KBS Sells San Antonio Office Asset

The property previously traded in 2006.

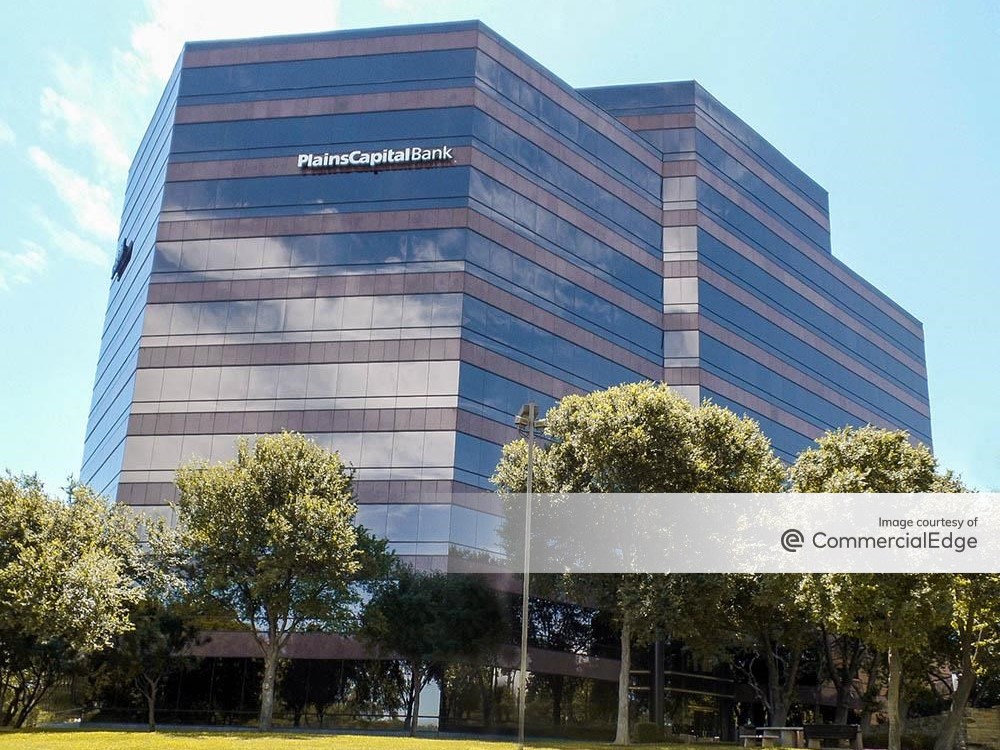

KBS Realty Advisors has sold Fountainhead Tower, a 179,932-square-foot office building in San Antonio. A partnership organized and managed by SynerMark Properties Inc. acquired the asset.

Cushman & Wakefield represented KBS in the transaction. Greenberg Traurig worked as legal counsel on behalf of the seller.

The property previously traded in October 2006, when KBS acquired it from American Realty Advisors, CommercialEdge information shows.

Located at 8200 Interstate 10 W., the property is close to multiple retail destinations and a medical campus. Downtown San Antonio is 10 miles away, while the San Antonio International Airport is 7 miles east.

READ ALSO: What’s Defining Office in 2025?

The office vacancy rate in San Antonio was at 18.8 percent by the end of 2024, a CBRE report shows. Meanwhile, the market’s overall asking rates reached historic highs at $28.71 per square foot, marking a 3.3 percent increase year-over-year

Major Texas office markets continue to perform well thanks to strong population growth and corporate migration, KBS’ Giovanni Cordoves told Commercial Property Executive in an earlier interview.

An upgraded office tower

Completed in 1985, Fountainhead Tower rises 10 stories and has floorplates averaging 18,783 square feet. The building underwent renovations in 2017, which included a new conference center. Other amenities at the almost 6-acre property are four passenger elevators, a 627-space parking garage, an exterior courtyard garden with a golf putting green, a deli, outdoor seating areas and bike storage.

The Class A building’s tenant roster includes COMBS Consulting Group, U.S. Navy Officer Recruiting, South Texas Healthcare Alliance, Transwestern and Marcus & Millichap, according to CommercialEdge.

Cushman & Wakefield Executive Managing Director Todd Mills and Director Hunter Mills represented KBS in the transaction. The Greenberg Traurig team comprised attorneys Bruce Fischer, Howard Chu and Tina Ross, as well as paralegal Amanda Kennedy.

You must be logged in to post a comment.