LEI, Partners Launch Venture with Purchase of 191 KSF Office Tower in Thriving Denver Locale

Lowe Enterprises, The Guardian Life Insurance Company of America and a subsidiary of Allstate Insurance Co. introduced their new venture with the acquisition of Alamo Plaza.

By Barbra Murray, Contributing Editor

Lowe Enterprises Investments, The Guardian Life Insurance Company of America and a subsidiary of Allstate Insurance Co. introduced their new venture with the acquisition of Alamo Plaza, a 191,150-square-foot office building in Denver. The team purchased the asset, located in the Lower Downtown, or LoDo, area of the city’s central business district, from Behringer Harvard REIT I Inc.’s Behringer Harvard Alamo Plaza H L.L.C.

Alamo Plaza made its debut at 1401 17th St. in 1981 and today, the 16-story tower is 85 percent leased. The property is a perfect fit for the venture’s strategy, which, as Peter Houghton, senior vice president with LEI, told Commercial Property Executive, is to “target markets that are demonstrating strong demand from growing industries including energy, technology, entertainment and some educational and health users.”

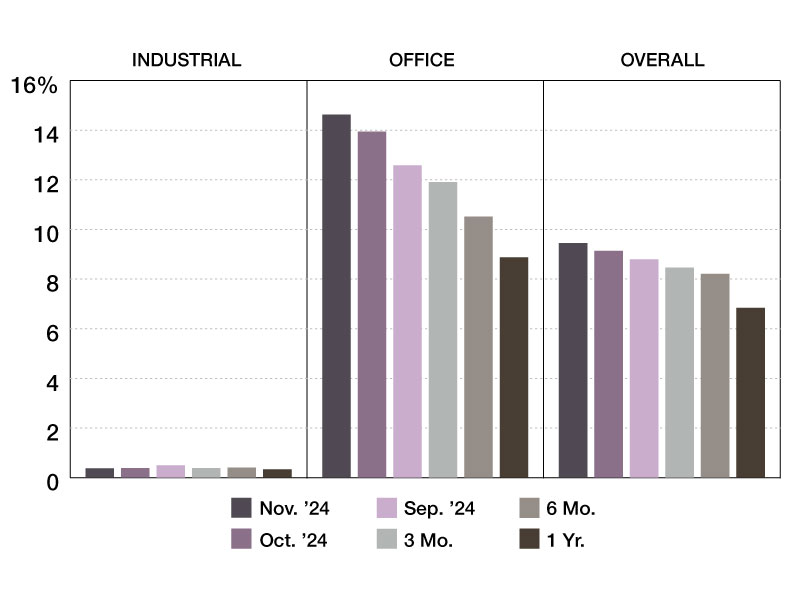

As manager of Alamo Plaza, LEI affiliate Lowe Enterprises will spearhead the venture’s $2 million upgrade program in an effort to capitalize on the strong dynamics in LoDo. The micro-market of the CBD recorded an overall vacancy rate of 9.5 percent in the third quarter, according to a report by commercial real estate services firm Newmark Grubb Knight Frank, down from 10.6 percent in the second quarter.

“The fact that LoDo occupancy has been outperforming the greater Denver market was one attraction to the deal,” Houghton said. “We see interest in the LoDo submarket strengthening as the result of significant continued public and private investment in the area.”

The investment in building improvements, he added, is to “keep the building at the top of its competitive set.”

Denver will remain on the venture’s radar, as will a bevy of other major cities, predominantly in the western states. “Priority will be given to markets where Lowe has a track record of successful investment, including West Los Angeles, San Francisco Bay Area, San Diego … and Denver,” Houghton added.

You must be logged in to post a comment.