

Read the full CommercialEdge report.

You must be logged in to post a comment.