Top 100 Office Leases of 2024 Point to Stabilization

One market led the country by a substantial margin, according to CBRE’s new report.

The average size of the top 100 office leases in 2024 rose to 288,834 square feet, up 8 percent year-over-year, according to CBRE’s latest report.

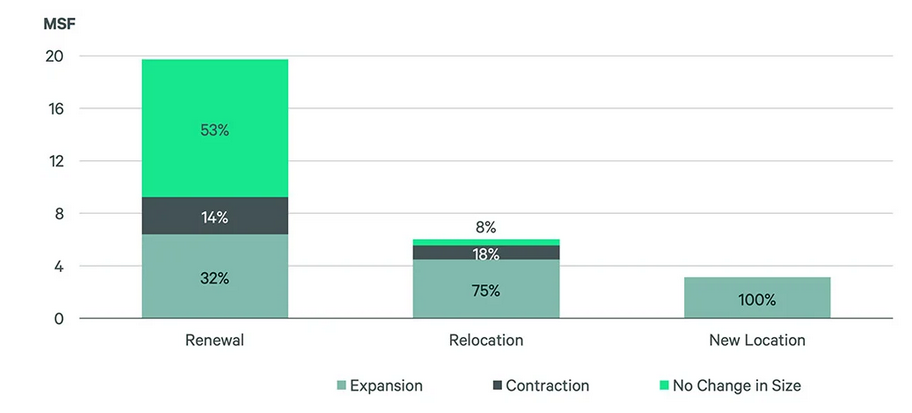

The survey also found that renewals accounted for 68 percent of the new agreements, marking a 10 percent increase compared to 2023.

The report also showed that more than 50 percent of renewing tenants maintained their existing footprint, and nearly one-third expanded. Three-quarters of those who moved out expanded their space with preference to Class A “trophy” space.

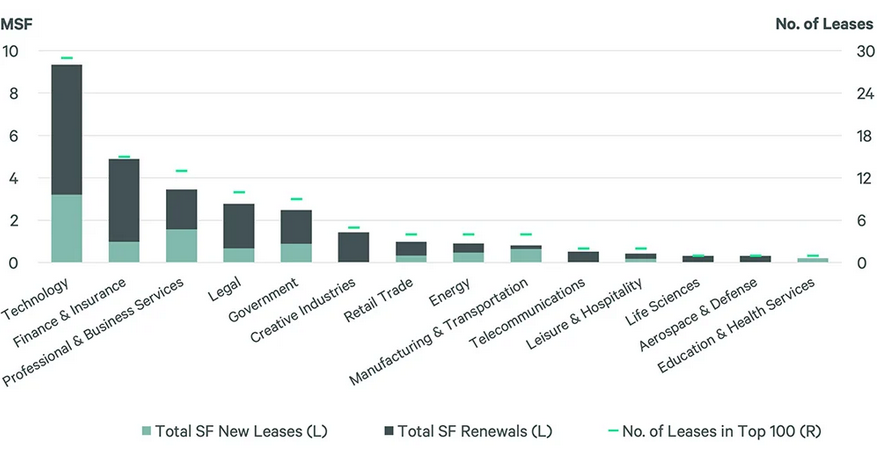

Technology companies led the list with 29 of the largest leases, followed by finance & insurance at 15.

“The rise of GenAI technology and implementations in businesses have been a driver of newly leased space as either new startups pop up or existing firms expand to develop these capabilities,” Ermengarde Jabir, Moody’s Director of Economic Research, told Commercial Property Executive.

For example, in San Francisco, arguably one of the most impacted office markets during the current cycle, a fair amount of recent absorption has been related to the need for office space associated with AI endeavors, she said.

Those relocating gave the nod to “vibrant mixed-use” districts, defined as having a dense population, closeness to retail, dining and culture and prime office buildings.

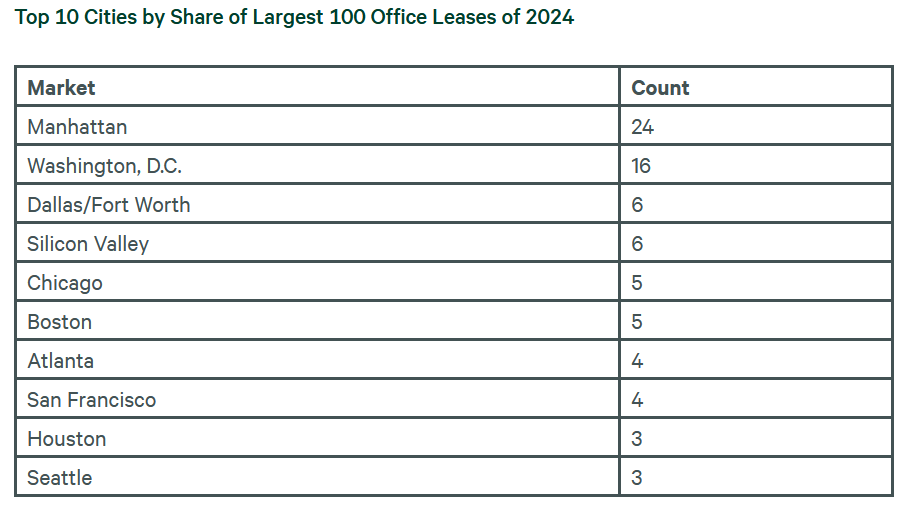

The Northeast (42 percent) and Pacific (17 percent) regions held the greatest amount of square footage on the list. On a market level, Manhattan dominated, securing the largest share of the top 100 leases by a substantial margin, with 24 large leases signed.

More space enhances productivity

“While the office leasing market has been in a downturn for several years amid shifting workplace strategies and elevated vacancy rates, several sectors continue to display resilience and even expansion,” Nick Schlanger, director of research services at NAI Hiffman, told CPE.

Growth among professional services, life science and tech firms has been a key driver of large lease transactions, as these industries maintain a strong need for high-quality office environments, Schlanger observed.

“Across these sectors, the push toward premium office space reflects a broader shift: rather than leasing just for capacity, companies are securing space that enhances productivity, aligns with corporate culture, and provides a competitive edge in recruitment and retention.”

Schlanger said that in two of the largest office leases in the Greater Chicago area last year, Medline Industries expanded its footprint in both the CBD and the suburbs.

The medical supply giant signed a long-term lease for an additional 110,000 square feet at the Merchandise Mart, bringing its total space there to 161,000 square feet. Simultaneously, Medline secured a 214,560-square-foot lease at 2375 Waterview Drive in Northbrook, marking the largest new suburban office lease since 2022.

“Medline’s expansion highlights the resilience of health-care and life sciences firms, which continue to grow their office presence even as other sectors recalibrate. These companies prioritize high-quality space to support corporate operations, innovation and workforce needs, reinforcing their role as key drivers in today’s office market.”

Altered remote policies have an impact

“We are firm believers in urban office space and have seen a dramatic uptick in activity in early 2025,” James Grady, senior vice president of leasing for Synergy, told CPE.

Synergy is one of Massachusetts’s largest and most active commercial landlords, and it owns a significant number of downtown Boston office buildings.

READ ALSO: Which Asset Classes Stole the Spotlight in 2024?

“We have witnessed a noticeable surge in office leasing activity, not just in the broader market but also across Synergy’s significant portfolio. As more and more companies continue to alter their remote work policies, we anticipate this momentum will only grow.”

There is increased collaboration between landlords and tenants, as both sides work together to create office environments with on-site amenities that support these evolving policies, he added.

B and C products not seeing the pop

David Curry, partner at Farrell Fritz, P.C., said he is seeing a similar trend at the higher end of the office market, which is not translating to the lesser B and C products.

“The vast majority of these spaces are in top Class A office buildings,” Curry told CPE. “Class A office remains a desired commodity despite the generally flat overall performance of office.”

According to Curry, businesses remain willing to spend record rents on full-service, high-end spaces their employees want to come to, and their clients are impressed by.

These spaces offer amenities such as dining options, fitness centers and other recreational spaces. They are typically newer buildings with open floorplans and more natural light, which enhances the work experience and fosters collaboration. “Such Class A amenities offer these companies a leg up to recruit the best and brightest talent,” he said.

READ ALSO: What’s Defining Office in 2025?

Curry added there has also been an increasing “mandate” to return to office in the years since the COVID-19 pandemic.

“Many companies believe that productivity, collaboration and comradery among its staff suffer the more their employees are permitted to work remotely,” he said. “A growing number of large and influential Class A tenants are requiring their workforce to return to the office by increasing their ratio of in-person workdays to remote workdays or eliminating the ability to work remotely entirely. This shift in policy requires additional square footage.”

Curry said this trend is likely a sign that these top companies are thriving and expanding their workforces, requiring more space, which is a welcome economic indicator.

Larger office spaces can fill that expansion and/or consolidate operations that may be spread among multiple locations. These consolidations can be meaningful ways to cut overhead costs and increase efficiency.

You must be logged in to post a comment.