Industrial Still Going Strong

The latest CommercialEdge report shows how the sector has stayed stronger than ever, even despite global supply chain setbacks.

CommercialEdge data as of October 2021

The industrial market has continued to make gains in virtually every aspect, the latest CommercialEdge report shows. Though the sector has been affected by myriad difficulties, from severe supply-chain bottlenecks to skyrocketing construction costs, demand for industrial real estate has only grown.

Nationwide, industrial rents hit an average of $6.37 per square foot in October, a 3.9 percent gain over the year. New leases had an average premium of $0.82 per square foot, highlighting the sustained, elevated demand in the sector across the country. The highest rents were in California, with Orange County averaging $11.47 per square foot followed by the Bay Area (at $10.87 per square foot) and Los Angeles ($10.20 per square foot).

The Inland Empire had the fastest rent growth nationwide, up 6.6 percent year-over-year to $6.45 per square foot in October. Outside of the Golden State, a number of key markets also exhibited soaring growth, including Nashville, up 6.2 percent over the year to $4.88, and New Jersey, where rents jumped 5.7 percent to $7.92. New Jersey also had the highest premiums across the country, with new tenants paying an average of $2.54 per square foot above the market average for leases signed during the previous year.

Vacancy increased to 5.9 percent in September, a 20-basis-point uptick over the month, but wide variations were seen at the market level. The Inland Empire, long the market with the tightest vacancies, registered a rate of 1.0 percent, again the lowest among all major metros. Outside of coastal regions, a number of other markets showed tight vacancies, including Columbus at 1.9 percent and Nashville at 2.8 percent.

Construction in the industrial sector is moving faster than ever: More than 522 million square feet was under construction at the end of October, accounting for 3.2 percent of nationwide inventory. Completions year to date already surpassed 250 million square feet, though the amount of new inventory is unlikely to eclipse last year’s delivery of 319.2 million square feet by year-end.

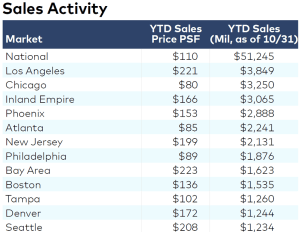

Industrial investment leapt to a new high, with transactions totaling $51.2 billion, already exceeding last year’s total volume of $47.1 billion. Sales prices also have continued to escalate, averaging $110 per square foot this year, a staggering 25 percent higher than last year’s average.

Read the full CommercialEdge report.

You must be logged in to post a comment.