Life Science Market Finds Its Spark

A few bright spots emerge from Colliers’ new report.

Life science companies’ long-term outlook remains strong, according to Colliers’ latest research.

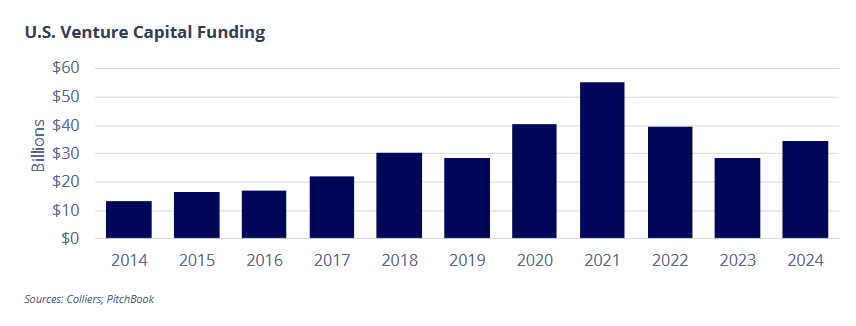

More treatments are under examination, pharmaceutical spending remains high and venture capital investment in 2024 was $5.6 billion higher than the year before—making it the fourth-best year on record.

Among property types, the life science sector ranks as the smallest among the four key commercial real estate asset classes, but its share of properties today is eight times higher than in 2016.

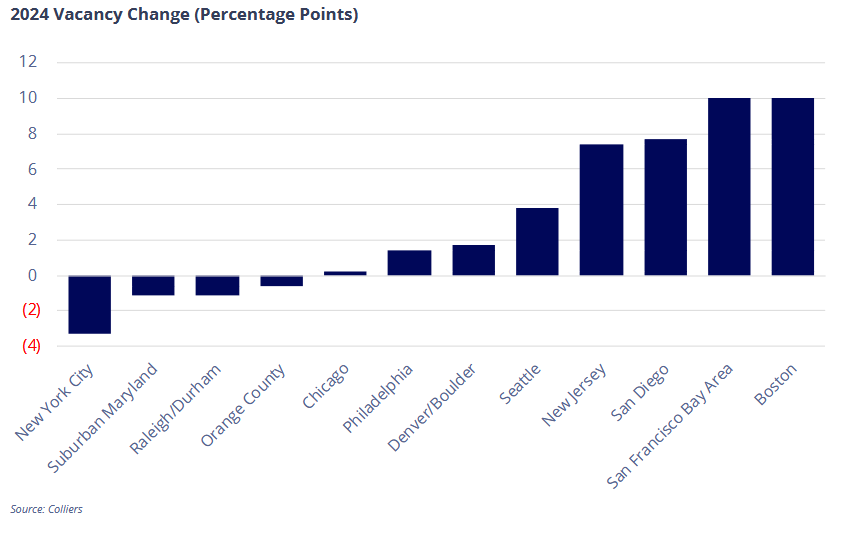

Colliers reported negative net absorption of properties during 2024 in almost half of the markets tracked, and aggregate vacancy rates in the major markets are nearly three times greater than in 2021. Vacancies exceed 20 percent in leading markets Boston, San Francisco and San Diego.

Biotech companies have retreated in value on the stock market. As of the end of February, the S&P 500, for example, is 24 percent above its 2022 peak. However, the S&P Biotechnology Select Industry Index is 48 percent short of its 2021 peak.

Nationally, construction has peaked, but new projects in some cities will continue to pressure vacancies. Across the major markets, more than 43 million square feet of new life science space were delivered from 2022 to 2024, nearly 15 million square feet in 2024 alone.

The delivery of new life science real estate product is relatively minimal for this year, with just 17 million square feet underway, less than half of the previous year’s pipeline.

Investors still committed

An emerging trend to watch is that while deal count is down year-over-year, the overall level of venture capital funding in 2024 increased almost 20 percent over 2023, according to Joseph Fetterman, executive vice president at Colliers.

“This dynamic is evidence that focused investors are still committed to the life science sector and are seeking more advanced, ‘de-risked’ acquisitions with a higher probability of a successful exit downstream,” Fetterman told Commercial Property Executive.

“Another unexpected finding, given the headlines, is that after bottoming out at a 1.4 percent year-over-year decline in the first quarter of last year, R&D jobs in the biotechnology sector increased by more than 3 percent in 2024 to an all-time high in the fourth quarter.”

READ ALSO: Foreign Investment Down, but Not Out

The San Francisco Peninsula life science market has echoed the improving conditions around the country, according to Sonia Taneja, managing director for King Street Properties in California.

“We are seeing an uptick in touring activity at our new project, The Landing, in the Peninsula city of Burlingame,” Taneja told CPE. “High quality, purpose-built life science space should continue attracting the lion’s share of leasing.”

She said her firm’s purchase of the 242,000-square-foot Esplanade life science campus in San Diego at the end of December demonstrates confidence in that market.

“The fundamental role that the life science and biotech industries play for U.S. and global health care, as well as the overall economy, reaffirms these industries’ resilience and strategic importance despite periodic slowdowns in the funding and leasing markets,” Taneja said.

Ken Richter, vice president and national life sciences sector lead at Project Management Advisors, agrees that the long-term outlook for life science/pharmaceutical companies remains strong for many reasons.

“Demographics, AI and technology are a few,” Richter said. The major life science markets have a glut of new purpose-built space, and the absorption rate is the key to the health of this development sector, he added.

“We would be surprised to see any new speculative life science projects break ground soon. Tariffs are another variable and risk. However, the vacancy rate and market demand are far greater impediments to any new speculative development.”

Life science ‘clusters’ attractive

Established life science clusters will prove crucial as the sector experiences growth in the coming years, according to Mark Barer, director of development at Lendlease.

Leading markets like Boston—regularly ranked among the top hubs in the nation—offer immediate access to top universities, research institutions and companies, Barer added.

“This infrastructure allows startups to tap into skilled talent pools, institutional partnerships, commercialization opportunities and other resources necessary for success.”

For example, Lendlease and Ivanhoé Cambridge recently delivered FORUM, a nine-story, 350,000-square-foot life sciences property in the Boston Landing neighborhood.

“Besides large, flexible floorplates and state-of-the-art lab space, FORUM focuses on placemaking and community integration,” he said.

Amenities include a hospitality-inspired, publicly accessible lobby with locally sourced artwork, a coffee and cocktail lounge, and space for community programming. Tenants can also access an expansive outdoor terrace with cabanas, seating areas and grilling stations.

“These features help foster collaboration and community while integrating FORUM into the surrounding neighborhood,” Barer said. “In the evolving and competitive life science sector, developments that balance legacy credibility and livable surroundings will resonate most with today’s talent-driven companies.”

Brent Amos, principal in design firm Cooper Carry’s Science + Technology studio, said that while the volume and scale of life science projects have generally contracted, there are opportunities in other science and technology-related work, with significant demand shifting toward advanced manufacturing.

“We are also seeing more studies happening instead of full-service projects,” Amos told CPE. “Like other architecture firms, we are closely watching market trends, remaining nimble, and pivoting as needed to respond to the changing needs.”

You must be logged in to post a comment.