Investcorp Acquires $200M Industrial Portfolio

The transaction includes a collection of properties in South Florida and Denver.

Investcorp has acquired a 1.3 million-square-foot, 31-building industrial real estate portfolio in South Florida and Denver for about $200 million.

With this purchase, Investcorp has about 43 million square feet of U.S. industrial real estate assets, valued at about $5.1 billion.

Investcorp described the portfolio as being located in two of the nation’s best-performing industrial markets, in infill areas that are convenient to major thoroughfares, strong transportation infrastructure, labor bases and residential neighborhoods.

An Investcorp spokesperson was unable to provide additional information requested by Commercial Property Executive, including the portfolio’s seller.

Steady acquisitions

Growth in the metro Denver industrial real estate market is currently being driven in large measure by demand for space near Denver International Airport, which is seeing cargo volumes noticeably ahead of those before the pandemic, according to a first-quarter report by Marcus & Millichap.

READ ALSO: CRE’s Deal Anxiety Shows Signs of Easing

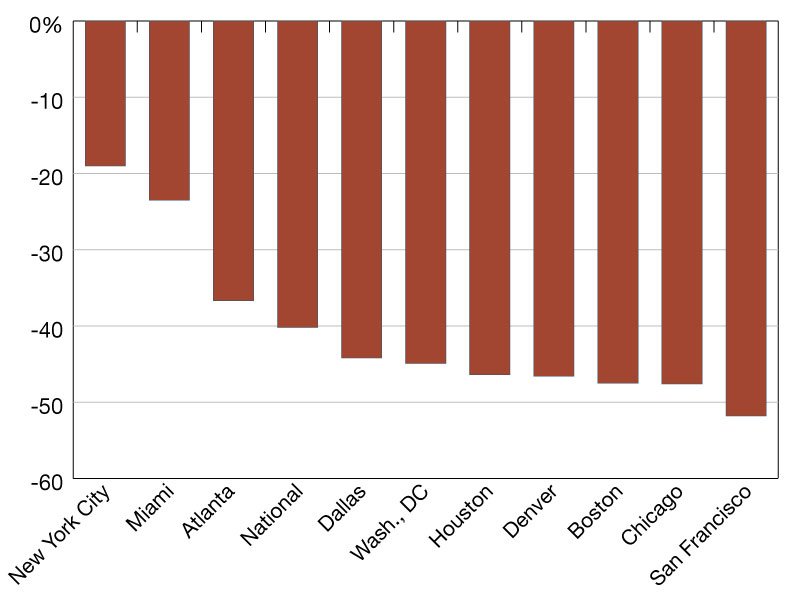

Elsewhere in the region, however, “fundamentals are softening,” the report states. Overall vacancy has been trending up for at least two years, to a level not seen since 2011, and the current construction pipeline will add about 2.0 percent to Denver’s industrial inventory.

Miami-Dade’s industrial market is notably healthier, with an overall vacancy of just 2.3 percent and steady leasing and sales activity, according to a first-quarter report from JLL. About 7.5 million square feet of space is under construction, fairly evenly shared across the major submarkets.

The Bahrain-headquartered Investcorp has a recent history of acquiring significant industrial portfolios, buying:

• $800 million in U.S. industrial assets in November 2019. The two deals netted 126 properties in all, totaling 10.2 million square feet.

• $280 million worth of properties that included a 434,000-square-foot fulfillment center in Cleveland that was leased to Amazon, in October 2020.

• An 89-property, 2.2 million-square-foot Class B portfolio across four markets, for $380 million in October 2021.

• In February 2022, a 64-property, 5.6 million-square-foot portfolio across seven markets for $640 million.

• In partnership with BKM Capital Partners, a seven-building, 740,000-square-foot portfolio in Las Vegas, for $158 million, in March 2023.

You must be logged in to post a comment.