Investment, Occupational Markets Moving Toward Balance, Says JLL

JLL's latest report suggests that occupational markets will take the driver's seat across all major global regions and property sectors in 2016.

By Scott Baltic, Contributing Editor

Chicago—The dynamics of the world’s dominant real estate markets have begun to shift, from being driven by investment markets strengthened by “a huge weight of money” targeting commercial real estate assets, to one in which occupational markets are showing more momentum, according to the latest Global Market Perspective from JLL.

“Market fundamentals are improving across all major global regions and property sectors, and recent leasing activity has surprised on the upside,” the report summarizes. And despite geopolitical and economic concerns, “for now, corporate occupiers remain in growth mode which, combined with tightening supply, will support rental value growth during 2016 in most major markets.”

Despite notes of caution, the report seems a bit optimistic, given this week’s terrain. Yesterday afternoon, the Federal Reserve announced that it would maintain the target range for the federal funds rate at ¼ to ½ percent. Though the Fed acknowledged that inflation has been trending upward, it has remained below the 2 percent threshold, partly because of lower energy prices.

“It is a testament to the tenuous state of the economic recovery eight years later that the Fed is still exercising so much caution,” wrote The Huffington Post.

Just the previous day (March 15), the latest retail sales report from the Commerce Department showed that U.S. retail sales fell less than had been expected. But the report also revised downward the retail sales figures from January, from a 0.2 percent gain to a 0.4 percent drop, while another Commerce report showed business inventories rising by 0.1 percent in January, according to Reuters.

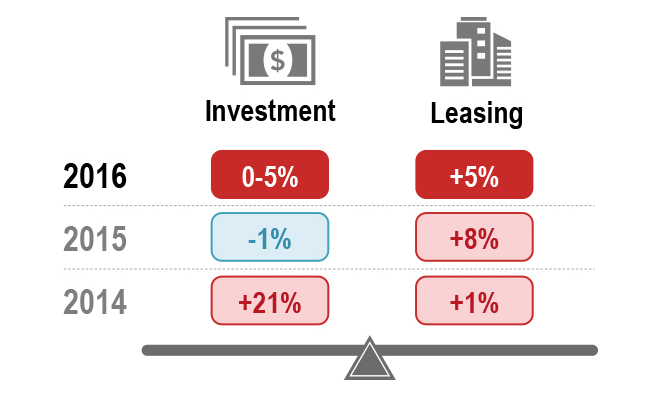

Against that backdrop, the JLL report noted that even though investor activity in CRE globally slowed in the final quarter of 2015, full-year 2015 transaction volumes, adjusted for the strong U.S. dollar, hit $765 billion, 8 percent ahead of 2014—and a new record, besting the previous high of $758 billion back in 2007.

The report found investor sentiment to be perhaps more cautious going into this year, as yields continue to compress to new lows, and suggested that growth going forward will be “more measured.” JLL is forecasting 2016 volumes to be “broadly in line with 2015,” or about $720 billion to $730 billion, with any modest growth arising from new capital being to allocated to CRE.

On the office leasing side, vigorous global volumes in the final quarter led to surprisingly strong full-year volumes that surpassed 2014 levels by 8 percent. Asia-Pacific did especially well, with 2015 leasing volumes growing 19 percent year over year. JLL predicts that “there will continue to be progress towards expansion demand during 2016 as tenants move away from cost containment, consolidation and renewals.

With strengthening demand and generally tight supply, rents at prime office assets across 26 major markets grew 3.7 percent in 2015, equaling 2014 levels. Better yet, JLL is looking for further rises of 3 to 4 percent this year, led by Boston and Tokyo.

The Q1 Global Market Perspective is bullish on consumer confidence and retail sales in the United States and Europe: “Several U.S. markets, primarily gateway cities, are now witnessing conditions typical of a peaking market as rents see assertive growth and vacancy continues to compress.” U.K. regional markets and Berlin led rental growth in the final quarter in Europe, with increases also recorded even in Italy and Spain.

Global warehousing demand remains robust. Absorption is leading new supply in nearly every U.S. market, while strong occupier demand in Europe resulted in record absorption volumes last year.

At more than $85 billion, hotel transactions globally in 2015 were the second-highest on record, with 50 percent growth over 2014, according to the report. JLL expects transaction volumes in 2016 to reach $70 billion.

Finally, all major U.S. markets registering positive absorption in the multi-family sector, with rental growth at its highest pace this cycle. Institutional investment in apartments continued to grow in Europe, where Germany had a record year and the United Kingdom is expected to do well in 2016.

You must be logged in to post a comment.