Industrial REITs Lead the Sector for FFO in April

The sector continues to lead the sector in terms of the last 12 months’ FFO multiple.

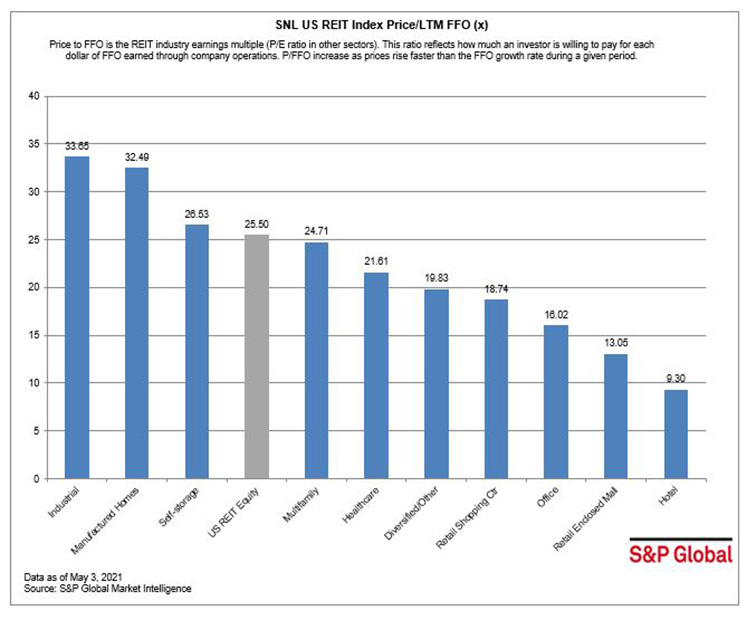

As of May 3, the industrial sector led all publicly traded U.S. equity REIT sectors in terms of the funds from operations multiple for the last 12 months.

Furthermore, the sector posted a 33.65x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 8.15 percentage points. The manufactured homes and self-storage REIT sectors followed with multiples of 32.49x and 26.53x, respectively. On the other hand, the hotel sector ranked last with a 9.30x price to LTM FFO.

Among the REITs focused on the industrial sector, Americold Realty Trust Inc. had the highest price to last 12 months FFO multiple of 52.6x.

Lastly, Equity Commonwealth, an office REIT, had a 221.4x LTM FFO multiple, the highest among the publicly traded U.S. equity REITs.

George Ziglar is an associate for the Real Estate Client Operations Department of S&P Global Market Intelligence.

You must be logged in to post a comment.