Investors Find Office Bargains

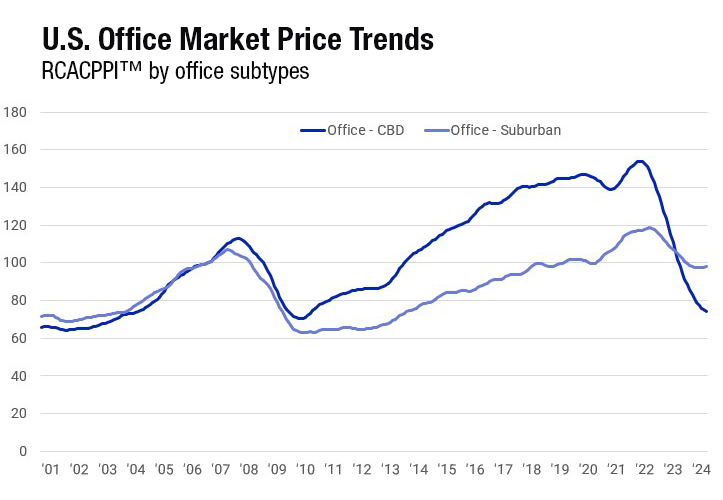

CBD values have fallen more than 50 percent from their high, according to MSCI.

The office sales market is starting to churn again. But, it’s hardly a cause for celebration, given the prices that many properties are going for.

It’s well known that, as office users implemented remote and hybrid work, many downsized their occupancies to reflect changing utilization. That’s when vacancies shot up and incomes took a hit. Spiking interest rates have been a double whammy.

As a result, many buildings are selling at a sharp discount to previous trading prices and, in some cases, the remaining debt on the property.

According to MSCI, values for CBD office values have plummeted to date about 52 percent from a record RCA CPPI peak of $408 per square foot in Q1 2022, and continue to decline. Suburban office values have not dropped as severely—declining 17 percent from their RCA CPPI peak in Q3 2002—and have stabilized over the last three months, noted Jim Costello, executive director of MSCI Research.

READ ALSO: CBRE Finds RTO Policies Mostly Go Unenforced

Low mortgage rates in 2021 and early 2022 caused investors hungry for yield to invest in real estate, Costello said. “There was a lot of capital flow into real estate investment, even in offices, and it pushed values to unusual highs,” he stressed.

Rising interest rates created turmoil on mortgage rates, rates of return and cap rates. Weaker financial conditions, combined with low occupancy rates, have decreased CBD office prices and increased investors’ perception of risk. “Given that leases often are 10 years in CBD locations, there’s going to be a slow, steady drumbeat of the market reacting to the 2020 shocks well into the future,” he stated.

On the other hand, transit in suburban office markets is car-focused and people tend to have shorter commutes because housing is mixed with office hubs, Costello continued. Additionally, he noted that in some Southern states like Florida, many people continued to go to the office during COVID, so there was never the same level of demand shock nor a work-from-home culture like in the Northern and Western CBD markets.

But the degree to which values have dropped depends on the type of property, not just location, noted Patrick Gildea, co-head of U.S. Office Capital Markets at CBRE.

“The value for a high-vacancy office building with heavy capital requirements may be off by more than 50 percent, whereas a trophy office value may be closer to a 30 percent discount when compared to 2022 levels,” Gildea said. “Fortunately, many of those trophy properties have experienced much stronger rental rate growth than was underwritten, which will help uphold value to some extent.”

With values dropping and a significant number of office loans maturing, many investors have been waiting for more distressed bank-owned assets to come to market at deep discounts. But that has not materialized in great numbers because lenders have been willing to work with borrowers, the majority of which pursued short-term loan extensions with the hope that interest rates will soon come down, said Alex Gregoire, senior manager in Strategy and Transactions at EY.

That is expected to change in the short-term, however. According to a recent CommercialEdge report, loan defaults and delinquencies rose 7.5 percent, totaling $1.87 billion, by the end of June—a 4.5 percent increase over the same period last year.

Further, a substantial amount of delayed loan maturities will come due in late 2024 and early 2025, noted Abby Corbett, senior economist & global head of investor insights at Cushman & Wakefield.

“The distress process is unfolding, generating demand for loan extensions, modifications, refi’s, bridge loans, loan sales and opportunistic asset auctions/purchases,” added Corbett, noting that opportunistic capital should be able to deploy into gateway cities, which are seeing most distress.

Here are a few recent examples of office properties acquired at a deep discount or fraction of the remaining debt:

- Lloyd Goldman’s BLDG Management Co. Inc. and David Werner Real Estate Investment acquired 100 Wall St., a 29-story Manhattan office building, from Barings for $116 million. Barings had purchased the asset for $270 million in 2015.

- The two historic Esperson Buildings in downtown Houston, which total 600,000 square feet, were acquired in a foreclosure sale by local private boutique equity firm Interra Capital Group for $12 million. A total of $41 million was still owned on the two office towers, one 32 stories and the other one 19 stories.

- Montgomery Park, a nine-story, 768,443-square-foot office building in Portland, was sold to a division of Menashe Properties by the lender, Natixis, for $33 million. The former owners, which acquired the asset in 2019 for $255 million, defaulted on the remaining loan of $149.7 million.

- Finmarc Management recently acquired Trinity Centre, a four-building office complex in Centreville, Va., a Washington, D.C. submarket, for $39.4 million. The sale price was about one-third of the $108.5 million the nearly 500,000-square-foot property traded for in 2012.

Some reasons for optimism

Despite the weakness in office fundamentals, the second quarter of 2024 saw a noticeable uptick in office transaction volume in core markets. According to JLL, $25.8 billion in office sales closed during the first half of 2024, up 22 percent from 2023. But, that’s still 50 percent less from the “pre-pandemic” activity.

“Quarterly improvements witnessed in both volumes and pricing can be credited to a combination of both firming investor confidence and certainty on the path of monetary policy as well as gradual investor and owner acceptance of this normalized interest rate environment,” said Corbett.

Still, the increased activity must be viewed in context, she added: “Conditions are still very challenged and deal activity is far from a trend.”

The growing population of opportunistic investors, however, believes the office market is at the bottom of the cycle, said Al Pontius, senior vice president & national director for office, industrial and healthcare at Marcus & Millichap. They are expecting big discounts, and they want to jump in before it goes the other way.

READ ALSO: Leveraging Today’s Growing Capital Sources

“But for the very few exceptions that exist on the highest quality buildings in a given market, so far, it’s very far from being a vibrant sales market,” Pontius said.

One bright spot for the office sales market, particularly in New York, is companies buying buildings for their own use, observed James Nelson, principal & head of Avison Young’s Tri-State Investment Sales group.

“Typically, vacancy is problematic and makes it more challenging for an investor,” Nelson said. “But for an end-user who wishes to occupy and use the space, it’s obviously a positive.”

Nelson cited the recent sale of 980 Madison Ave. to Bloomberg Philanthropies for $560 million. Bloomberg paid a premium for this five-story, 100,000-square-foot building in Manhattan’s Upper East Side. It was appraised in 2021 at $350 million and values have fallen since.

According to Matt Carlson, co-head of U.S. Office Capital Markets at CBRE, Eastern markets— predominantly Miami, New York and the Sunbelt cities—are outperforming Western markets in terms of office sales volume.

“At the high end of the market, we are seeing prime assets trading in highly amenitized, walkable neighborhoods with access to transportation, housing and a skilled workforce,” he said. On the other end of the market, transactions are driven more by lender motivations.

In Atlanta, for example, several Class A buildings have traded over the last two months.

In June, B Group Capital Management acquired Ameris Center One and Two, a two-building office campus in Atlanta’s Buckhead district totaling 532,000 square feet. The asset traded for $81 million, or about $152 per square foot, and about 10 percent less than its 2015 purchase price, according to Bisnow. The property has an onsite MARTA bus stop and is within walking distance to the Buckhead MARTA rail station and numerous area amenities.

Additionally, the joint venture of Cousins Properties and Town Lane earlier this month acquired Proscenium, a 23-story, 526,000-square-foot office tower in Atlanta’s Midtown district, for approximately $83 million. The seller, Manulife, had bought the building in 2003 for $118 million. The new owners plan to invest capital in upgrades to reposition and modernize the building, which was 74 percent leased at the time of sale.

While there are more individual office sales in CBDs than in suburbs, suburban office values have held up better, down 7.5 percent year-over-year compared to 24.7 percent for CBD buildings.

READ ALSO: How Suburban America Is Changing

Pontius noted that some suburban office markets are outperforming CBDs in terms of both leasing and sales for a variety of reasons, but “none the least of which is the aging of the millennial population, which is starting families and looking at suburban (housing) options much like their parents did,” he said.

Craig Tomlinson, a senior vice president at Northmarq specializing in office leasing and sales, cited another silver lining in office sales: smaller markets. Sales in some secondary cities, such as Nashville, Salt Lake City and Oklahoma City, he said, have only declined 9 percent since the pandemic due to lower values for high-quality assets. Other advantages, like local tenants and lenders which understand a property’s position in the marketplace, have also played their part.

Back to business

Danny Mangru, leader of U.S. Office Market Intelligence at Avison & Young, attributed increases in office sales activity in core markets, in part, to more companies figuring out their occupancy.

“I would say that return-to-work policies have been cemented over the last 18 to 24 months, so that’s a big driver that’s contributed to the uptick in sales activity in the second quarter,” Mangru said.

Leasing activity has increased across all gateway markets between 5 percent and 25 percent, he added. In Manhattan, leasing is up 20 percent year-over-year and occupancy is now at 80 percent of pre-pandemic levels.

But, while a lot of space adjustment has already occurred, more is expected because a significant number of pre-COVID leases are yet to rollover.

“Although smaller local and regional businesses have generally right-sized and figured out their employee base and work schedules, many large, national companies are still working through a viable solution,” added Scott Romick, principal & managing director at Lee & Associates.

Space allocated per employee has dropped 9 percent to a 22-year low since the pandemic, Carlson noted. However, office-using jobs have increased 5.4 percent, a metric that has historically aligned with increased absorption. “Companies continue to re-work their space as leases expire, but the data shows they may be overcompensating,” he said.

Smith noted that many tenants have already exited leases early or subleased space, and/or downsized existing leases prior to lease expiration. As part of a recent survey conducted by Cushman & Wakefield and CoreNet Global, occupiers indicated that they expect their office footprints to stay flat over the next year. “This is a reversal of lease size reductions that has been experienced since 2020,” he concluded.

The return-to-office trend is impacting how investors underwrite assets, often increasing permanent vacancy above 5 percent, which lessens downward pressure on exit cap rates, Gildea said. However, the cost of tenant improvements, availability of debt and overall investor sentiment are having more of an impact on sales activity than improving occupancy.

Adjusting for new realities

According to Gildea, buyer composition today is roughly 75 percent private capital (equity and hedge funds and family offices), with the majority of buyers using seller financing, buying cash or signing a recourse with a relationship bank.

“More than half of office sales involve a lender in some form, whether a consensual short sale, REO sale, loan sale or outright disposition driven by a pending loan expiration,” he said.

Carlson, who oversees capital markets for the Western Region, contended that the recent increase in office sales is being catalyzed by loan maturations, rate cap expirations and lenders no longer willing to offer short-term, pandemic-era extensions to borrowers. In addition, he said the volume of trades has increased because buyers and sellers are accepting the new reality of depressed office values and higher interest rates over the longer term.

Major office hubs, particularly along the East coast, have seen the highest concentration of sales, noted Gildea. “Although we are seeing more office properties being purchased, it is a small percentage compared to the number of property owners that would like to sell,” he added, noting that the bid-ask spreads are still too wide apart to move investors.

In a year-end 2023 report, MSCI noted that investors and sellers will need to meet halfway to close the gap between buyer vs. seller expectations to achieve liquidity-adjusted pricing. In other words, that CBD office asset that sold for $408 per square foot in 2022 would now go for a market-clearing price of about $245 per square foot.

Tomlinson contended that going forward, interest rates will continue to be the single biggest factor affecting sales volume, noting that when the Fed raised rates 525 basis points in just over 90 days in 2023, office sales dropped 68 percent from the prior two-year average.

You must be logged in to post a comment.