Law Firm Office Leasing Maintains Momentum

And why relocating has become less feasible, according to Savills’ latest report.

Law firm real estate transactions continue to gain momentum in 2024 after achieving a level of leasing demand in 2023 that met pre-pandemic activity, according to a new report from Savills.

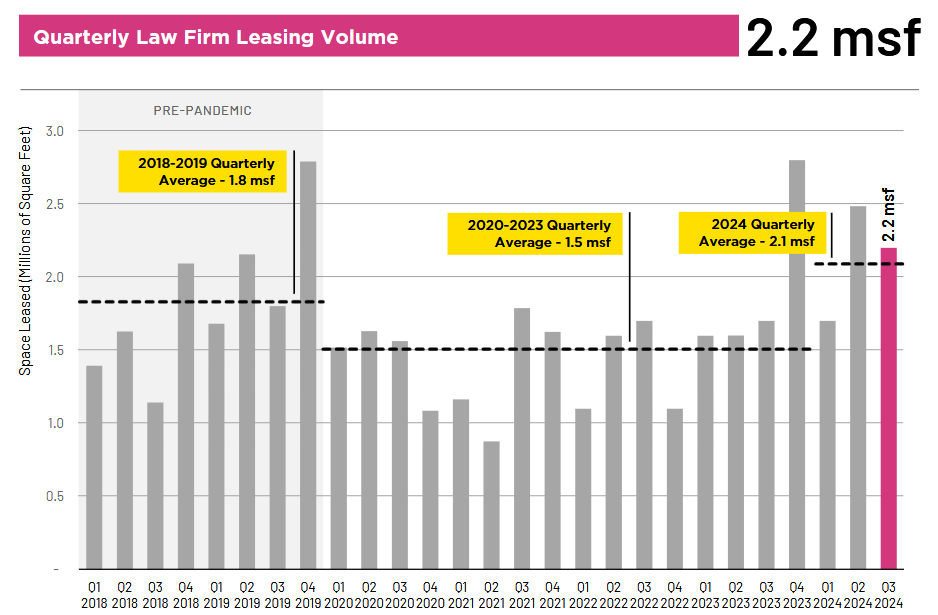

Legal sector leasing volume from the first quarter to the third quarter increased by 29.9 percent compared to the same period last year, as shown in the firm’s latest research study.

Interestingly, downsizing transactions were up by 6.7 percent compared to 2023, reflecting law firms’ efforts to adapt their space utilization to shifting market dynamics.

“Over the past four quarters, quarterly leasing volume has averaged 2.3 million square feet, a notable rise from the 1.5 million square feet quarterly average recorded between 2020 and 2023,” according to the report. “This trend highlights the consistent leasing momentum of recent quarters, with volumes frequently surpassing pre- and post-pandemic levels over the past five years.”

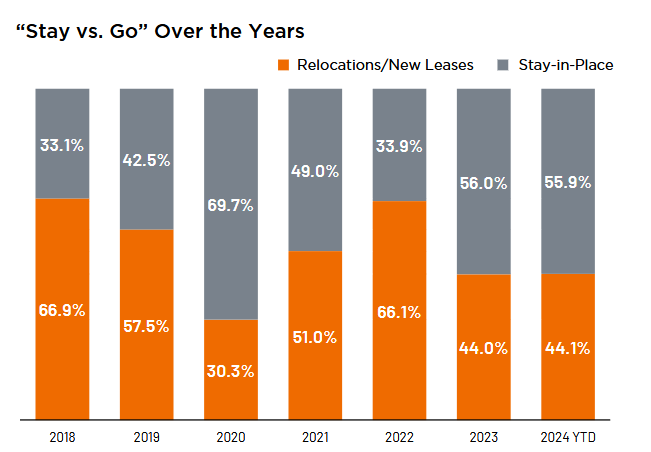

A majority of firms want to stay in place, with 55.9 percent of leasing activity doing so this year through the third quarter, consistent with 2023 levels.

Occupancy changes showed 35.4 percent downsizes, 34.5 percent expansions and 30.1 percent negligible size changes.

After preferring relocations earlier this year, by the third quarter, renewals became more common as limited high-quality options, rising improvement costs and landlord financial constraints made moving less feasible.

READ ALSO: Return-to-Office Traffic Reaches Record Level

Because tenant improvement allowances increasingly fall short of covering build-out expenses, there has been a “steady shift” to longer lease agreements to manage record-high construction costs, the report indicated.

Focus on high-quality office spaces

“Law firms strongly prefer high-quality office spaces, even as other industries shift toward remote work,” Doug Ressler, business intelligence manager at Yardi, told Commercial Property Executive.

Law firms are leasing premium office spaces with modern amenities to attract and retain talent, Ressler observed. These spaces often include features like touchless elevators, networking areas and dining facilities.

“Many law firms relocate to prime locations, often taking advantage of favorable leasing terms in markets with high vacancy rates. This trend is particularly noticeable in cities like New York and San Francisco.”

Ressler said law firms have actively leased large amounts of space despite the broader office market challenges. For example, in 2023, law firms leased around 12 million square feet of office space in the U.S., with significant activity in major markets.

“These trends highlight the legal sector’s unique approach to office space, balancing the need for high-quality environments with strategic relocations to optimize costs and benefits,” Ressler said.

Need for in-person interactions

Law firms emphasize the importance of physical office space for collaboration, training and maintaining corporate culture, according to Michael Romer, Esq., co-managing partner, Romer Debbas.

According to Romer, this is reflected in their preference for spaces that facilitate in-person interactions.

“As law firms continue to face challenges posed by remote work and competing firms operating virtually or predominantly virtually, it is promising to see the legal community appear to recommit to an in-person model,” Romer said.

A physical office space where lawyers and staff can collaborate and share ideas is necessary for a law firm’s success and long-term survival, Romer observed. “The remote work concept can provide certain quality-of-life benefits to established attorneys. Still, it hinders the education and growth of the next generation of lawyers, not to mention office morale.”

The Savills survey focused on firms with 20,000+ in square footage, generally larger firms that thrive on institutional clients paying two to three times the hourly rates of small law firms.

“Office space expense is less of a concern for such firms,” Romer said. “Meanwhile, small to mid-size firms struggle to balance office space and the attorney talent needed to occupy it. Many producing attorneys who wish to remain remote would switch firms or look elsewhere if they had to report to the office daily.”

Firms continue to explore how their office space can be a tool in recruiting and retaining top-tier talent.

In many cases, they identify areas where they can create efficiencies within their physical spaces to offset the higher rental rates commanded by the newest and most attractive buildings that many firms have pursued, according to Stream Realty Partners’ Vice Chairman & Managing Director Craig Wilson.

“For many firms, being in a building with an energetic vibe, a complimentary tenant base and attractive, high-caliber amenities is paramount to large individual offices, libraries and some of the other fixtures of law firms of the past,” he told CPE.

You must be logged in to post a comment.