Industrial Market: Still Going Strong

Despite approximately 1 billion square feet of new space coming to the market over the last three years, demand continues to drive rent growth, Transwestern reports.

Transwestern’s fourth quarter report on the national industrial market shows that the segment is not slowing down anytime soon, with rents commanding higher figures than ever.

Transwestern’s fourth quarter report on the national industrial market shows that the segment is not slowing down anytime soon, with rents commanding higher figures than ever.

Even though almost 1 billion square feet of new industrial inventory was delivered since 2015, 2018 ended with a 4.7 percent vacancy rate, less than half of what the post-recession high was in 2010, when the figure reached 9.5 percent. Furthermore, rents have been on an ascending trajectory for six years, ending the fourth quarter at $6.29 per square foot.

According to the report, the increased demand is driven by factors such as high port volumes, job growth in construction, manufacturing and retail trade, and an increase in e-commerce sales.

“The growth of the industrial market in the U.S. has coincided with the current economic expansion, which has lasted since mid-2009,” Matt Dolly, Transwestern’s director of research in New Jersey, told Commercial Property Executive. “The growth of e-commerce has been at the forefront, as its percentage of overall retail sales in the U.S. has more than doubled from 4 percent to more than 9 percent during the same period.”

Furthermore, technology—more specifically, mobile commerce—has contributed to an increase in online shopping and supply chains continue to be enhanced to meet consumer needs. This, in turn, positively affects the industrial market. The manufacturing resurgence has also given an assist.

U.S. Looking Up

In the U.S., noteworthy trends impacting the market include job growth in several sectors which support the industrial market, such as construction, manufacturing and retail trade; e-commerce sales during the holiday season, which saw a 20 percent increase year-over-year; and container volumes at ports accelerated during the fourth quarter, ahead of potential increase on tariffs.

Transwestern tracks 47 industrial markets and of those, more than 90 percent saw year-over-year rent growth last quarter, and only four markets didn’t post net absorption for the year.

Transwestern tracks 47 industrial markets and of those, more than 90 percent saw year-over-year rent growth last quarter, and only four markets didn’t post net absorption for the year.

“The port markets have continuously set annual records for container volumes, bolstering their respective industrial markets,” Dolly said. “The nation’s largest port markets, Southern California and New York/New Jersey have been strong growth regions, and warehouse supply is becoming limited in core submarkets.”

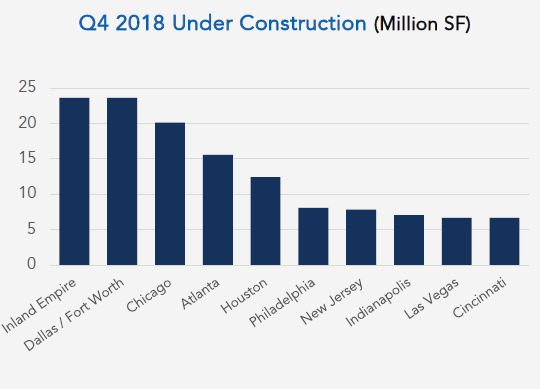

Other metros with large population centers resulting in high demand and increased warehouse construction include Atlanta, Chicago, Dallas and Houston. Smaller markets which are expanding rapidly include South Florida, Seattle and Lehigh Valley, PA.

Looking ahead, Transwestern believes the leasing pace could slow this year because of political uncertainty, a decrease in retail sales, plus a smaller percentage of large deals simply due to a lack of space.

“It’s full steam ahead for the industrial market in the U.S., at least for the next 12 to 18 months, which is why many investors continue to focus on this product type,” Dolly said. “E-commerce is growing at a faster pace every year and we are still early in its cycle—there is plenty of room to grow. Since much of what is shipped to consumers are everyday needs, and people depend more and more on convenience and accessibility, we would be hard-pressed to find something that would slow this industrial freight train down.”

A recent Kingsley Associates survey showed that overall tenant satisfaction in the industrial sector is relatively volatile compared to the office sector. In fact, over the past five years, overall satisfaction with the tenant experience has ranged from a low of 79.9 percent in the second quarter of 2014 to a peak of 86.9 percent in the third quarter of 2016.

Charts courtesy of Transwestern

You must be logged in to post a comment.