Life Science Prospects Are Looking Up: JLL

Demand is back to 2019 levels in top markets, new research shows.

Another sector is turning a corner. Life science demand was up 6.3 percent across the U.S. in the first quarter. In the Bay Area, Boston and San Diego, however, growth hit an impressive 30 percent, according to a new JLL report.

Signs are pointing to a resurgence, and there are reasons to be optimistic about improving conditions, said Travis McCready, head of life sciences for the Americas with JLL, in a prepared statement. McCready emphasized company creation throughout 2023 despite significant headwinds. He noted venture capital firms have record funding waiting deployment and big pharma has substantial resources aiming for acquisitions. There’s also an upcoming patent cliff that will help drive activity.

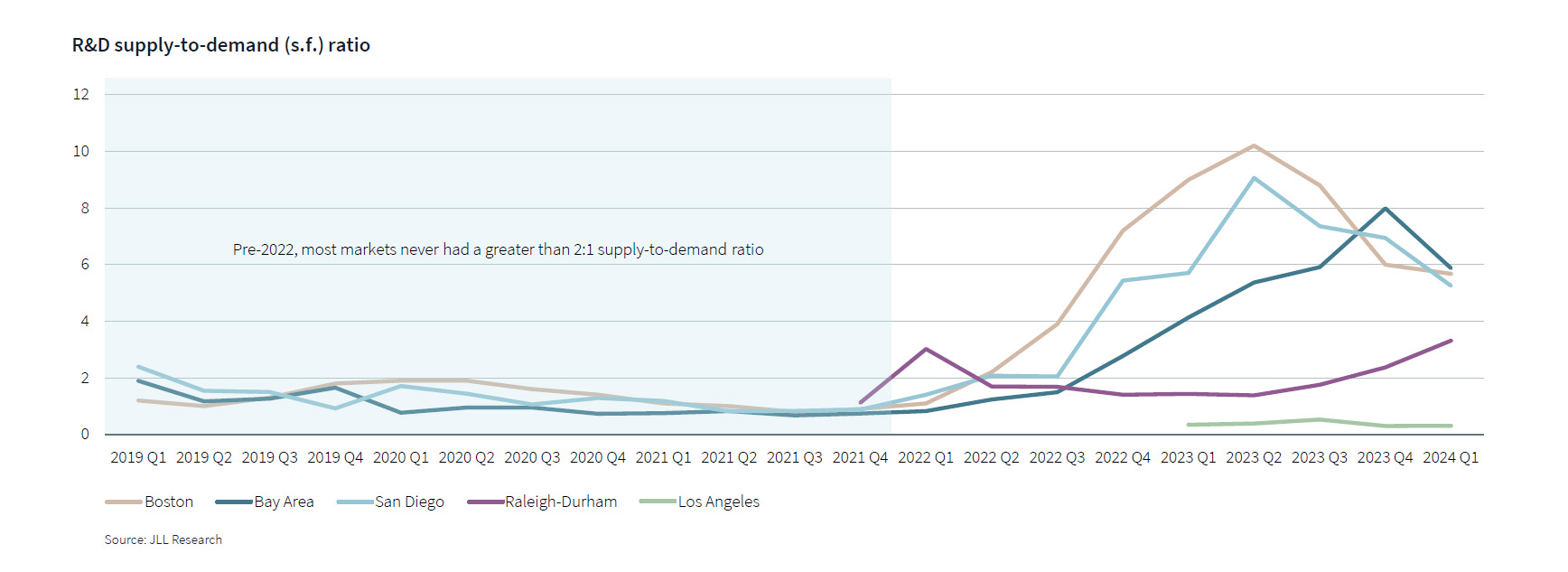

The JLL paper pinpoints five key trends for lab space, including growing national demand, how quality in top markets is driving leasing successes and how the supply-to-demand ratio is gradually beginning to normalize in most major cities. Other top observations include the fact that lease terms are shrinking in an occupier-favorable environment, and that newly added vacancies are expected to fall after 2024.

While there are good rebound indicators, the main hurdle is dealing with current oversupply, virtually everywhere. The sector saw a dramatic shift in the macro environment combined with a glut of new supply arriving while the market cooled, leading to a downcycle. Data shows the sector is on the right path to achieving equilibrium, though.

READ ALSO: Emerging Life Science Hubs Stake a Claim

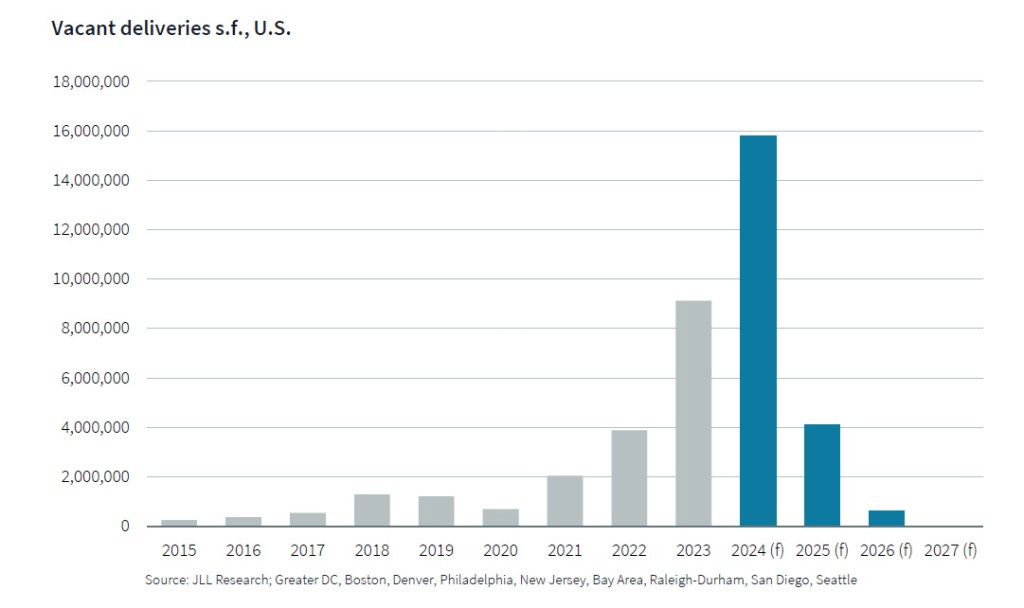

Newly added vacancies are set to fall quickly after 2024, but the sector must first absorb all the new space that came online after 2021. A little more than 13 million square feet of vacant space came online in the U.S. lab market in 2022 and 2023 alone. This year, more than 15 million square feet of new vacant space could be delivered unless demand materially changes before the year ends.

However, the numbers drop considerably after 2024. Currently, only 4.7 million square feet of lab space underway has the potential to deliver vacant from 2025 into 2027, according to JLL. The report also notes that a respite in new supply will give the market some breathing room for improved absorption. Total supply at the end of 2024 could be more than 65 million square feet, with aggregate demand at only 11.5 million square feet.

Hot markets, shorter leases

The usual suspects continue to see strong activity: Boston, San Diego and the Bay Area. The Bay Area alone jumped from less than 2 million square feet of demand at the end of 2023 to 2.7 million square feet in the first quarter. Kevin Wayer, division president for JLL life sciences, stated occupiers in those markets should take advantage of conditions this year because competition for space is likely to heat up once startup capital starts flowing more freely in 2025 and beyond.

READ ALSO: Attracting Life Science Tenants in Core Markets

Wayer also noted demand in the three markets is now on par with 2019 levels. While the aggregate U.S. figure is still 55 percent lower than the 2021 peak, the big three have 6.9 million square feet of demand today. Over the past three quarters, they have seen quarterly growth in demand for lab space averaging 17 percent.

Not surprisingly, the top-tier “core” submarkets have significantly outperformed peers in the three areas. Those top submarkets include UTC and Torrey Pines in San Diego, South San Francisco in the Bay Area and East Cambridge in Boston.

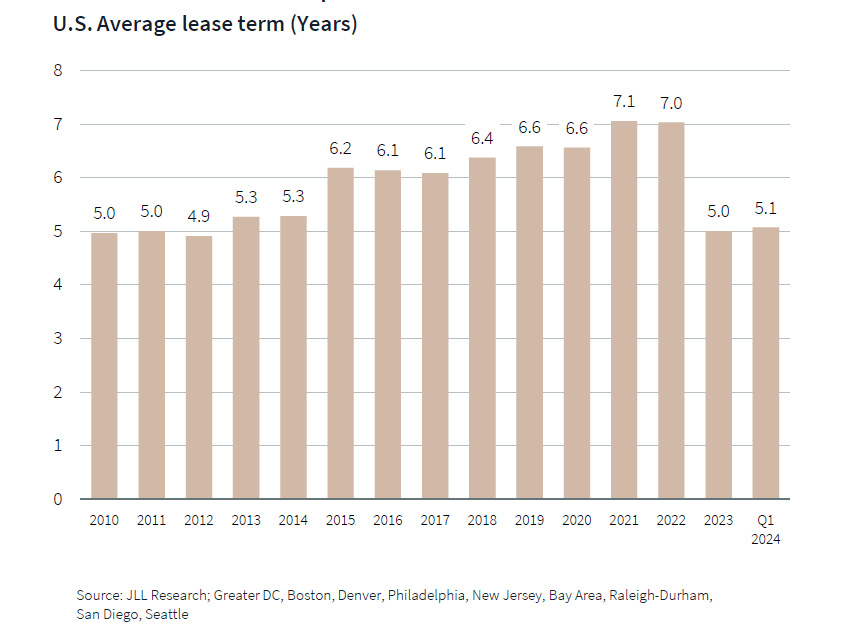

JLL also observed that lease terms are shrinking in an occupier-favorable market. In the second half of the last decade, demand started to outpace supply, giving landlords greater leverage. With supply outpacing demand as of late, tenants are now pushing for shorter lease terms, particularly startups.

The report notes that shorter leases are particularly evident in smaller and midsize deals, which make up the majority of activity now. The average term has decreased by 2 years for middle-market deals and by almost 1.5 years for smaller deals, compared to 2 years ago. Lease terms in the first quarter of 2024 were at an average of 5.1 years.

You must be logged in to post a comment.