Industrial Real Estate’s Positive Prognosis

Increased online shopping should continue after the pandemic and that's good news for warehouse and distribution real estate in the long term.

The COVID-19 pandemic is disrupting the supply chain and forcing many consumers to change the way they shop. But while these disruptions are creating economic strain, they also present huge opportunities for industrial real estate.

“The industrial market is one of the obvious winners in the current situation,” said Bert Sanders, vice chairman at Newmark Knight Frank.

It’s easy to see why. Social distancing has changed the nature of how people buy goods because, in the absence of conventional retail, consumers are making the most of their purchases online. The “just in time inventory “supply-chain strategy is suffering under the strain of this expansion of e-commerce. As a result, the need for warehousing of additional inventory has grown. Additionally, retail locations that are temporarily closed will need additional storage for their excess inventory, creating short-term demand for temporary space.

It’s easy to see why. Social distancing has changed the nature of how people buy goods because, in the absence of conventional retail, consumers are making the most of their purchases online. The “just in time inventory “supply-chain strategy is suffering under the strain of this expansion of e-commerce. As a result, the need for warehousing of additional inventory has grown. Additionally, retail locations that are temporarily closed will need additional storage for their excess inventory, creating short-term demand for temporary space.

CBRE reported 34 million square feet of positive net absorption nationwide in the first quarter, and average vacancy at 4.5 percent—nearly a record low. Asking rents rose by 4.8 percent year-over-year. Other property types did not finish the first quarter as solidly.

READ MORE: Grocery Stores Pick Up, While Most Retail Slows Down

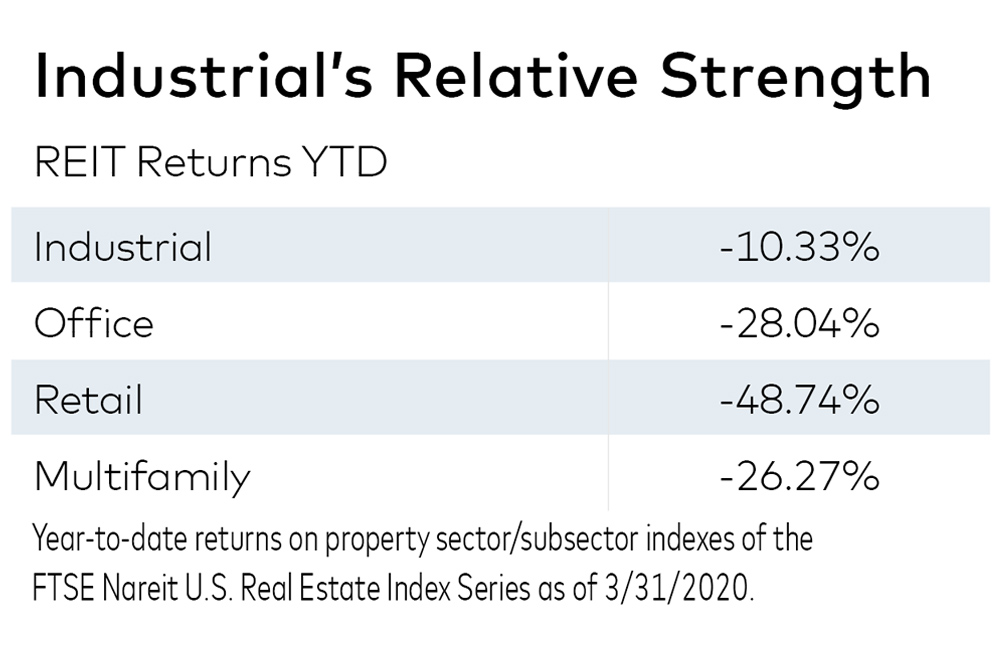

The resilience of the sector is also seen in investor returns. According to Nareit, every major real estate sector yielded negative year-to-date returns. Multifamily posted a 26 percent loss, office a 28 percent loss and retail a whopping 48 percent loss. Meanwhile industrial was only down 10 percent over the same period.

Not all markets benefit

“The obvious benefactors are the tier-one cities,” Sanders noted.

The largest markets and point-of-entry markets can be expected to see increased demand for warehouse and distribution space. Los Angeles, for example, hosts over a billion square feet of industrial inventory while having vacancy rates less than half of the national average. The available space is being absorbed as fast as it’s getting built, yet they still have a lot of room to run.

Tertiary markets, on the other hand, will profit less from the increased demand. Cincinnati, for example, has seen industrial vacancy nearly double in the past year with preexisting construction threatening to overburden an already saturated market.

Tertiary markets, on the other hand, will profit less from the increased demand. Cincinnati, for example, has seen industrial vacancy nearly double in the past year with preexisting construction threatening to overburden an already saturated market.

Cincinnati is not alone, as many inland markets have been overbuilt in the past few years in a flurry of investments in last mile logistics. Meanwhile, nearby Indianapolis is projected to be one of the highest markets for absorption as it establishes itself as the premiere distribution hub for the lower Midwest. The pandemic has moved the bottleneck in the supply chain from last mile to primary and intermediary transportation hubs.

Investors are taking a “wait and see” approach to new deals until the dust settles, while many deals that were already in the works are continuing to go forward as scheduled. Sanders says that “there is a lot of dry powder on the sidelines looking for opportunities.”

Consumers still buying

While it is clear an economic downturn is upon us, consumer demand for essential goods has not abated and, in some cases, it has increased. The most obvious example is food. Home delivery of groceries has become dramatically more popular and overall grocery sales have increased as well. This is entirely due to social isolation practices preventing people from eating out and social distancing concerns keeping people from visiting grocery stores unless absolutely necessary.

Andrew Kern, Senior Research Analyst, Yardi Matrix.

A recent CBRE report on the COVID-19 food industry implications on industrial real estate cited data showing online grocery sales grew 100 percent between March 13 and March 15 and that 46 percent of respondents intend to continue buying groceries online after the pandemic subsides.

This underscore’s CBRE estimate that an additional 75 million to 100 million square feet of cold storage is needed. It is possible to retrofit existing inventory for cold storage, but purpose-built climate-controlled facilities are more desirable and tenants are willing to pay a premium to occupy them.

Durable goods go online

On the durable goods side, increasing demands on e-commerce will require additional warehouse-distribution facilities—bf particularly in the port-of-entry markets. Consumers who are unable to patronize retail locations will need to order online, putting greater strain on the supply chain. Since these goods must be kept in larger quantities to supply that demand, the existing bulk facilities will need to be expanded to accommodate the change. Additionally, the need for temporary inventory storage for brick-and-mortar retail will also fuel demand for the immediate future.

There is a great deal of economic hardship ahead, but industrial real estate will not only weather the storm but grow in new and interesting ways.

You must be logged in to post a comment.