Institutional Investors Eye Bigger CRE Allocations

Confidence is at a nine-year high, according to this annual global survey.

Institutional confidence in commercial real estate hit a nine-year high in 2021 and target allocations increased for the eighth straight year, according to the annual allocations survey by Hodes Weill & Associates and Cornell University’s Baker Program in Real Estate.

READ ALSO: CRE Applauds $1.5T Infrastructure Plan

The average target allocations increased to 10.7 percent, up 10 basis points from 2020, indicating the potential for an additional $80 billion to $120 billion of capital to be allocated to real estate in the coming years.

The survey found there was some impact from the COVID-19 crisis as actual returns declined significantly in 2020 from 8.5 percent to 5.9 percent, due to a decline in property valuations resulting from vacancies, cash flow risks and uncertainty about the pandemic. This marked the lowest reported returns over the past nine years. But most institutional investors consider the decline a one-time event related to the pandemic and remain optimistic, with valuation metrics climbing to all-time highs for 2021 and institutions seeing a strong bounce-back in returns for this year.

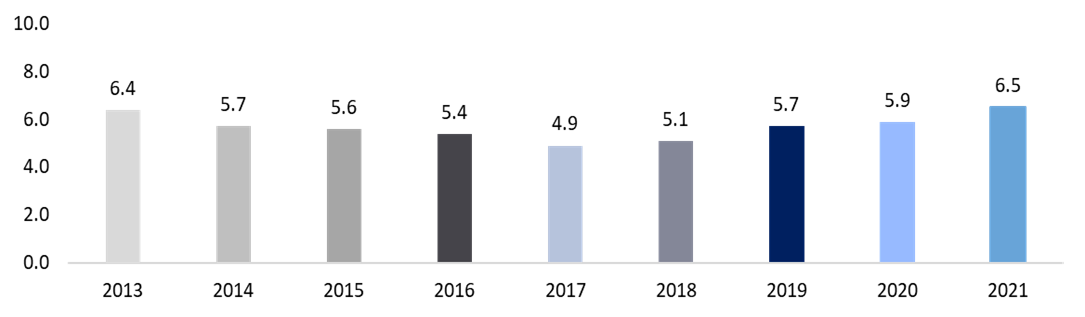

The Conviction Index, which measures institutions’ view of real estate as an investment opportunity from a risk-return standpoint, seems to indicate that the drop was temporary, increasing from 5.9 to 6.5—the highest number since the survey began in 2013. The report attributes the growing confidence to strong fundamentals in industrial, multifamily and niche sectors like data centers and life sciences that are attracting capital. Also driving investor confidence is an expectation that there are or may be opportunities to invest in sectors or markets that are experiencing distress or dislocation.

Conviction Index, All Institutions. Chart courtesy of Hodes Weill & Associates and Cornell University’s Baker Program

Since 2013, advisory firm Hodes Weill has partnered with Cornell University’s Baker Program in Real Estate to publish the annual Institutional Real Estate Allocations Monitor, which surveys hundreds of global investors across more than 25 countries to determine the impact of institutional allocation trends on the investment management industry. The 2021 Allocations Monitor includes research collected from 224 institutional investors in 37 countries. The participants have total assets under management of more than $13.4 trillion and have portfolio investments in real estate totaling approximately $1.2 trillion.

More key findings

The rate of increase in target allocations has remained relatively steady in recent years, but the survey found institutions expect to increase allocations at a faster pace over the next 12 months to an average of 11.0 percent. Institutions in the Americas held target allocation at 10.1 percent for the third straight year and are projecting a 20-basis point increase for 2022. Asia-Pacific-based institutions expect the highest increase, with a forecast bump of 90 basis points.

The monitor found that in 2021, institutional portfolios are under-allocated to real estate by the widest margin over the past seven years, a result of the investment slowdown at the onset of the pandemic in 2020. But the level of under-investment, combined with rising investor sentiment is accelerating capital flows.

Douglas Weill, managing partner at Hodes Weill & Associates, said in a prepared statement that last year institutions reported being under-allocated by an average of 60 basis points, which was attributed to the denominator effect and poor performance by equities at the beginning of the pandemic. He noted the pace of capital deployment into real estate has been accelerating as people return to work and travel more and the public markets stabilized and reached record levels.

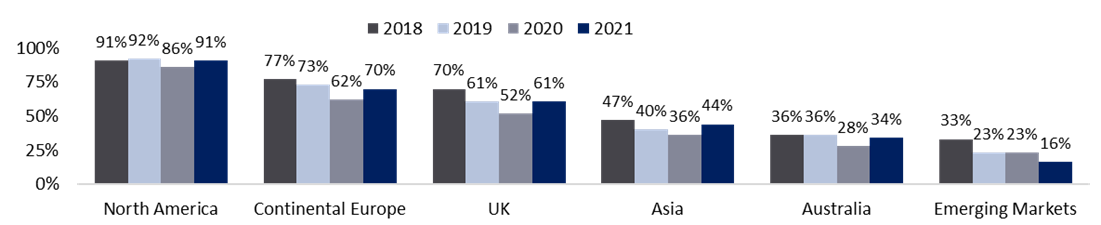

The ability to travel post-pandemic will play an important role in cross-border capital flows, which remain strong, and in the percentage of institutions investing outside their domestic region. The U.S. remains the preferred destination for international capital flows, with continental Europe as the second choice. The report notes transaction volumes in the U.K. are up, with investors returning to real estate markets following BREXIT.

While institutional investors in the Americas and EMEA are expected to continue favoring investments in their home markets, approximately 95 percent of institutions in APAC have reported intentions to invest outside of their domestic region over the coming years.

Geographic Focus, All Institutions. Chart courtesy of Hodes Weill & Associates and Cornell University’s Baker Program

Increased cross-border investing, along with rising future target allocations are among reasons cited in the report for a growing number of institutions that are outsourcing their real estate portfolios to third-party managers. Approximately 70 percent of institutions report outsourcing their entire real estate portfolio to third-party managers, up 7 percentage points from 2020. Overall, 94 percent of institutions report outsourcing all or a portion of their portfolio to third-party managers. Most of the investments for 2021—65 percent—are expected to be allocated to groups that have existing relationships with the institutions.

Investment strategies

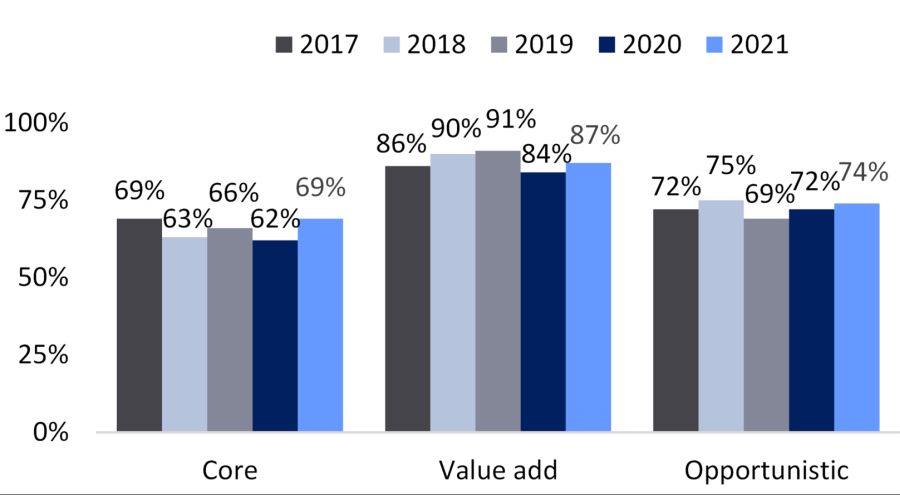

U.S.-based institutions are showing the greatest appetite for risk as investors look for higher return strategies, including looking for emerging distress and dislocation in the markets. About 92 percent of institutions responded they are actively allocating capital to value-add and/or opportunistic strategies this year, with value-add being the most favored investment strategy.

Risk Preference, All Institutions. Chart courtesy of Hodes Weill & Associates and Cornell University’s Baker Program

Closed- and open-end private funds remain the preferred investment products for institutions. Nearly 80 percent of investors reported they are actively allocating to closed-end funds. But the report also noted the percentage of institutions investing in both joint ventures and open-end funds increased slightly. Meanwhile, the appetite for separate accounts was the lowest in survey history, at 28 percent.

This year’s survey found that ESG investments for institutional portfolios continues to grow. The report noted investment managers are positioning their organizations and operating practices to accommodate their clients’ ESG objectives as well. More than 50 percent of institutions reported they have an ESG policy as ESG moves from a “nice to have” to a “have to have” approach from managers and their institutional clients.

Read the full report by Hodes Weill & Associates and Cornell University.

You must be logged in to post a comment.