Top Markets Shaping Coworking Growth

Find out which U.S. metros have the largest footprints, according to CommercialEdge data.

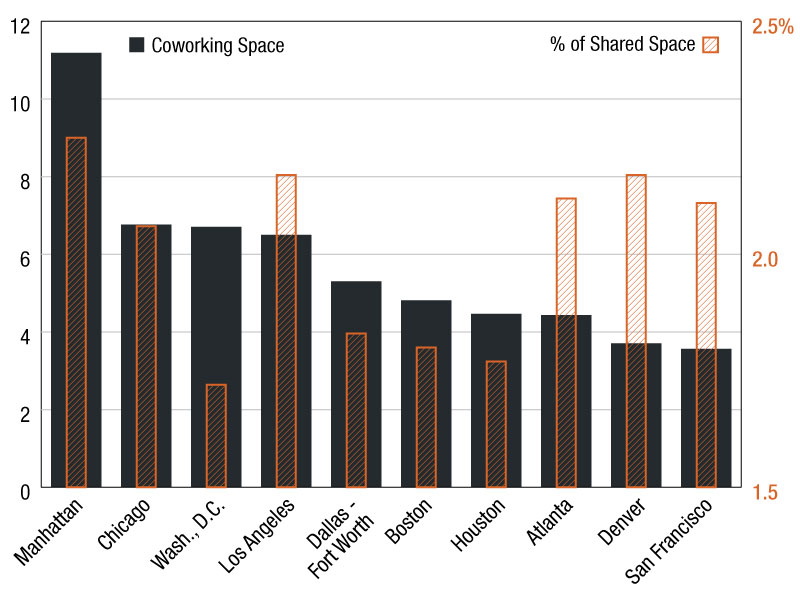

In November, CommercialEdge data provided a snapshot of the nation’s coworking landscape, highlighting the top 10 markets driving the growth of shared office space. These key locations showcased notable variations in footprints, reflecting the evolving demand for flexible work environments across the U.S.

Manhattan led the way, with 11.2 million square feet coworking space spread across 275 locations. This accounted for 2.2 percent of the metro’s total rentable office stock, underscoring the enduring appeal of such spaces in one of the world’s most competitive real estate markets. Similarly, Los Angeles (6.5 million square feet) and Denver (3.7 million square feet) demonstrated robust coworking footprints, each reporting a share of 2.2 percent, slightly above the national average of 1.9 percent.

Chicago, Atlanta and San Francisco followed closely, with coworking locations comprising 2.1 percent of their total rentable space inventory, CommercialEdge data shows. Chicago encompassed 260 locations and 6.8 million square feet of coworking space, while Atlanta’s 242 locations accounted for 4.4 million square feet. As of November, San Francisco had 125 locations offering 3.6 million square feet of coworking space.

Meanwhile, Dallas-Fort Worth had 5.3 million square feet of coworking space, representing 1.8 percent of its rentable office space stock. Boston and Houston rounded out the rankings with coworking pipelines of 4.8 million and 4.5 million square feet, respectively. In both markets, coworking space represented 1.8 percent of the total rentable office inventory.

—Posted on November 27, 2024

You must be logged in to post a comment.