July Issue: Finance & Investment—At Your Service

Loan servicing’s disappearing maturities wall.

It is a good time to be in the loan servicing business—if you have the wherewithal to compete in the arena. Loan servicing is likely to stand on solid footing for the next few years, if current trends hold.

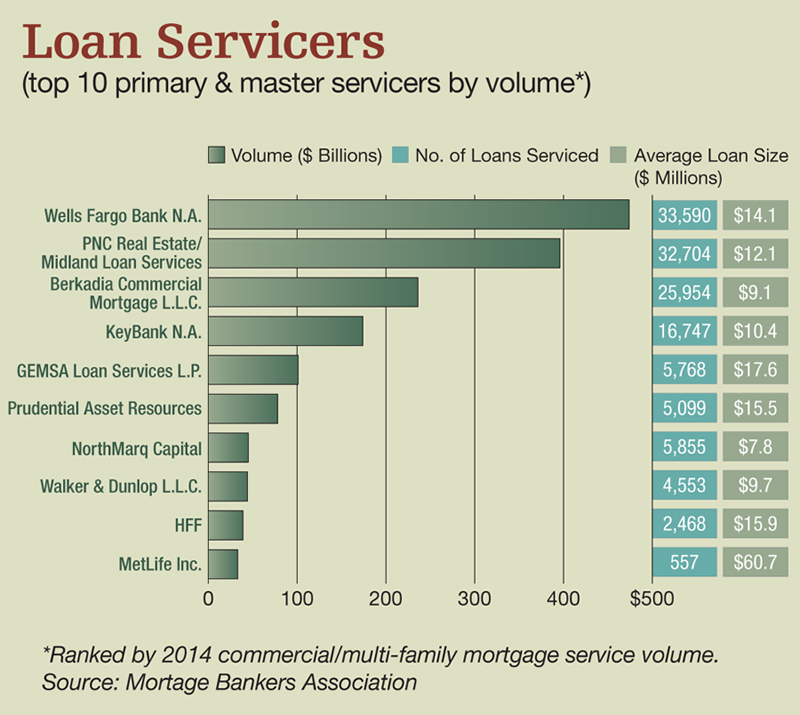

Jamie Woodwell, vice president for research and economics at the Mortgage Bankers Association, anticipates “another strong year” in mortgage servicing volume growth. One of the prime measures of the size of the loan servicing universe is the volume of outstanding loans, as every mortgage on the books has to be serviced. In 2014, total outstanding commercial real estate/multi-family mortgage debt increased at the fastest pace since 2007—by 4.7 percent or $119.5 billion, to $2.6 trillion, according to MBA data.

That growth is expected to continue this year, boosted by robust lending. “Originations through the first quarter were very strong—that will boost servicing volumes further,” said Woodwell. In 2014, commercial/multi-family originations reached $399.8 billion as life insurance companies and GSEs set new records, and commercial banks’ origination was the second highest ever, according to the MBA. And the MBA forecasts a further 7 percent increase this year for commercial/multifamily originations by mortgage bankers.

True, there are going to be loans maturing. In fact, the much vaunted “maturity wall” will hit beginning this year and extend through 2017. This consists mostly of the CMBS loans made in 2005, 2006 and 2007. Nevertheless, not all of the “runoff” loans will leave the system—they may be refinanced, for example.

And a high proportion of loans maturing this year are being paid off in advance. For example, as much as 25 percent of the outstanding loans coming to the end of their term in 2015 was already prepaid in 2014, according to the MBA. This lowers the actual loan runoffs for this year. Favorable interest rates and property valuations encourage the advance refinancing of maturing loans, added Woodwell.

“We are finding that borrowers are very proactive refinancing and defeasing loans because there is so much capacity in the market,” agreed Jan Sternin, senior vice president & managing director at Berkadia. “The wall of maturities (the industry) thought was approaching is not so much a wall anymore,” because so many of the loans are flowing through early, she said. Indeed, some lenders report they are experiencing a slowdown in loan runoffs, and that originations are offsetting payoffs.

Berkadia, which ranks among the MBA’s top five servicers, expects its servicing portfolio to remain more or less constant at today’s level of about $240 billion. “We have pretty much found steady state, which is nice, considering the rest of the industry is dealing with significant runoffs,” Sternin explained.

Because Berkadia was not so active at the end of the CMBS 101 period in conduit financing, it does not face as significant a wave of maturity, said Sternin. And since its wave of maturities came early, its runoff volume currently may be considerably smaller than some other servicers’.

For KeyBank, its loan servicing platform currently represents some 18,000 loans valued at about $180 billion, reported Dan Olsen, senior vice president at KeyBank Real Estate Capital. Maturities have waned and are now breaking even with originations. “Overall, there is net zero over the past 18 months when the maturity wall kicked in,” he said. If originations stay in line with expectations, it could go either way—there may be no significant outflow or inflow.”

Nevertheless, KeyBank, which has acquired significant servicing portfolios from Bank of America and Berkadia in the last few years, expects to further expand its volume this year by taking a bigger piece of the servicing pie. “Originations compared to maturities is at breakeven, so the way to grow the portfolio is by increasing market share,” Olsen said.

Low Expiration Rate

Other lenders that do not service CMBS loans may be experienceing a lower rate of loan payoffs during this period.

For Walker & Dunlop, which primarily services its own originations and has a portfolio heavily weighted in multi-family loans, only 12 percent of its portfolio is maturing in the 2015 to 2017 window, said Jim Schroeder, senior vice president of loan servicing. Boosted by the very robust pickup in financing for multi-family and the relatively low level of loan maturities, many of which have been refinanced in house, Walker & Dunlop’s loan servicing portfolio has grown by more than $7 billion from the first quarter of 2014 to the first quarter of this year, said Schroeder.

Walker & Dunlop experienced its two strongest quarters of originations in the fourth quarter of 2014 and first quarter of 2015, he said. Moreover, the company expects a significant increase in its loan servicing portfolio going forward, due to the continued strength of originations and refinancings, said Schroeder.

Overall in the industry, new originations are projected to outpace expirations this year. In 2014, the $400 billion in non-bank-held originations far exceeded the $82 billion in non-bank-held mortgages that matured, according to Woodwell. In 2016 and 2017, about $200 billion in commercial/multifamily non-bank mortgages will come due, but originations will total more than $200 billion.

Moreover, loan servicing volume will be shored up to the extent that maturing mortgages are refinanced at higher balances because of higher property valuation, Woodwell added. “We’d expect that overall balance of loans outstanding will continue to increase over the next few years,” he said.

You must be logged in to post a comment.