Outdoor Storage Portfolio in Jersey Commands $156M

IOS is benefiting from the tailwinds of infrastructure investment and onshoring of manufacturing.

Ambient Capital Partners has acquired a six-property industrial outdoor storage portfolio in northern New Jersey for $156.3 million. NAI James E. Hanson arranged the transaction.

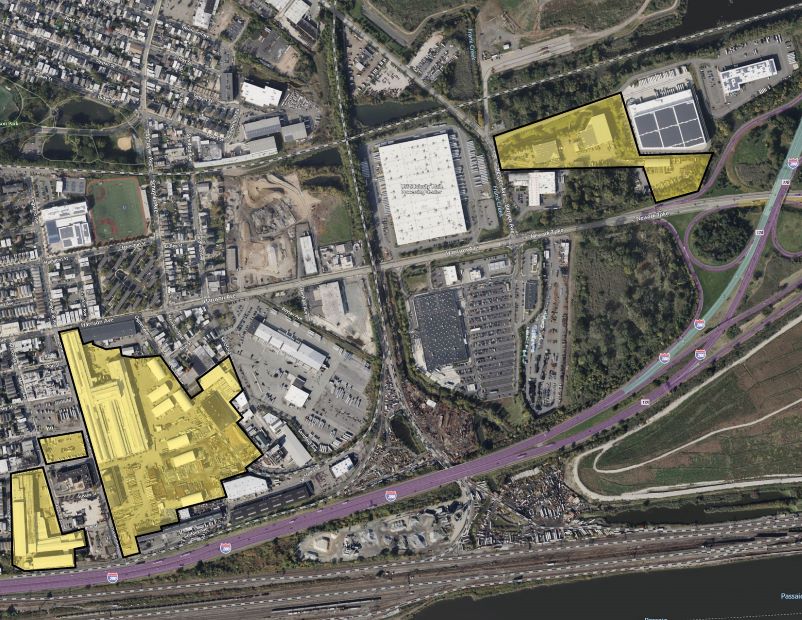

The portfolio comprises 310 Manor Ave., 505 Manor Ave., 401 Supor Ave., 500 Supor Ave. in Harrison, N.J., and 129 Sanford Ave. and 433 Bergen Ave. in Kearny, N.J. It is less than 10 miles from Port Newark Elizabeth and provides regional connectivity through Route 280 and the New Jersey Turnpike.

The buyer was represented by NAI James E. Hanson’s Scott Perkins, Christopher Todd and William Ericksen. The seller was a private, undisclosed entity.

Perkins told Commercial Property Executive that despite some softness in the broader commercial real estate market, he continues to see robust industrial outdoor storage sales and leasing activity in dense markets with complex supply chain needs, like northern New Jersey.

“Since these markets offer highly favorable long-term value creation prospects, institutional investors like Ambient Capital Partners have been significant demand drivers over the last several years,” Perkins said. “We expect this trend to continue with strong industrial outdoor storage sales and leasing activity to support the needs of their increasingly complicated supply chain networks in these markets,” he added.

Perkins said that finding or assembling assets that meet institutional investors’ criteria can be a significant challenge in mature, densely populated markets like New Jersey.

“These areas are highly land-constrained, often with multiple competing uses for the same parcels,” he observed. “As a result, larger deals take considerably more time to structure and demand extensive local market expertise to navigate complex dynamics and ownership situations.”

READ ALSO: Which Asset Classes Will See the Most Investment & Development?

According to Perkins, the price was fair. “Port Newark–Elizabeth Marine Terminal is the busiest port on the East Coast and one of the most active industrial markets in our region, which makes it exceptionally difficult to find nearby institutional-quality IOS sites,” he said. “Spanning nearly 50 acres, this portfolio presents a rare opportunity, with pricing that aligns with the area’s limited supply.”

Secular tailwinds

Neal Moskowitz, senior vice president & principal at Stonemont Financial Group, told CPE that industrial outdoor storage stands poised to benefit from the secular tailwinds of increased infrastructure investment, onshoring of manufacturing, and the direct-to-consumer distribution of an ever-increasing portion of the retail economy.

“We continue to see rental rate growth for well-located IOS assets in growing markets with irreplaceable heavy industrial zoning outperforming rent growth for traditional industrial assets,” Moskowitz said. “These strong demand drivers, combined with the prospect of further rate cuts associated with an economic soft landing and increased institutional appetite for the asset class at scale, will continue to create long-term value for IOS investors for the foreseeable future.”

Peter Cecora, JLL senior managing director, told CPE that historically, IOS has served as a solution for surplus materials and seasonal inventory fluctuations.

“However, the e-commerce boom and supply chain challenges have transformed it into an essential niche within the industrial property sector,” Cecora said.

“IOS offers the flexibility and efficiency that a diverse range of industries now demand. We’re witnessing a shift from mom-and-pop operations to institutional ownership, with a notable investment trend in this space.”

For example, in Florida, Cecora said that Pinellas and Ocala have seen increased demand over the past three years, “but East Tampa, particularly near the Port of Tampa Bay, remains the focal point, where proximity to concentrated populations is key.”

You must be logged in to post a comment.