Ivanhoé Cambridge Expands Closer to Home

After focusing on investments in the U.K., China and Australia in recent months, Canadian-based Ivanhoé Cambridge has returned its attention to the United States.

By Gail Kalinoski, Contributing Editor

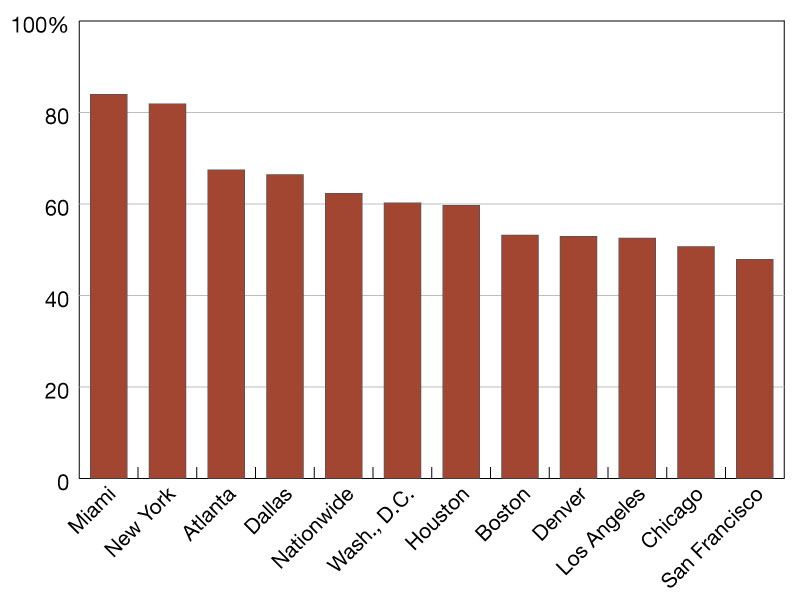

After focusing on investments in the United Kingdom, China and Australia in recent months, Canadian-based Ivanhoé Cambridge has returned its attention to the United States, where it is acquiring four office properties with its partner, Callahan Capital Properties. The first two purchases, located in Boston and Denver, have already closed and cost more than $225 million.

The remaining assets in Chicago and New York City will close at a later date. Ivanhoé Cambridge, the real estate investment and development arm of Canadian pension fund manager, and Callahan are buying all four properties – totaling almost 2 million square feet – from Boston-based Beacon Capital Partners. Closing dates and prices for the final two acquisitions were not released.

“This transaction furthers our strategy of acquiring well-located, high-quality office properties in key U.S. cities,” Arthur Lloyd, executive vice president, Office, North America, at Ivanhoé Cambridge, said in a news release. “Our focused approach of building critical mass in each market reinforces our local presence and strengthens our overall national platform.”

One of the first assets acquired is Channel Center, a three-building, interconnected brick-and-beam office property totaling 251,394 square feet in the hot Seaport District submarket of the city’s Fort Point neighborhood. The Boston Business Journal reported that Beacon Capital, which had purchased the property for $62 million two years ago, sold the property for $100 million to Ivanhoé Cambridge and Callahan.

The second deal that closed is for 410 17th St., a 24-story, 434,740-square-foot office building in Denver’s Central Business District.

The partners are also under contract to acquire 180 North LaSalle St, a 38-story, 768,859-square-foot building in Chicago’s CBD, and the remaining 51 percent interest in 330 Hudson St., a 16-story, 467,830-square-foot office property in Manhattan’s Hudson Square submarket. A year ago, Ivanhoé Cambridge bought the 49 percent interest in 330 Hudson St. for $150 million. The amount to be paid for the remaining 51 percent was not available.

“Not only does this portfolio enable us to efficiently expand and diversify our platform in several of the top-performing office markets in the country, but also provides an opportunity to enhance value through lease-up and targeted investments,” Tim Callahan, CEO of Chicago-based Callahan Capital Properties, said in the release. “These are fantastic properties with physical and locational characteristics that appeal to both creative and traditional space users.”

Founded in Quebec in 1953, Ivanhoé Cambridge has direct or indirect interests in over 160 million square feet of office, retail and logistics properties and in more than 23,000 multi-family units around the globe. In the U.S., Ivanhoé Cambridge and Callahan currently own about 11.5 million square feet of office properties in New York, Boston, Chicago, Seattle and Denver.

The firms made news in January, when they acquired Three Bryant Park, a 1.2 million-square-foot office property in Midtown Manhattan for $2.2 billion, making it the second-largest single-office building transaction in U.S. history. Also this year, Ivanhoé Cambridge teamed up with Beacon Capital Partners to acquire a 40 percent interest in 515 N. State St. in Chicago for about $55 million.

Most recently, Ivanhoé Cambridge has been active outside the U.S. with a May acquisition of a London office property for $198 million and an April acquisition of an office building in Sydney, Australia, for $183.25 million. In June, Ivanhoé Cambridge teamed up with CBRE Global Investment Partners to make logistics investments in China that could total up to $400 million.

You must be logged in to post a comment.