Commercial Real Estate Industry Outlook for 2019: Who Will Drop the Ball?

The U.S. commercial real estate industry was a powerful machine in 2018 and promises more of the same. But the year ahead will present a number of challenges.

For real estate decision makers, the No. 1 challenge in 2019 may be whether to put more confidence in signs of headwinds or tailwinds. Since the recession ended in 2009, 33 of 36 quarters have seen positive economic growth, according to the MIT Center for Real Estate. Along the way, commercial real estate fundamentals have remained solid well past the point that many observers expected them to. But as the U.S. enters its 10th year of this unhurried expansion, economists are not ruling out the possibility that a slowdown will finally arrive in late 2019 or early 2020 and bring a lagging dampening effect on investment and development. In light of so many moving parts, the prospects for the year ahead will demand creativity, adaptability and a measure of risk-taking from the commercial real estate industry.

Economic safety net

The commercial real estate industry is riding the wave of another year of solid performance for the economy at large. In 2018, unemployment fell to the lowest level in half a century, wage growth started to pick up after many stagnant quarters and GDP increased by roughly 3 percent. That uptick is widely credited to the Tax Cuts and Jobs Act of 2017 and increased federal spending. “Objectively I still think it’s a good, but not great, result,” said Ryan Severino, chief economist at JLL. “I would love to see the economy be knocking it out of the park like in the 1990s, but we’re just not that economy anymore.” Overall, U.S. real estate values are projected to hold steady in 2019, with prices maintaining and transaction volume poised to outpace previous years.

Moreover, the GDP bump attributed to the tax cuts will likely fade during late 2019 and early 2020. That, could coincide with a market correction, said Melissa Reagen, managing director & head of research for the Americas for TH Real Estate, an affiliate of Nuveen. Interest rates are on the rise and the U.S. Treasury yield curve is flattening.

In this environment, a slowdown remains a possibility, however unlikely it appears today. Pricing pressures are building across several sectors of the economy, further pointing to a market correction. Low unemployment and accelerating wage growth give the Federal Reserve motivation for additional rate increases. Severino, for instance, is projecting that the Fed could authorize three hikes in 2019.

In an October 2018 report, Blue Chip Economic Indicators put the chances of a recession in 2019 at 26 percent. That may sound alarming to veterans of the market crash a decade ago, but analysts project a much softer landing. “Should that happen, my view is that the value correction won’t be a 2008 correction,” said Reagen. “I say that because fundamentals do remain solid, and I’m guessing they’ll continue to remain solid.” However, real estate assets have a secret weapon in the form of NOI growth, which Nuveen expects to drive the majority of real estate returns in 2019.

The real estate lending market offers ample liquidity, as alternative lenders expand market share. By the third quarter of 2018, debt funds had accumulated more than $58 billion in dry powder, boosting their market share to nearly 20 percent, according to Newmark Knight Frank’s capital markets report. Refinancing has continued to accelerate as capital has remained plentiful and owners seek to hold onto assets, in anticipation of a higher cost of debt in the future.

Shifts and movement

If retail and multifamily properties consistently achieved the highest returns in the previous cycle, the industrial sector is dominating today’s investment market. Over the past six years, the category has generated the most significant gains, NKF reports. Market analysts expect more of the same, largely because the category seems to be less susceptible to economic vagaries than any other major asset category. “Industrial will continue to be the clear leader,” predicted Kevin Thorpe, Cushman & Wakefield’s global chief economist. “Almost regardless of what’s happening in the economy, it has continued to soar.”

A main factor in the stepped-up demand for logistics facilities is e-commerce. In a first, orders placed from mobile devices exceeded $1 billion on Black Friday in 2018. That marked a milestone for a day traditionally associated with brick-and-mortar shopping, not to mention an 8 percent year-over-year increase.

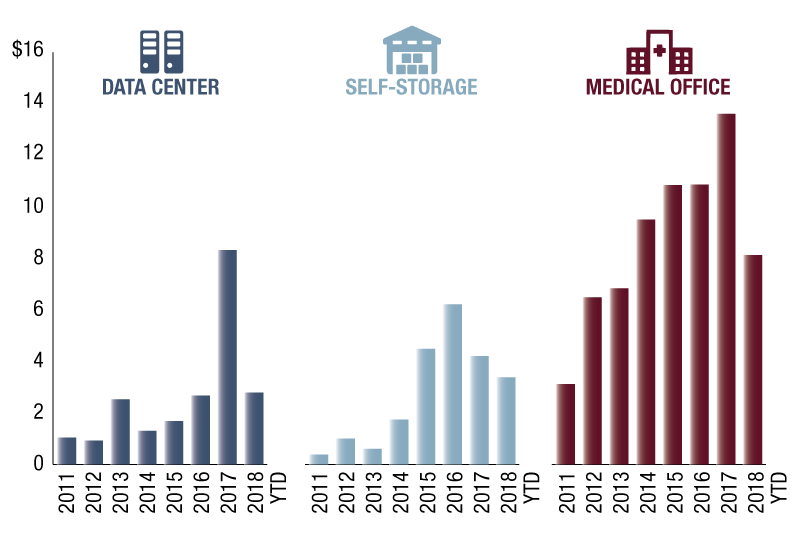

Specialty growth (U.S. totals by property category; $ in billions) Sources: NKF Research, Real Capital Analytics

“Industrial has overall become one of the darling sectors of this cycle,” said Graydon Bouchillon, head of industrial in the U.S. for TH Real Estate. “We’re seeing that unfold still today, and growth rates that indicate to me that this secular trend for industrial still has legs through the end of this cycle and into the next one.”

In the third quarter of 2018, multifamily sales volume surged 33 percent quarter-over-quarter, with investors continuing to chase yield into suburban, value-add deals in the Southeast and Southwest, according to NKF’s report. By the third quarter of 2018, the multifamily sector had drawn the highest sales volume of any property type for the past six quarters, even surpassing the office sector.

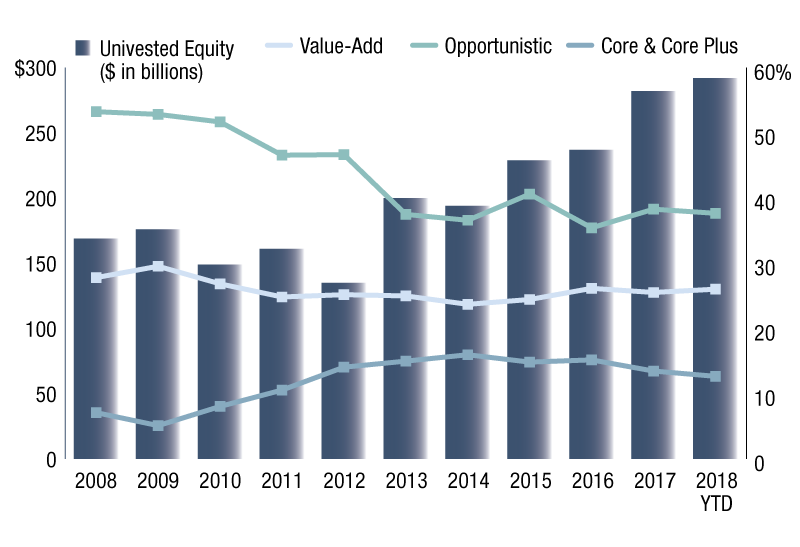

Dry powder (U.S. totals by asset category; $ in billions) *Excluding debt and distressed funds.

Sources: Preqin; NKF Research

Despite lingering concerns about overbuilding and too much high-end product, multifamily investment retains its built-in advantages. Though the oldest group of Millennials has now reached traditional home-buying age, the cohort will continue to drive the multifamily sector. In 2018, the number of Millennials reached 73 million, edging out Baby Boomers to become the largest demographic group. In 2016, 74 percent of Millennials lived in a rental property, according to Pew Research Center. That bodes well for long-term investment and development. “Yes, there is a lot of construction and supply, but there’s also a whole lot of demand,” said Thorpe. “Demographics are still very, very favorable for the multifamily sector.”

The office sector continues to offer a mixed bag. After strong absorption through 2017, a steady stream of new product began to push supply past demand in 2018, the MIT Center for Real Estate reported. That ratcheted up competition for tenants, nudged up vacancy and squeezed rent growth. Notwithstanding those issues, demand for space created by coworking is a factor to watch closely. Of note, WeWork emerged in late 2019 as New York City’s single largest tenant. Technology hubs are creating opportunities for office development in secondary markets like Provo, Utah, and Raleigh-Durham, N.C., as well as in San Francisco, Seattle and other established hugs.

The Millennial effect

No other property category matches retail for challenges, contradiction and innovation. The sector will watch closely for the impact of the series of events that unfolded in 2018. On the consolidation front, Brookfield Property Partners’ $15 billion acquisition of GGP Inc., and Brookfield Asset Management’s deal for Forest City Realty Trust, are recalibrating the investment playing field. Another factor will be the fallout from the Sears bankruptcy, expected to result in store closings and further difficulties for owners of properties anchored by the troubled chain.

Retail assets, including both malls and strip centers, are starting to be repriced. According to the Green Street Advisors Commercial Property Price Index, the two niches have lost 11 percent of their value since their peak in the fall of 2016, and mall REITs are trading a 20 percent discount to net asset value.

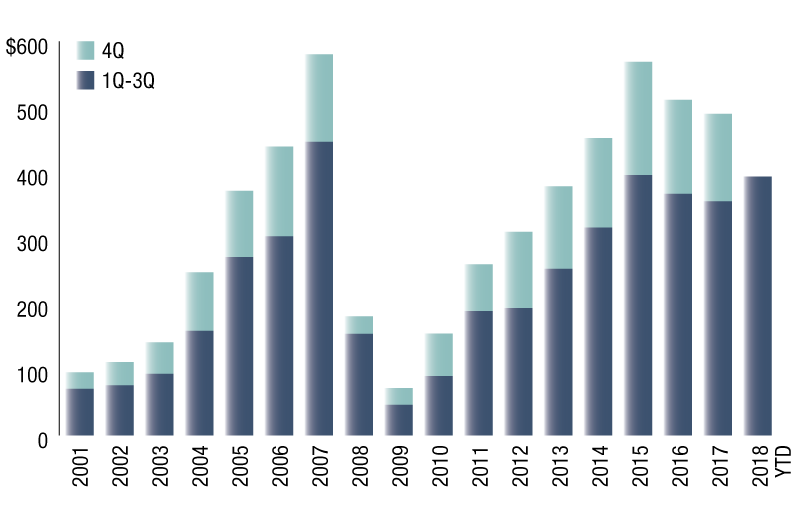

Fluctuating volume (U.S. totals, 2001-2018; $ in billions) Sources: NKF Research, Real Capital Analytics

E-commerce is often viewed as the retail sector’s main disruptor and a negative influence, yet a growing body of research points to a more complex reality. A 2018 study commissioned by the International Council of Shopping Centers found that the opening of a new store boosts the retailer’s web traffic 37 percent in that market. Moreover, brands less than 10 years old register a 45 percent increase in local web traffic when a new store opens.

New twists to the experiential retail model will make transform brick and mortar into destinations that emphasize the social and entertainment aspects of retail, particularly important for wooing younger Millennials and Gen Z customers. In 2019, the food and beverage segment of retail is expected to have the strongest online sales growth, Nuveen predicted recently in its THINK US Cities report. Grocers that embrace technology and focus on in-store customer experiences will do well.

The self-storage market has experienced a significant transition in recent months, as development has intensified across the country, especially in major metropolitan areas across the South. Along with an increased supply, self storage’s role is itself changing. Millennials, in particular, are turning to self storage to support the needs of their active lifestyles, noted John Chang, senior vice president & national director of research services at Marcus & Millichap. “It becomes an extension of the home, especially as the apartments have become more and more efficient and have less and less space for storage,” he said.

Despite some worries about a market correction, the overall outlook for 2019 is overwhelmingly positive, with U.S. real estate fundamentals expected to remain solid as supply and demand remain in balance across all sectors. In particular, the industrial and multifamily sectors are expected to outperform office and retail due to the tailwinds from Millennials and e-commerce sales. In the absence of events that shake consumer and business confidence, 2019 will be a strong year for real estate.

Thorpe sees benefits to a certain degree of global volatility, as it keeps downward pressure on interest rates and brings greater capital flows to the U.S. “Going into 2019, I’m extremely confident,” said Thorpe. “I know that some of the economic data has gotten a little softer more recently, and that’s true globally and in the U.S. But I would argue that’s ideal for the U.S. economy.”

You’ll find more on this topic in the CPE-MHN Guide to 2019.

You must be logged in to post a comment.