Is the Rise in Construction Costs Decelerating?

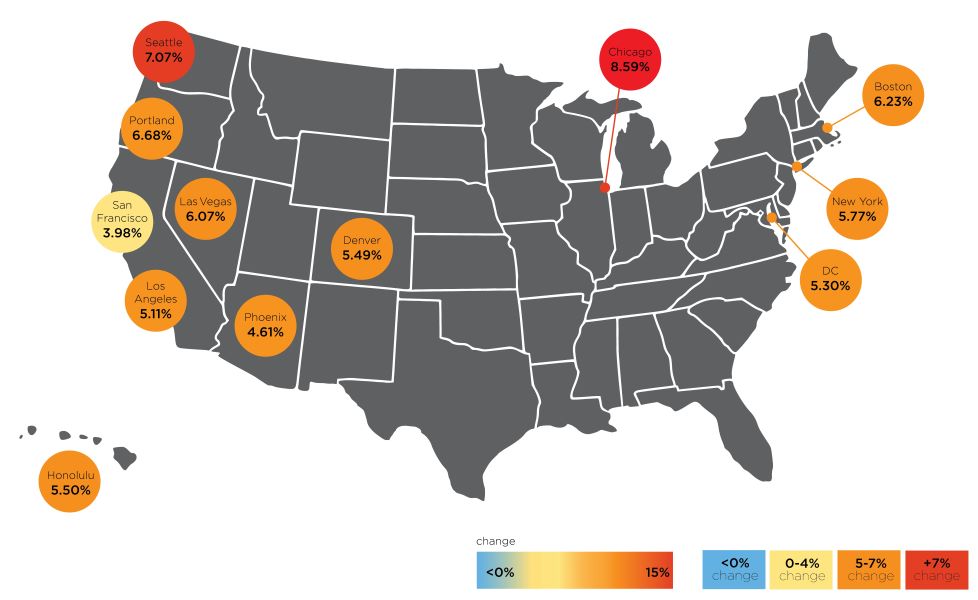

The increases vary widely among major markets. Here's how much.

The rise in construction costs looks to be slowly decelerating, according to the latest research from Rider Levett Bucknall. The firm’s report showed that the average national growth in construction costs was 1.29 percent in the first quarter of 2024 and 5.85 percent year-over-year. The previous quarters of 2023 saw percentage increases of as much as 1.5 percent.

The construction costs percentage has been on an upward trajectory, but the latest quarterly growth matches the increases from the pre-pandemic levels of 2019. The latest year-over-year growth is also just slightly higher than five years ago.

On RLB’s comparative cost index, cities like Chicago, Seattle, Portland and Las Vegas recorded even higher annual percentage increases as compared to the national average of 5.85 percent. Chicago had the biggest jump with an 8.59 percent increase, where Seattle saw a 7.07 percent uptick followed by Portland at 6.68 percent and Las Vegas at 6.07 percent. Several other cities, like Denver, New York and Los Angeles came in below the national year-over-year increases. The lowest percent change went to San Francisco, at only 3.98 percent.

READ ALSO: Construction Costs Continue to Rise in 2024

In his editorial note, Paul Brussow, president of RLB North America, commented that he’s cautiously optimistic for the construction industry following these latest numbers. He added in the report that the industry faced a lot of uncertainty dating back to 2020 but should see a promising future in the coming years.

Looking ahead at the industry

While costs continue to go up, the construction unemployment rate stood at 4.4 percent in the fourth quarter of 2023, unchanged from the fourth quarter of 2022, as indicated by RLB’s report. Brussow said in the report that companies in the field should invest in their existing workforce since finding skilled workers is becoming more difficult. And even though employment increased in more than two-thirds of metro areas in the last year, there are still 400,000 construction job openings nationwide.

Looking ahead, RLB is expressing optimism for the industry. The costs of construction materials are finally trending down, which should lessen the pressure throughout 2024. Moreover, public funding for manufacturing and infrastructure projects should drive industry growth this year, offsetting the anticipated decline in privately financed developments.

You must be logged in to post a comment.