Life Science Companies Expand Talent Search Beyond Clusters: CBRE

The number of researchers has jumped 79 percent in 20 years, and the growing industry still struggles to fill positions.

The life science industry has mushroomed over the last two decades and now, according to CBRE’s Life Sciences Research Talent 2022 report, employers are scoping leading, emerging and potential markets for top talent as the demand for employees expands exponentially in lockstep with the sector.

There’s a talent shortage across the board in the U.S. employment market and the life science industry is among the industries that are most challenged, particularly in the areas of scientific and professional roles.

READ ALSO: Life Science Properties Must Make ESG a Priority. Here’s How.

The number of professionals engaged in life science research in the U.S. increased 79 percent between 2001 and 2021, while overall occupations in the U.S. recorded growth of just 8 percent, according to the CBRE report. Major demographic, economic and technological trends combined with technological innovations have taken the life science industry to new heights. “As total employment has rebounded from the 2020 downturn, the life science industry has continued to grow at its fastest pace on record,” the report finds.

Among life science research positions, medical scientists comprise the largest segment of the group, totaling more than 132,000 and having grown a notable 131 percent since 2001. Biochemists and biophysicists have seen an even greater expansion in their profession over the past two decades, recording growth of 167 percent. However, the data scientists profession, which fuels the high-tech and software industries and the scientific research sector to a lesser degree, has skyrocketed 1,363 percent.

Where the talent grows

There has been a movement in the U.S. to address the shortage in life sciences talent since 2001, with efforts to increase education in the areas of science, technology, engineering and mathematics. The endeavor has garnered tangible traction. Over the last 15 years, degrees and certificates conferred in biological and biomedical sciences have risen 103 percent. “As more students flock to these fields, the pipeline of talent appears to be growing sufficiently in line with the industry’s expansion,” as noted in the CBRE report.

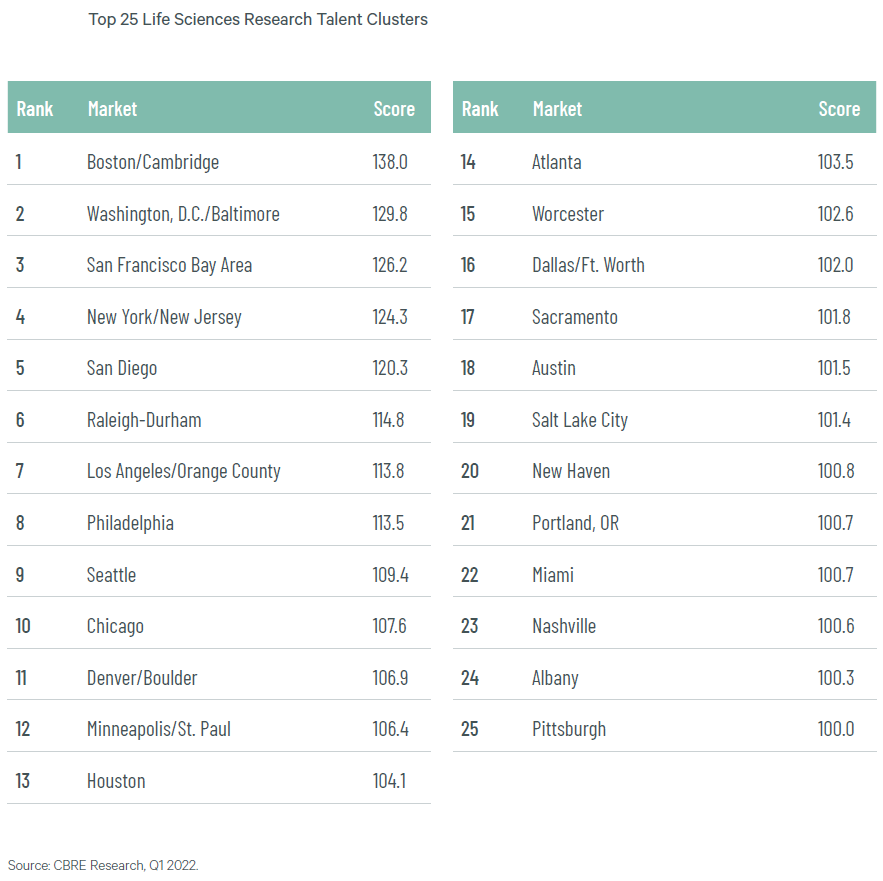

The leading pools for existing and emerging talent are located in the top life science clusters, starting with Boston/Cambridge, the center of the life sciences universe in the U.S. The area, which boasts higher densities and concentrations of talent, hits just about every coveted datapoint, including high general education levels, influential universities and institutions, a historical presence of private industry locally and the availability of capital to fund growth.

The Washington, D.C./Baltimore area ranks as the second-leading life sciences talent cluster. The area is bolstered by its status as a major population center, as well as its numerous world-renowned universities and industry presence. The San Francisco Bay Area, the second-largest life science hub in the U.S., is the third-largest life science talent hub, followed by New York/New Jersey and San Diego.

While the traditional leading life science hubs are the obvious destinations for talent searches, there are other locales that are proving to be emerging hunting grounds for highly qualified employees. Metros including Sacramento, Calif.; Austin, Texas; Salt Lake City; Nashville, Tenn.; Pittsburgh and Portland, Ore., offer a highly educated workforce and substantial concentrations of life science researchers. Worcester, Mass., New Haven, Conn., and Albany, N.Y., for instance, benefit from a cast-off effect of sorts, given these smaller cities’ proximity to major markets Boston/Cambridge and New York/New Jersey, as well as their own strengths in the areas of educated talent and high levels of researchers.

“It is notable, especially when evaluating future sources of talent and expansion, that the most successful clusters ultimately thrive where an abundance of highly educated people live and work in the professional, scientific and technical industries more broadly,” according to the CBRE report.

And CBRE has a suggestion for holding onto the best and brightest. “As noted in CBRE’s recent analysis of the labor issue, employers can counter this [shortage] trend by addressing employees’ pain points, optimizing flexible work arrangements, fostering cultures that transcend physical space and tapping new markets for talent.”

Read the full report here.

You must be logged in to post a comment.