Google Just Canceled $15B in Bay Area Projects. Does It Signal a Bigger Problem?

Experts weigh in on what the move tells us about the tech sector's space needs.

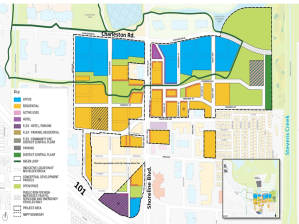

In June, Google and Lendlease received unanimous approval from the city council to move ahead with the 153-acre Google North Bayshore Master Plan in Mountain View, Calif. Image courtesy of Google and Lendlease

Last week’s news that Google and Lendlease have mutually agreed to halt development on four Bay Area master-planned districts, valued in total around $15 billion, has been widely reported.

And against a backdrop of worsening post-pandemic upheaval in the office sector nationwide, this seems like an appropriate moment to try to understand Google’s and Lendlease’s decision in a broader context.

Progress was being made as recently as June, when the partnership received unanimous approval from the city council in Mountain View, Calif., to move ahead with a 153-acre, master-planned mixed-use neighborhood there.

READ ALSO: Emerging Trends for CRE

The other three sites were Downtown West in San Jose, Calif., Moffett Park in Sunnyvale, Calif., and a second location in Mountain View. Demolition had already begun for the 80-acre campus in San Jose, which was to have included a massive 7.3 million square feet of office space, along with about 4,000 housing units and 15 acres of parks.

In an announcement last week, Lendlease said, “the decision to end these agreements followed a comprehensive review by Google of its real estate investments, and a determination by both organizations that the existing agreements are no longer mutually beneficial given current market conditions.”

The Australia-based construction giant added that it will be paid “in consideration for value created through the entitlement and master-planning process,” and that the overall San Francisco Bay Project, originally set to get underway in fiscal year 2026, has been removed from its development pipeline.

Trouble in Techtopia

Lawrence Yun, Ph.D., Chief Economist & Senior Vice President, National Association of Realtors. Image courtesy of National Association of Realtors

Google has been cutting both jobs and its budget since the beginning of this year, and in February the company stated that it anticipated incurring $500 million in costs in the first quarter in connection with reducing its office space globally.

The implosion of the Bay Area projects reflects more than just an issue at one tech powerhouse, industry observers agree.

“Google halting the development of new office properties is not unique and has been a theme since late ’22,” Ryan Miller, a senior analyst at CRE analytics firm Green Street, told Commercial Property Executive.

READ ALSO: Creating a Winning Back-to-the-Office Formula

“Other large tech companies have also pressed “pause” on new office developments across the nation,” he added. “Tech companies continue to put more sublease space on the market, and we expect tech leasing activity to be lower than pre-pandemic levels over the near term.”

Glenn Brill, Managing Director of Real Estate Solutions, FTI Consulting. Image courtesy of FTI Consulting

Glenn Brill, managing director, real estate solutions, at FTI Consulting Inc., agreed: “The slowdown and disruption in the tech industry, combined with general economic uncertainty and a high cost of capital, makes for a situation whereby any large capital investment in a non-core business will likely demand a higher return than previously considered, which makes partnering with core real estate investors more difficult.”

Brill also pointed to another angle of tech firms’ real estate projects: “Over the past several years, big tech has been committing to large-scale, long-term, mixed-use development projects to relieve pressure on local housing markets where they reside and to accommodate their own, and that has not changed and has only been delayed.”

Lawrence Yun, chief economist for the National Association of Realtors, predicts some ongoing pain.

“The office market will continue to bleed for at least the next two years,” he told CPE.

Particularly in San Francisco, Yun continued, there has been “a sharp rise in vacancy to around 20 percent, from under 10 percent pre-pandemic. Moreover, the shadow vacancy is likely running at 50 percent, with many formerly leased properties that will not be renewed once the time arrives.”

You must be logged in to post a comment.