Investment Matters: The CRE Finance Spigot Reopens

CPE finance editor Therese Fitzgerald joins host Paul Rosta to evaluate what’s next for the capital markets.

Change is in the air this fall for commercial real estate investment. The Fed’s announcement of a 50-basis-point interest rate cut in late September, and the expectation that more cuts are ahead, signals a reopening of the spigot for real estate finance. But there’s plenty more in the mix these days.

To start sorting out some of today’s key trends, I brought in my colleague and CPE investment editor, Therese Fitzgerald. We spoke in late September, shortly after the Fed’s long-awaited rate cut.

In this episode, Therese gives us a snapshot of what’s around the corner for investment, explores trends in CMBS and debt funds, and brings key takeaways from CREFC’s recent conference in New York City.

Episode highlights:

- The impact of interest rate cuts (1:23)

- What’s ahead for the rest of 2024 (2:40)

- Market momentum: will investors wait? (3:40)

- The “wall of maturities” and other CREFC conference takeaways (5:20)

- CMBS snapshot (6:56)

- Why capital is flowing to debt funds (8:49)

- What’s next for bank lending?

- Some good news for borrowers (11:11)

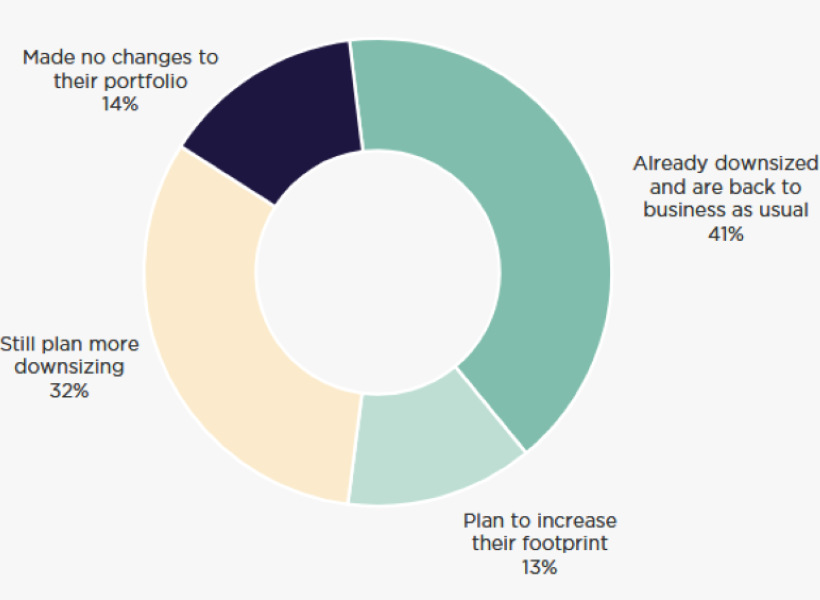

- Signs of an office sector reset (12:27)

Follow, rate and review CPE’s podcasts on Spotify and Apple Podcasts!

You must be logged in to post a comment.