Retail Shows Surprising Resilience: IRR Report

Despite retailer bankruptcies and the onslaught of e-commerce, the retail real estate sector in most markets is in reasonably good shape, the analysis concludes.

By Scott Baltic, Contributing Editor

The latest Annual Retail Report from Integra Realty Resources is notably upbeat about retail real estate, a sector that has, by many accounts, taken the worst drubbing of any major commercial real estate product type in recent years.

No, it isn’t as if e-commerce and all those retail store closures never happened. But it is that the retail sector is for the most part actually in reasonable balance and that overall it’s no worse off nationally than a year ago.

The report, by Hugh F. Kelly, Ph.D., notes a few key points. First, though bankruptcies in the retail sector continued through 2017, mostly driven by e-commerce model, “this could also be seen as an industry correction, as the U.S. is an over-retailed country.”

Second, “The critical segmentation of the shopping center industry means that broad-brush depictions of trends must give way to a more pointillist perspective.”

Third, e-commerce, on top of the “deconstruction of the department store model” and “a growing demand for experiences versus goods,” are having an effect on retail transactions.

In all, the report concludes, the sector’s moderation is likely a sign that retail developers and investors put on the brakes soon enough to avoid an out-and-out crash.

Getting into some specific numbers

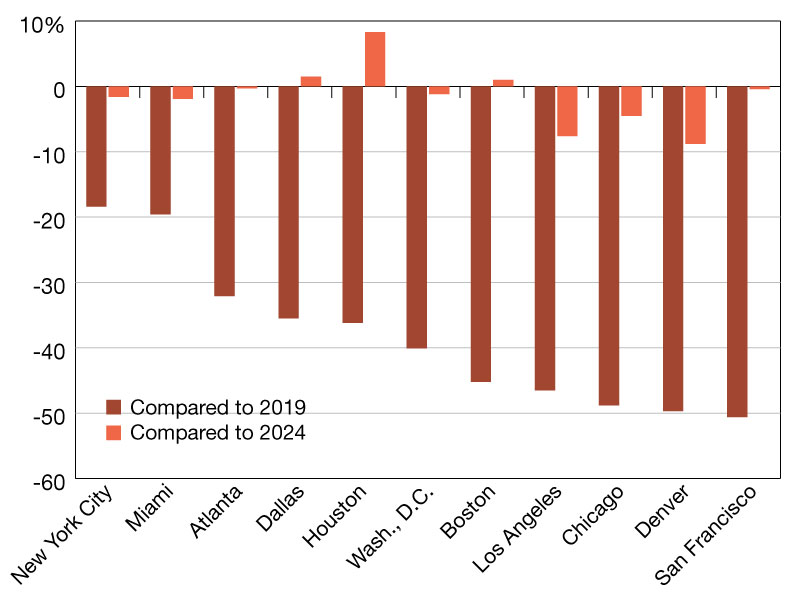

Retail property trading velocity continues to decline. By dollar value, it fell 19 percent from late 2016 to late 2017, and by number of assets traded it fell 9 percent, based on data from Real Capital Analytics.

The West Coast and Denver are anticipating 2018 retail rent increases of 3 to 4 percent, while the Midwest is being forecast to be substantially more sluggish. (Central region markets are also on average those with the highest vacancies for community and neighborhood centers).

Select markets in other regions are looking at up to 3 percent rental rate bumps at best; these include Wilmington, Del.; Providence, R.I.; Austin, Texas; Charleston, S.C.; and Orlando, Fla., though not necessarily for all product types in each of these metros.

Still, for all the talk of retail doom, the commercial real estate report notes that the vast majority of U.S. metro areas are in the recovery or the expansion phase of the economic cycle, and that about two-thirds are in the expansion phase.

Image courtesy of Integra Realty Resources

You must be logged in to post a comment.