Life Science Market to Bounce Back: JLL

Following a reset in demand, opportunities lie ahead for both occupiers and owners.

Mark Bruso, JLL Boston and national life science director and a report author. Image courtesy of JLL

Coming off a “sugar high” between 2020 and 2022, the U.S. life science market is undergoing a reset with downward pressure on rents and occupancy as demand for lab space has slowed amid volatility in the capital markets. But the market is well positioned for a comeback as early as 2025, according to a new JLL report.

JLL’s 2023 Life Sciences Industry and Real Estate Perspective report examines the state of the life science sector across the U.S. and identifies trends and opportunities for future and current lab space demand. The report ranks the nation’s top innovation clusters and this year added two new rankings—top markets for medical technology and biomanufacturing.

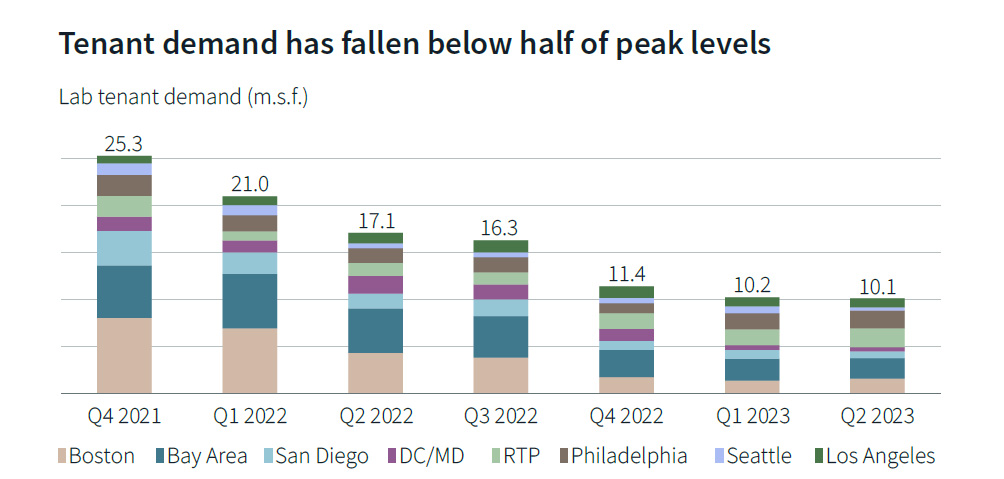

Proving how sensitive the biotech sectors are to economic forces, particularly movement in interest rates and inflation, the report states the supply landscape has shifted dramatically over the past 18 months. At the end of 2021, demand across the top eight U.S. markets was more than 25 million square feet. By mid-2023, that had fallen to just over 10 million square feet.

Tenant demand for life science space has fallen to half of peak levels. Chart courtesy of JLL Research

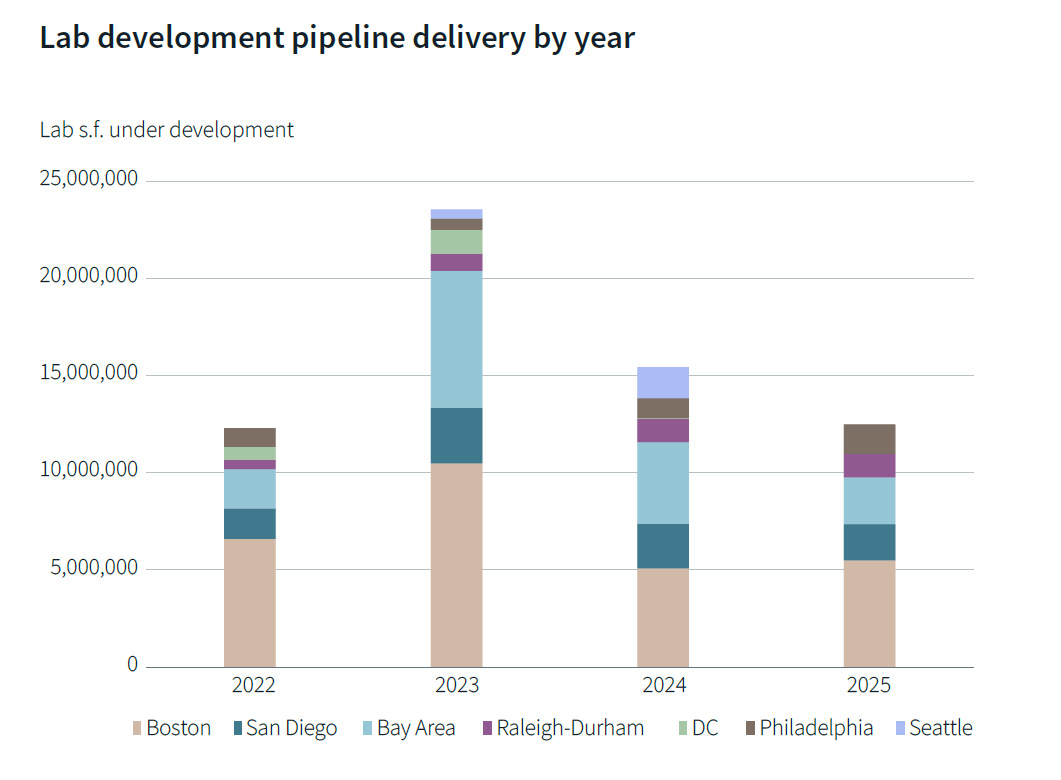

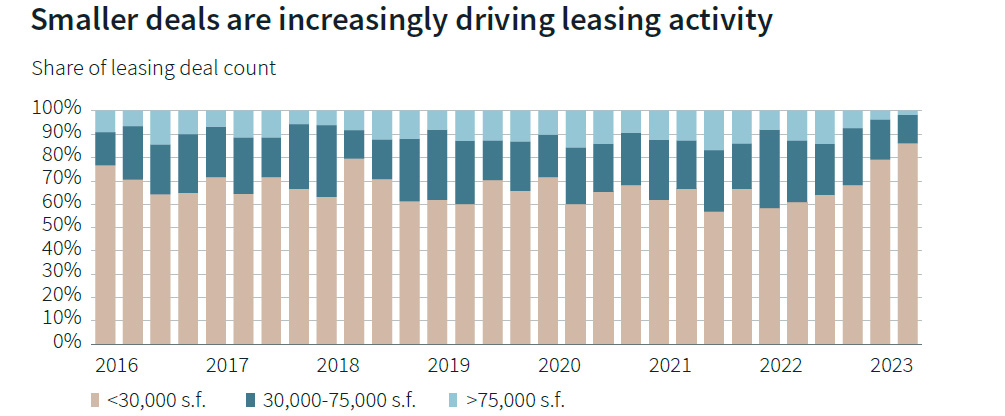

The composition of demand has also shifted in most markets as mid- to late-stage companies hesitated to expand because of the capital markets’ situation. Small users seeking 30,000 square feet of space or less accounted for 82 percent of the deals in the first half of 2023, up from the previous average of 65 percent. The construction pipeline has also slowed down with labs under development dropping by 2 million square feet since year-end 2022 and spec lab construction costs rising by more than 10 percent.

READ ALSO: Life Science Assets Outperform Despite Slowing Economy

The report states in the short term the smaller tenants are as important as ever to landlords and will have opportunities to drive economically favorable transactions.

“This will materialize in low capex, shorter-term lease commitments and falling rental rates—a market the likes of which have not been seen in over 10 years,” according to the report, which adds that more established companies will take advantage of the opportunity to strategically select new markets for growth.

Kevin Wayer, president, Life Sciences, Work Dynamics Division, JLL, said in prepared remarks that it’s the perfect opportunity for larger companies to analyze their real estate portfolios and facilities and make informed location choices as well as for growing companies and startups seeking to scale. He states it marks a new era of strategic decision-making in the life science industry.

Optimism for bright future

Despite the challenging environment, which the report acknowledges and details, the overall tone is one of optimism that it will be a short-lived slowdown. Mark Bruso, JLL Boston and national life science director and a report author, cites two main reasons—record amounts of venture capital dry power just waiting to be deployed and the scientific advances being made across the industry.

“One thing we lose sight of often is how bright the future is,” Bruso told Commercial Property Executive. “There’s new modalities and there’s new therapeutics that are coming to the market that are evidence of that.”

Bruso said he believes the industry is probably at or near the low point.

“We’re starting to see pretty big rounds (of funding) getting signed across the U.S., especially in Boston. So as that pace quickens and picks up, which we think it will do at least some time in 2024, that will be a harbinger of better things to come in a lot of those real estate markets,” he said.

Bruso notes the top 20 venture capital firms focused on life science have raised more than $22 billion since 2021 and are waiting to deploy that record amount of capital into growing startups. He said that figure is four times the annual pace of fundraising in 2021 and 2022.

Travis McCready, head of life sciences, Americas markets, JLL, said in a prepared statement the relationship between funding rounds and startup expansion are symbiotic and drive growth throughout the biotech sectors. He said private markets may have cooled off, but private capital remains hopeful with record dry power from top VCs focused on life sciences.

Bruso added he expects the funding environment to pick up by mid- to late 2024 to increase the leasing velocity from smaller companies and mid- and late-stage companies.

“It’s really just a reflection of how much space they need, why do they need it and how much funding is circulating in the broader environment,” he said.

Another indicator of a quicker bounce back compared to previous downturns—job demand in the life science sector has returned to record highs, according to JLL. The report states this indicates a potential increase in demand for lab space in the coming quarters. Established pharma companies have been driving much of the job growth in 2023 as they are generally cash rich and in strong financial positions.

Top markets & emerging clusters

Many of those workers will be employed in the top three life science real estate clusters in the U.S.—Greater Boston (1), San Francisco Bay Area (2) and San Diego (3). These clusters have matured and evolved over 30 to 40 years. They’ve got the deepest benches of researchers at the discovery and clinical stages along with the highest concentration of VCs with deep industry knowledge, according to JLL.

The report also states those markets have the most options for tenants with second-generation space, spec suites and additional supply. JLL lists the remaining top 10 life science clusters as Greater D.C. and Baltimore, Raleigh-Durham, N.C., New Jersey, New York City, Boulder, Colo., and Northwest Corridor, Philadelphia and Seattle. JLL states Los Angeles is not traditionally thought of as a top 10 market but is “rising fast.”

Among the top submarkets within those clusters are Boston’s East Cambridge and Seaport District. In the Bay Area, South San Francisco is joined by Mission Bay/China Basin and in San Diego, a top submarket is UTC. Other top submarkets for the life science industry can be found in Seattle’s Lake Union, the Bay Area’s Brisbane, Philadelphia’s Navy Yard, Downtown Durham (N.C.) and San Diego’s Del Mar Heights/Carmel Valley. The report notes these top 10 submarkets outperform all others in occupancy by nearly 300 basis points and in asking rents by 23 percent.

Bruso said one of the more surprising markets they looked at was Boulder.

“Their concentration of talent, the amount of innovation activity going on there is surprising a lot of people. Boulder feels like one of those second-tier markets that has a lot of wind at their backs, has a lot of momentum right now. And we’re seeing that in a lot of the numbers that we look at across a lot of market metrics,” he said.

Bruso said some of the others on the top 10 list were markets that no one was looking at five or six years ago for life science real estate development.

“One thing we’ve noticed in the last couple of years is that biotech isn’t just Boston, San Francisco and San Diego. It’s broad based and diffused across the country and there are a lot of really, really strong nodes that folks sometimes overlook. And you can’t overlook them because they’ve got a strong bench of talent. They’ve got top tier universities and hospitals,” Bruso told CPE.

Spotlighting medtech & biomanufacturing

JLL notes the life science industry is more than the development of new therapeutics. It also involves other life-impacting scientific endeavors including medical devices and technologies and biomanufacturing. The report added rankings for both markets within the life science industry for the first time, noting that they are key drivers of the overall industry’s evolution. Because there are significant capital investments being made in these operations, JLL states choosing locations and sites with long-term value and optimal deployment is imperative.

For medtech, Orange County, Calif., is the top-ranked market due to its presence of renowned academic and research institutions, support of local government and industry associations and strong VC presence. The other top clusters are Minneapolis-St. Paul (2), San Francisco Bay Area (3), Greater Boston (4) and Salt Lake City (5).

Bruso said they decided to shine a light on these markets, many of which have been established for decades with industry-leading companies like Medtronic, Boston Scientific, 3M and Abbott Laboratories. He noted many of these companies own their real estate and are expanding their campuses.

“In many ways, medical devices are a more mature subsector than life sciences R&D,” he said.

JLL listed Raleigh-Durham as the top biomanufacturing market, noting the area “is uniquely positioned due to the history of large-scale biomanufacturing in and around Research Triangle Park and the outlying talent pool and three tier-one universities. Philadelphia (2), New Jersey (3), Greater Boston (4) and the San Francisco Bay Area (5) make up the top 5 markets.

You must be logged in to post a comment.