Industrial Lending Runs at Record Pace

MBA’s latest snapshot of key CRE finance trends.

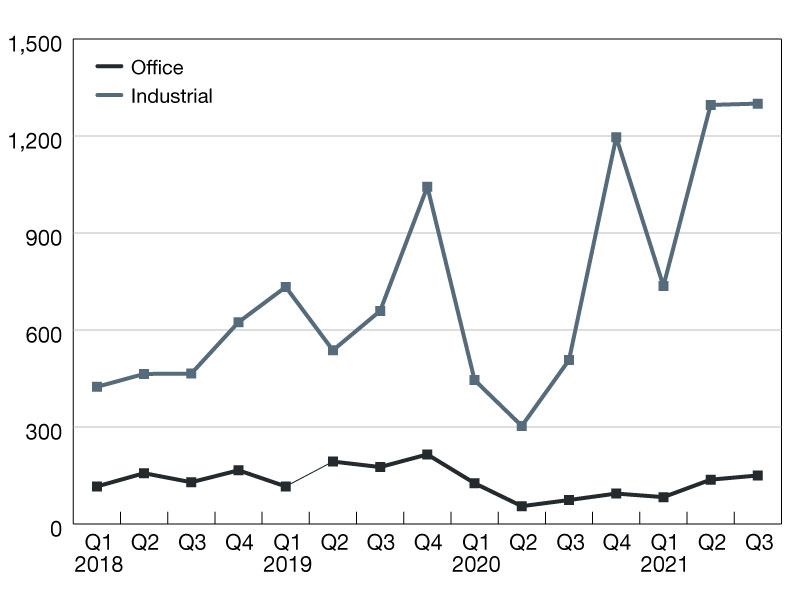

Origination Volume Index; 2001 Quarterly Average = 100

2021 is shaping up to be a very strong year for commercial real estate finance.

According to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations, borrowing hit an all-time quarterly high during the third quarter, driven by strong or improving market fundamentals, higher property values, low interest rates, and solid mortgage performance.

It is clear borrowing and lending are running at high levels, but there continues to be an important differentiation by property type. A prime example of this is when looking at the industrial and office sectors.

Lending activity backed by industrial and multifamily properties are each running at a record annual pace. Year-to-date office lending is up significantly from last year’s lows but remains below 2019 levels.

With the worst of the COVID-19 pandemic hopefully in the rearview mirror, MBA expects the economic rebound to continue this year and next. More good news for the office market? According to the U.S. Bureau of Labor Statistics’ October jobs report, only 11.6 percent of workers teleworked in October due to the pandemic, a drop from 13.2 percent in September.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.