Kennedy Wilson Closes $111M Purchase of Three L.A.-Area Buildings

Kennedy Wilson has completed the second phase of a $143 million Los Angeles-area office portfolio with the closing of the purchase of three of the five assets for a total of $111 million for an aggregate 500,000 square feet.

October 24, 2011

By Barbra Murray, Contributing Editor

Kennedy Wilson has completed the second phase of a $143 million Los Angeles-area office portfolio with the closing of the purchase of three of the five assets for a total of $111 million. The three properties are in excess of an aggregate 500,000 square feet.

The transaction gives Kennedy Wilson a 37 percent stake in the entire 700,000-square-foot portfolio, which is co-owned Kennedy Wilson Real Estate Fund IV, Fairfax Financial and The LeFrak Organization. Among the three recently purchased properties in the group is 9301 Wilshire Blvd., an approximately 88,900-square-foot structure in the coveted Golden Triangle area of Beverly Hills. The property’s tenant roster includes entertainment-industry businesses and cosmetic surgeons. Kennedy Wilson also snapped up 9320 Telstar, a 258,600-square-foot asset in El Monte that counts the County of Los Angeles as an occupant. Rounding out the portfolio is the 169,600-square-foot building at 16501 Ventura in Encino that is home to a variety of tenants, including a handful in the legal profession.

Kennedy Wilson completed the acquisition of the first property in the Los Angeles office portfolio in June, and the company expects to wrap up the purchase of the remaining building in November.

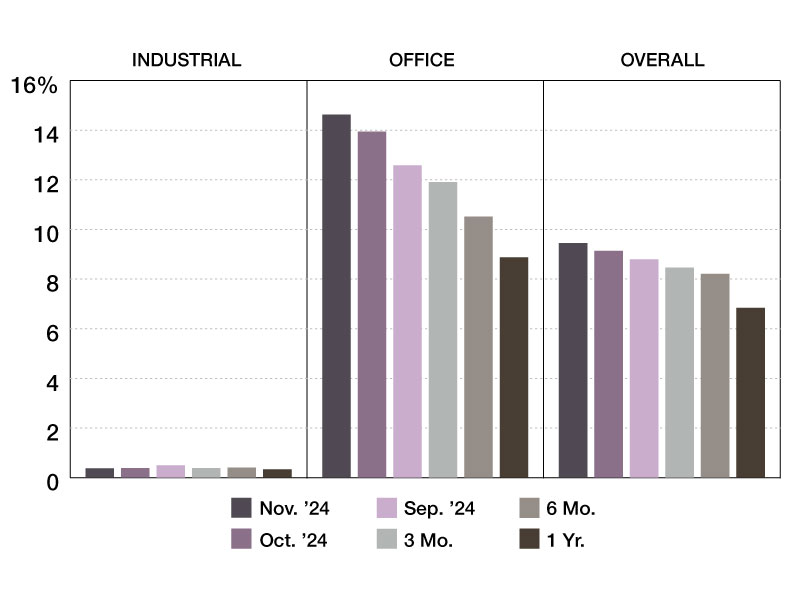

The metropolitan Los Angeles office market has not made a complete comeback just yet — the average vacancy rate in the third quarter was 16.6 percent according to a report by Grubb & Ellis Co. — but investors have still been quite eager to grab available assets in the area. “Sales activity improved over the past year, driven by buyers’ perception of bottoming values and prospects for long-term revenue upside,” the report said. “As such, institutional dollars pursuing performing assets increased markedly in that time, contributing to a substantial rise in deals sold above $5 million.”

Transactions in the third quarter included Morgan Stanley and Lincoln Property’s purchase of the 950,000-square-foot Parsons Campus in Pasadena for $319.9 million, and Pacific Financial Equities Inc. buying of the Pacific Financial Center downtown at 800 W. 6th St. for $49.5 million. Office properties during 2011 have traded at a median price of $231 per square-foot as of the close of the third quarter.

You must be logged in to post a comment.