Las Vegas Stripped of Appeal as Casinos Suffer

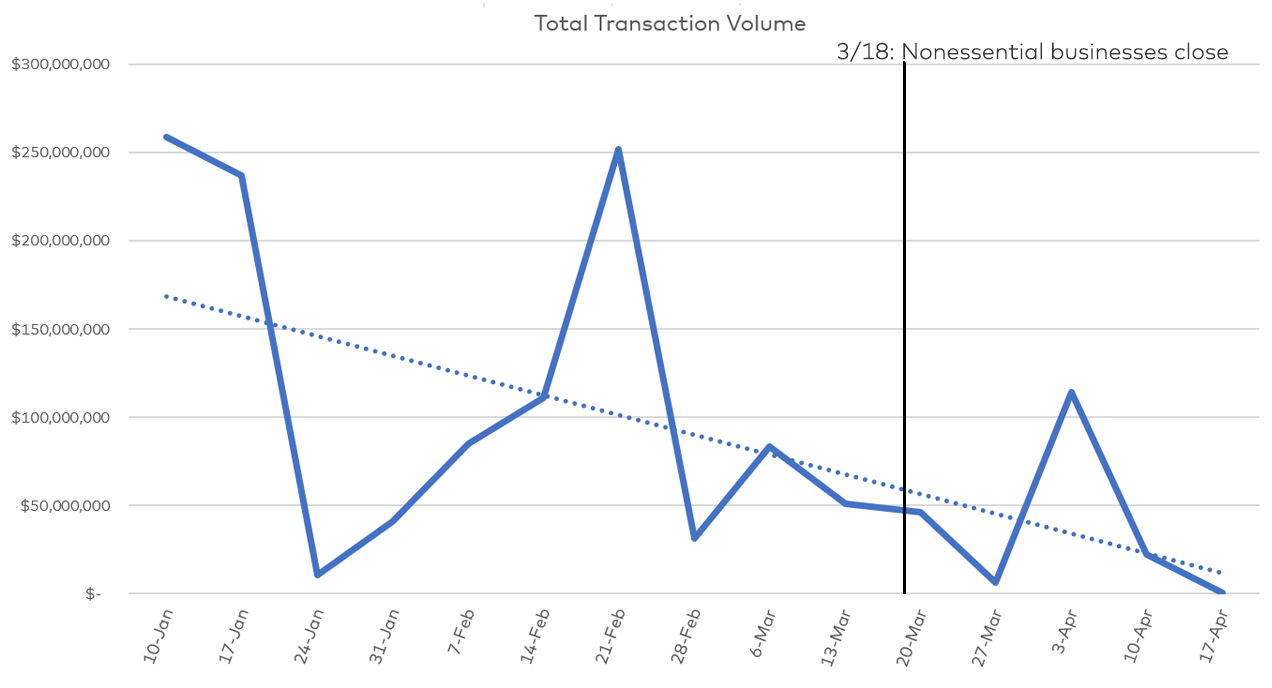

The coronavirus pandemic led to a nearly 33 percent drop-off in transactions in the weeks following Governor Sisolak's nonessential business closure order—though one asset class is bucking the trend.

A month and a half after the historic closure of Nevada’s nonessential businesses, Governor Sisolak outlined a recovery plan for the state on April 30. While many businesses could begin opening in phases as soon as mid-May, the fate of Las Vegas’ 440 licensed casinos remains in the hands of the Nevada Gaming Control Board.

While Vegas’ casinos had actually closed before—for one full day following the JFK assassination, for example—the March order truly was unprecedented, both in terms of scale and scope. Shopping malls, conference centers and recreation facilities shuttered, and the city’s restaurants were forced to shift to carry-out or delivery options only, similar to what has, by now, become commonplace across the country.

These hurdles have the power to unmake many of the gains made by Las Vegas’ diverse commercial real estate sectors throughout the past decade. For example, while Yardi Matrix data has long noted the metro’s multifamily rent growth as far outpacing the national average, skyrocketing unemployment could make rent collection a real issue. The retail sector faces similar issues, as stores remain closed and rents come due. In the office sector, as millions of Americans have shifted to working from home, demand for new, high-end space has fallen off a cliff, leaving developers and value-add investors holding the proverbial bag.

And then, of course, there’s Las Vegas’ critically important hospitality industry. In addition to casino closures, grounded flights and canceled conferences have gutted the sector in a matter of weeks. In April, RevPAR had already fallen, on average, more than 75 percent nationwide, and figures specific to Las Vegas are likely even more severe.

While the governor’s phased approach to reopening the state’s businesses is a positive step, Las Vegas’ real estate is still affected. With unemployment continuing to spike, consumer confidence and spending habits will take much longer to recover, leaving the future of many of the metro’s primary economic drivers up in the air.

Deals drop off

What has this meant in terms of the metro’s investment volume? Public records filed with the Clark County paint a bleak—albeit uneven—picture. Looking at the weekly volume of recorded Las Vegas property sales, a clear downward trend emerges. Transactions of less than $5 million were excluded from this analysis.

In the four weeks following the March emergency order, $141.6 million in property transactions closed in the county, nearly a third less than the $210.6 million from the previous four-week period. Though it comes with a caveat that deals may still be closing with greater delays due to increasingly overburdened county record offices, the sheer drop-off in volume offers a compelling narrative that investors are taking a “wait-and-see” approach to acquisitions. While the graph above excludes land sales, these too have fallen in a similar way, falling 46.8 percent from $69 million to $36.7 million between the same two timeframes.

So, what’s selling?

The breakdown between asset types involved in the deals—both before and after the government order—also provides us with some perspective on which sectors are feeling more pressure than others:

Following the shutdown, the majority of closed transactions involved industrial assets, while all other property types saw a significantly reduced share of the overall volume. Transaction volumes for nearly all asset classes fell significantly in the four weeks after the shutdown commenced. Retail and office volume fell by a respective 33.8 and 34.6 percent, and the “other” category—consisting mostly of education and entertainment facilities—dropped similarly, showing a 36.3 percent contraction in closed deals.

However, it’s not all bad: Distribution and logistics centers have become more important now than ever before, as e-commerce becomes the mainstay of the transformed shopping landscape. This is particularly true in Las Vegas, and the metro’s place as a growing regional distribution hub made it a prime spot for investment. As a result, industrial transactions increased by a staggering 210 percent, jumping from $34.1 million to $105.9 million.

What’s next?

While commercial real estate, both locally and at the national and global stages, remains in flux, good news may be on the horizon. With states like Nevada taking meaningful steps to flatten the curve, some optimistic estimates suggest the economy could recover to pre-coronavirus levels by the end of the year.

So many unknowns surround the pandemic and its impacts, however, and not just in epidemiological terms. Important questions persist about how businesses can effectively withstand drastic near-term revenue losses, levels of any future government assistance and how much forbearance lenders will be able to offer.

You must be logged in to post a comment.