Industry Faces Shortening Runway in 2018

The U.S. economy is showing few signs of deceleration, creating a matrix of growth opportunities across markets and property types. But for all its strengths, the real estate industry still faces its fair share of headwinds, as the post-recession recovery borders on a decade.

By Sanyu Kyeyune

The U.S. economy is approaching a decade of expansion, making this cycle the third longest on record. For the real estate industry, the slow but steady recovery has been largely fruitful.

This year’s rollout of new tax legislation has provided a welcome boost to commercial property owners, while near-full employment, historically low interest rates, unprecedented demographic shifts and changing consumer preferences have all driven demand across sectors. Technology’s impact has never been more pronounced: Innovation has been a boon for industrial growth and a challenge to office and retail, while leading occupiers to vie for attractive locations and compete for a dwindling talent pool. Though affordability has been increasingly problematic for multifamily, it has served to widen the range of opportunities owners and developers are considering.

As the cycle wears on, volatility, particularly around policy, calls into question how much runway the industry has left. So while the prospects look strong overall, growth is likely to moderate from recent years in the coming months.

Pricing problems

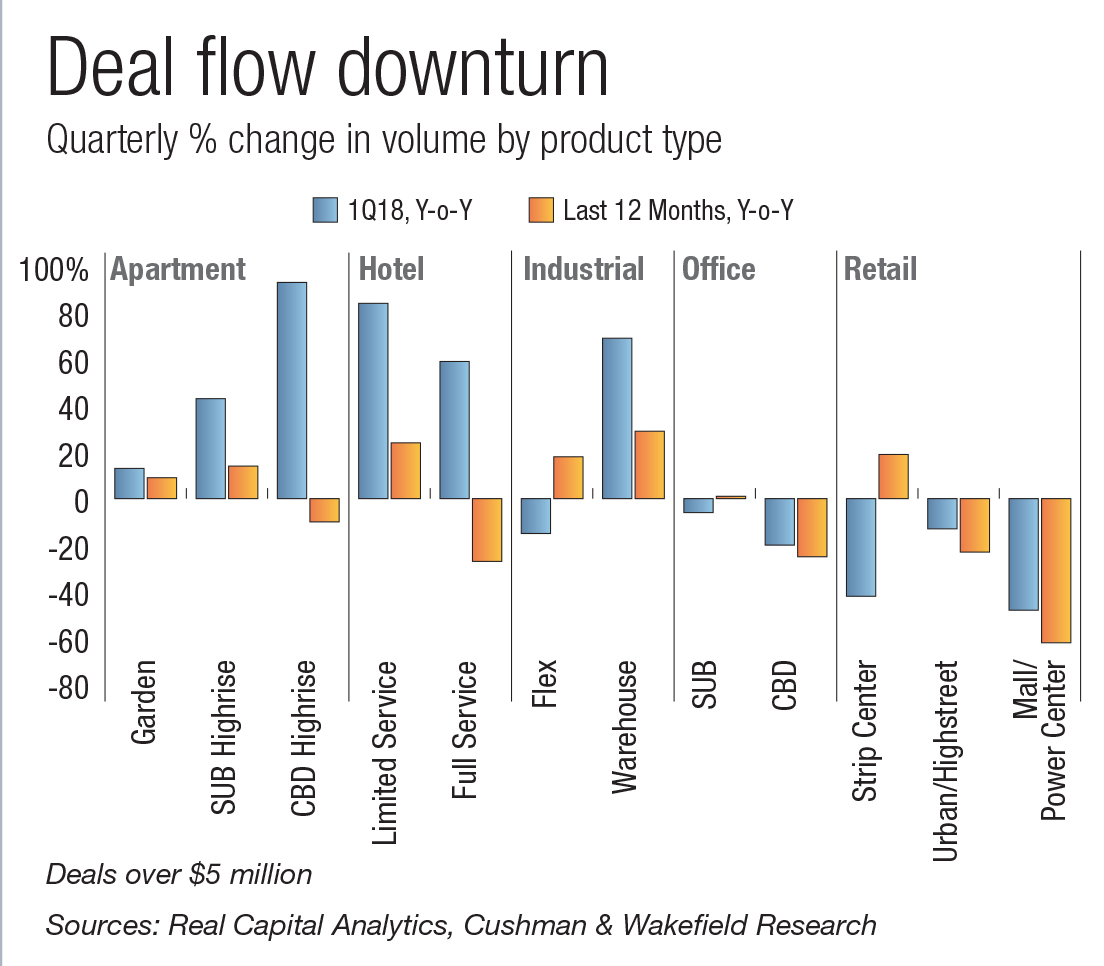

Transactions started the year slowly, despite rising 6.2 percent year-over-year in the first quarter of 2018. The uptick was the first of its kind since 2016’s third quarter, according to Real Capital Analytics (RCA) and Cushman & Wakefield. Coming in at 80 percent of total deal volume, core single-asset sales were responsible for most of this velocity, reaching their highest level on record at nearly $57 billion, up 10 percent in 12 months.

The gradual pullback in deal flow is due in part to dislocation around pricing, which has led more investors to postpone trades, despite having a wealth of dry powder on hand. “It’s hard to get a meeting of the minds between buyers and sellers,” said Ryan Severino, chief economist of JLL. Plus, the commercial real estate market is frothy at this point, he added, so even if sellers are able to offload assets, they’re finding it increasingly difficult to deploy proceeds into reasonably priced opportunities.

Sources: Real Capital Analytics, Cushman & Wakefield Research

Price growth isn’t pointing to an imminent comeback in transaction volume, either, having dipped slightly since peaking at 13 percent in the first quarter of 2015. Led by multifamily (11.1 percent) and industrial (11.3 percent), overall values rose by 8.5 percent year-over-year in the first quarter of 2018, according to RCA. And although price returns have rebounded since mid-2017, when they slid to a 6.7 percent trough, “investors should not count on appreciation returns. … Rather, steady income returns should provide a solid basis for investment strategy,” warned CBRE Americas Head of Research & Senior Economic Advisor Spencer Levy.

Capital concerns

Despite the mix of headwinds and tailwinds, investors are adapting their strategies to identify opportunities in a more diverse set of markets. Previously, foreign capital providers targeted mostly core CBD office assets in a few top cities, but now that they have become familiar with these places, said MetLife Investment Management Head of Real Estate Research Adam Ruggiero, “they’re likely to become a more permanent presence, increasing liquidity in the secondary markets and marginally reducing competition in the largest markets.” However, the global policy picture remains hazy, along with the future of trade relations, making the appeal of U.S. real estate to foreign investors anything but a given.

Private capital providers have stepped in to seize higher-yielding opportunities for current income. This cohort made a splash in 2018’s first quarter, charting a record 18 percent year-over-year increase in acquisition volume, according to RCA and Cushman & Wakefield Research. “All investors search for yield, but also the appropriate blend of yield versus risk,” explained Managing Director & Head of Real Estate Debt Strategies for MetLife Real Estate Investors Gary Otten. “In the current cycle, the investor bias appears to be generally leaning toward a trade for safety vs. yield. … This is evidenced by the amount of traditional real estate equity players entering the debt space and the amount of newly formed open- and closed-end debt funds, as well.”

The effect of rising interest rates has become clearer this year: The hikes have done little to move pricing because the signaled, gradual upticks didn’t shock markets, explained Revathi Greenwood, Americas Head of Research for Cushman & Wakefield. Instead, “the (question) now is how fast—not how much—rates will increase,” Greenwood continued. “If rates go up rapidly, investors might get more cautious.”

Meanwhile, cap rates have stayed relatively flat. By RCA’s tally, the volume-weighted average cap rate on transactions was 5.7 percent as of the first quarter of 2018, in line with historical averages since the second quarter of 2014. The industrial sector, however, posted a 28-basis-point cap rate increase in the first quarter, according to CBRE, helping to cement its position as a cyclical darling.

Flourishing fundamentals

Industrial. Industrial’s contribution to deal volume peaked at almost 20 percent, with trades up $4.5 billion, nearly double their 10-year average. The sector has found its strength in “the robust economy, combined with the growth in online retailers and retail sales, both of which require growing warehousing and distribution needs, particularly with multiple access points to shorten the product delivery cycle to the consumer,” said Otten. In its 32nd quarter of positive net absorption—including 50 million square feet absorbed in 2018’s first quarter—the segment saw an all-time-low vacancy rate of 5.1 percent, even after 53 million square feet worth of new product came online.

The rise in demand for U.S. exports continues to be a win for the industrial sector, adding to the appeal of logistics properties, primarily those located near ports. Class A deliveries are testing the growth prospects for warehouse/distribution space, which saw the highest asking rent on record in 2018’s first quarter ($5.46 per square foot), reported Colliers International.

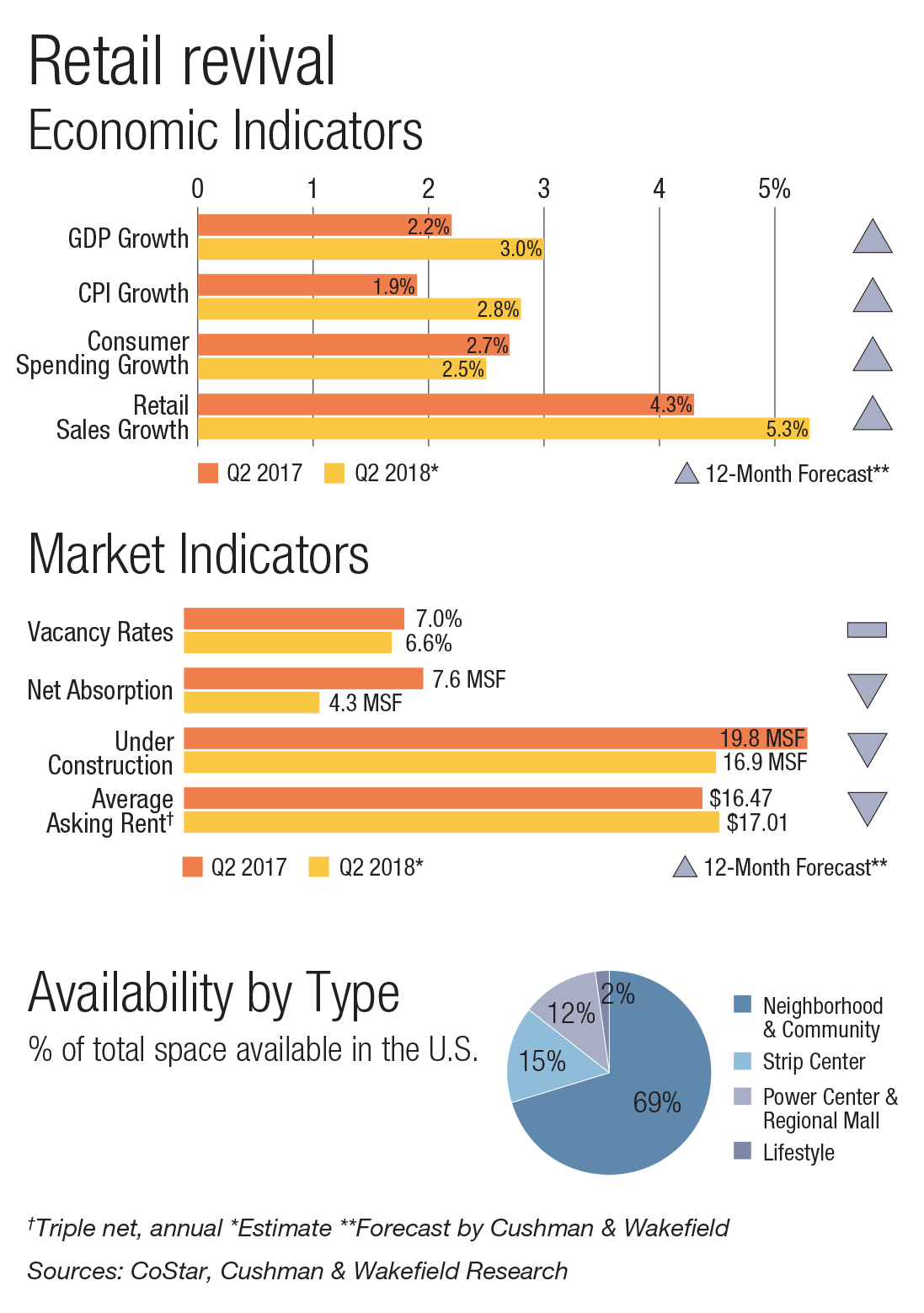

Retail. Following a strong holiday season, the retail sector is benefiting from a rise in consumer confidence and spending, too, and tax reform stands to better the segment’s future. First-quarter vacancy has been stable at 4.6 percent, according to JLL, while net absorption and asking rents both rose, reported CBRE. Facing limited opportunities to acquire core retail assets, investors are looking more to secondary, non-gateway markets with above-average wage and population growth. As a result, redevelopment has become a more prevalent strategy for deriving value from underutilized assets.

But e-commerce continues to create headwinds for the retail sector, where trades fell by $2.5 billion in the first quarter of 2018, according to online transaction platform Ten-X Commercial. Divergence in pricing expectations is partly to blame for the slowdown, though some big-ticket deals, such as Brookfield Property Partners’ acquisition of GGP, could shine light on valuations later this year. Expected to close in the third quarter, the transaction will create an entity with ownership interests in around $90 billion worth of assets and annual net operating income in excess of $4 billion.

Sources: CoStar, Cushman & Wakefield Research

Hospitality. “Correlated to a strong economy, the hospitality sector looks like it will outperform this year,” offered Greenwood, pointing to a balanced pipeline that has helped boost occupancy. In its 2018 outlook, PwC predicted record occupancy of 66.3 percent for the sector, sustained by increasing demand from business travelers. This trend is likely to support room rate increases, which helped generate a 3.5 percent RevPAR hike in the first quarter of 2018, according to Zacks Investment Research.

Larger deals and portfolio trades elevated hotel’s contribution to total volume to 10.2 percent, for a more than 60 percent increase. One such blockbuster, announced in May, is Blackstone’s $4.8 billion acquisition of LaSalle Hotel Properties. Expected to close in the third quarter, the transaction will expand the firm’s reach with 41 properties in 11 markets, totaling more than 10,000 guest rooms.

Still, the hospitality sector continues to struggle with a decline in international travel and tourism, compounded further by U.S. policies aimed at curbing immigration and crossborder trade. Mounting hotel construction costs are also compressing new deliveries, which were 1.6 percent lower in January 2018 than the prior year, according to Cushman & Wakefield. Add the mounting deterioration of U.S. infrastructure—and uncertainty around what an infrastructure bill would look like—and the sector’s trajectory becomes even more obscure.

Multifamily. Shifting demographics have helped fuel multifamily growth: Rentals have risen in popularity among Baby Boomers seeking large, amenity-rich living spaces and Millennials postponing home purchases. On the heels of last year’s post-recession peak in deliveries, the multifamily sector looks to exceed that number, with 360,000 new units in 2018, according to Yardi Matrix.

However, too little of this supply is in the workforce and affordable housing segments, pointing to the sector’s worsening affordability issue. Economic expansion has generally helped investor and consumer confidence during this cycle, but it has not resulted in meaningful wage growth in recent years, despite ever-rising rental rates. Although rents are generally trending up, overall rent growth has tempered, declining to under 3 percent in April 2018, according to Yardi Matrix.

Specialty’s stability

Niche property segments remain a hot target for investors and an opportunity to subvert some of the overheating occurring within the primary sectors and markets. Self-storage developers, for example, continue to chase population growth nationwide, planting new facilities in cities with strong, Millennial-driven in-migration and historically lower supply. Nashville, Portland and Denver led the pipeline pack, according to data provider Yardi Matrix, and at 5 to 6 square feet per person, new inventory in those markets stands a good chance of being absorbed, albeit slowly. By contrast, the Inland Empire, Los Angeles and San Francisco—California markets with high barriers to development—had the smallest pipelines. Overall, the 2,100 facilities planned or under construction comprised 9 percent of the 26,200 completed properties tracked by Yardi Matrix.

Concurrently, rents in the sector are contracting in response to new absorption: Year-over-year in April 2018, nationwide rates showed a 1.7 percent drop for the average 10-by-10-foot unit, following a 5 percent rise the previous fall. But in areas that have sustained positive rent growth, such as the Desert Southwest and Southern California, the picture remains fairly balanced. In most cities, the same applies when comparing climate- and non-climate-controlled units: The two segments reported similar rent gains, except for markets with above-average development levels. One such metro is Phoenix, where new supply besting the U.S. trend by 50 percent contributed to 8 percent rent growth for climate-controlled units, as opposed to just 2 percent for non-climate units.

Tapping into technology

Across industries, job growth remains strong: The unemployment rate fell 50 basis points in 12 months, to an 18-year low of 3.8 percent in May, according to the Bureau of Labor Statistics. By 2022, technology and health-care jobs are expected to grow the most, at 21.5 percent. So far in 2018, technology-related firms were responsible for 27 percent of leasing activity, noted Greenwood.

“Cities like Austin are seeing excellent job growth and relocation, even by big-name firms from (larger cities),” offered EY Global Real Estate, Hospitality & Construction Leader Mark Grinis. For occupiers, this has reinforced the need to stay ahead of innovation in the technology sector. As corporations continue to struggle with labor shortages, more occupiers are investing in space efficiency by creating flexible, amenity-rich, technology-enabled workspaces aimed at attracting and retaining talent.

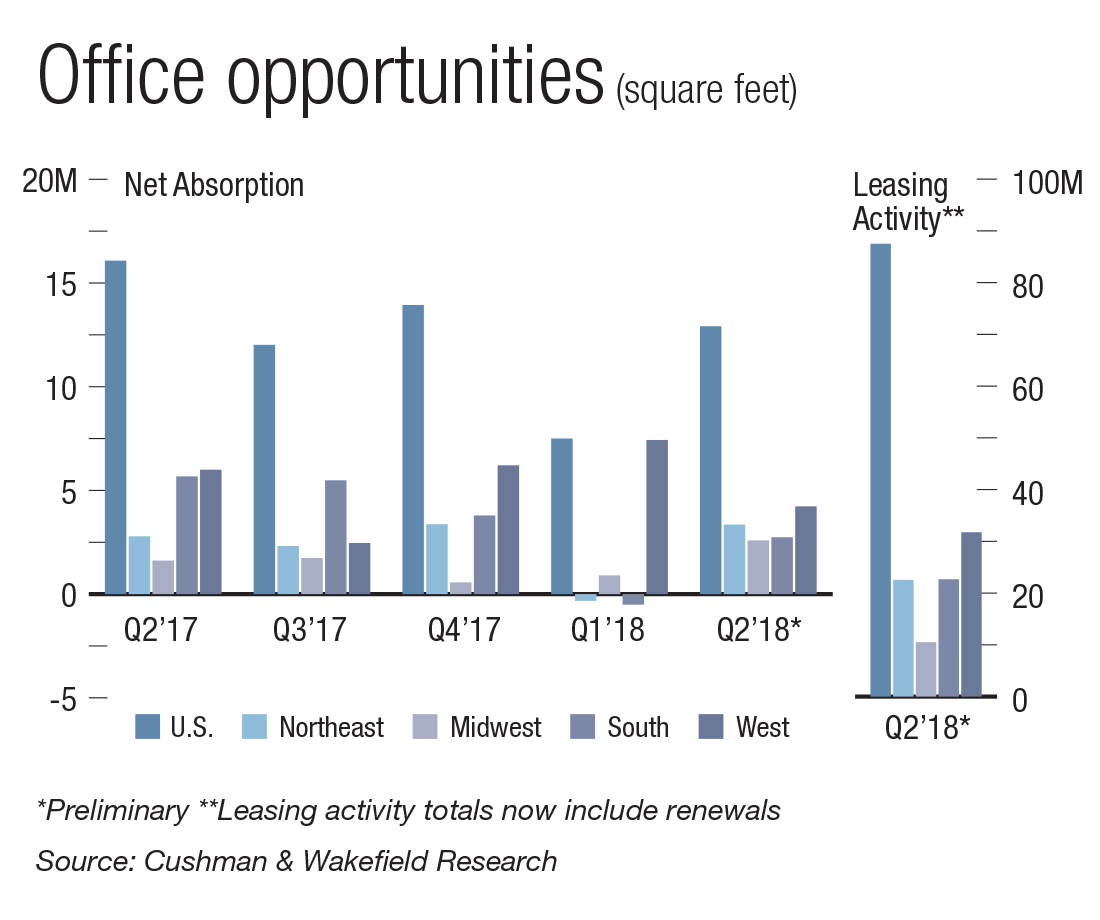

Source: Cushman & Wakefield Research

Technological innovation has impacted deal flow, too, particularly in the office sector, for which Ten-X Commercial reported a $9.5 billion drop in the first quarter of 2018. Potential oversupply also poses a risk to the office segment, most notably in a select few gateway cities—such as New York, Washington, D.C., and Chicago—which accounted for more than one-third of all U.S. construction underway. So does coworking’s ongoing rise as a more flexible alternative to conventional office space and its typically longer leases.

As in 2017, the office sector remains bifurcated by class: First-quarter net absorption fell to its lowest annualized level since 2010, at 3.7 million square feet. By contrast, Class A assets reported net absorption of 8.5 million square feet, according to JLL. But within the class, vacancy is diverging between suburban (up 20 basis points) and CBD (down 20 basis points) assets, due to pre-leasing of new supply by the latter group. At the same time, a few markets—led by Houston, Silicon Valley and New Jersey—saw the most profound decrease in leasing activity. Large construction projects contributed to first-quarter deliveries exceeding 100 million square feet.

Downside defense

The predictability of past cycles doesn’t provide an adequate view of what’s going on today, explained FTI Consulting Senior Managing Director Jahn Brodwin. “It would appear that economic cycles have fundamentally shifted,” concurred Deloitte U.S. Real Estate & Construction Leader Jim Berry. “What I would say is different this time is the maturity of the industry,” Berry added. Cushman & Wakefield, on the other hand, forecasts an end to the recovery in 2020, said Greenwood.

Should a downturn hit, CBRE’s Levy recommended that investors extend existing debt, maintain an agile capital stack and advise their equity partners that they may need to increase—rather than freeze—spending.

“There are few signs that commercial real estate is overbuilt, overleveraged or overheated,” suggested Nareit Senior Vice President of Research & Economic Analysis Calvin Schnure. “And that’s good news for the rest of this year and for 2019.”

While the timing of a slowdown remains undefined, one thing is certain: In order to stay ahead of real estate’s accelerated evolution, the industry will need to embrace creative strategies for unlocking value and achieving further growth.

You’ll find more on this topic in the CPE-MHN Mid-Year Update 2018.

You must be logged in to post a comment.