Life Science Sector Faces Challenges, Yet Recovery Is in Sight

What’s driving the market and when the supply-demand imbalance might ease, according to JLL’s latest report.

With a severe supply-demand imbalance intensifying in most major lab markets across the U.S. in the past year, the overall national lab availability rate has increased to 30 percent and rents have fallen by nearly 9 percent, back to the start of the downturn in early 2022, according to JLL’s new life science real estate perspective and cluster analysis report.

While the short-term market for life science real estate continues to be challenging, JLL’s experts note there is optimism for the sector long term. Demand for U.S. life science real estate has increased for the past three quarters, with 3 percent growth in the second quarter of 2024.

In other positive news, the report states demand for space in Boston was about even with 2019 levels; the San Francisco Bay Area is about 30 percent above pre-COVID levels; and San Diego is seeing more than 60 percent higher demand than in the first quarter of 2019.

Other reasons for optimism cited in the report include life science employment growing by 2 percent and new company growth climbing more than 10 percent higher than 2024.

JLL also noted 2023 was a banner year for FDA approvals and 2024, while slightly lower, is still within range of recent years. Biotechnology patent innovation was 22 percent higher in 2023 than it was in the prior decade, which should result in more company creation.

Pharma sales are projected to be more than 80 percent higher in 2030 than in 2023, driven by doubling of revenues from biologics. Growth capital is also expected to rebound. JLL notes the largest 20 or so life science venture firms, which have raised $2.4 billion a year in the past decade, have been raising that amount every four months since January. That means they are likely sitting on dry powder waiting to deploy.

Market equilibrium to vary

However, the return to market equilibrium will vary widely by geography as the industry works through the supply-demand imbalance created post-pandemic as billions of capital flowed into the life science sector, often from new entrants seeking investment opportunities. Some markets and submarkets may recover within two years while others may take from four to five years to recover.

“The real estate recovery could come sooner than 2030 for many markets,” Mark Bruso, JLL director, Boston and National Life Sciences Research, told Commercial Property Executive. “If there is one thing we know about the biotech industry, it’s when it shifts its gears into growth mode, it can grow quite fast.”

Bruso said the submarkets to recover first will be those long-established hubs and markets which avoided the supply excesses of 2020 to 2022.

“But certainly, there could be pockets across the U.S.—I am thinking of severely oversupplied submarkets today with not a lot of leasing to speak of—that might not see a market of equilibrium until (2030),” Bruso said.

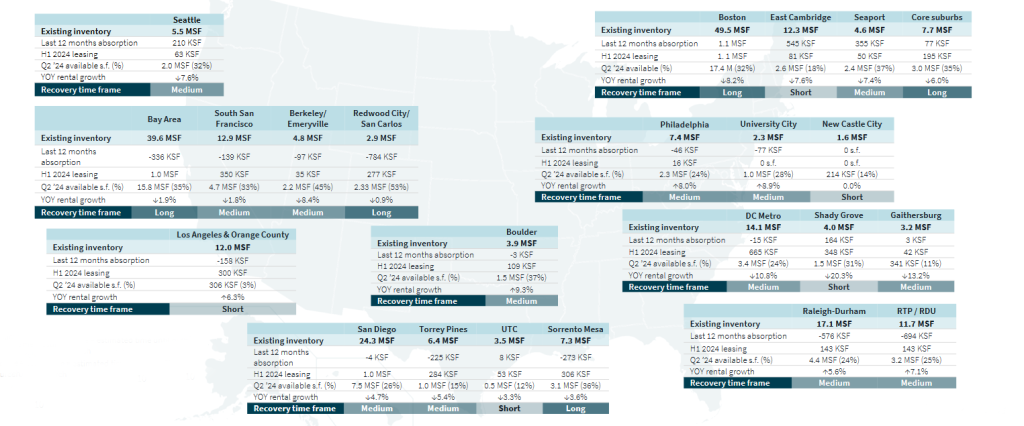

In the report, JLL outlines major markets and submarkets across the U.S. and breaks down the expected timeframe to return to equilibrium as short, medium and long term.

“We think of a short return to equilibrium being sometime in the next two years. A long-term return being something north of four to five years from today. And medium being in between those two,” Bruso said.

The Bay Area with 39.6 million square feet of existing inventory is listed as having a long timeframe while the South San Francisco submarket with 12.9 million square feet of existing inventory is considered in a medium recovery timeframe. The Los Angeles market, which has 12 million square feet of existing inventory, is expected to have a short return to equilibrium.

In the San Diego, the overall market has 24.3 million square feet of existing space and is in the medium timeframe for return to equilibrium. One of the top submarkets, Torrey Pines, with 6.4 million square feet of existing inventory, is also expected to have a medium return. But another hot submarket, UTC with 3.5 million square feet of existing inventory, is listed as a short return. The Sorrento Mesa submarket with 7.3 million square feet of existing space, is expected to have a long return to equilibrium.

In Boston, the overall market with 49.5 million square feet of existing inventory is listed as a long return to equilibrium but the East Cambridge submarket with 12.3 million square feet of existing inventory is considered to have a short return. The Seaport submarket, with 4.6 million square feet of existing space, is expected to be in the medium timeframe, while the Core Suburbs, with 7.7 million square feet of existing inventory, are in the long timeframe.

“When we give a submarket a long-term estimate, it is because that market has a high amount of leasable space given its size and historical leasing volume,” Bruso said. “So even when things normalize, it will take those submarkets additional time to find a neutral market.”

Bruso also pointed to long-established submarkets like Kendall (in the Boston market) and Torrey Pines where it is exceedingly hard to develop new projects because of a critical lack of developable parcels.

“Some submarkets had both excess land sites and old offices converted while the market was hot between 2020 and 2022 and provided a one-two punch of excess lab space once the market turned,” he said.

Pipeline slowing

JLL projects the “supply supercycle” will end within the next six to 12 months, depending on the market. It is expected to be followed by a period with limited new supply and repurposing of older lab assets to boost recovery.

The total U.S. lab inventory at mid-2024 was 171.6 million square feet compared to 151.1 million square feet in mid-2023, up 20.5 million square feet. Occupied lab space at mid-year was 130.8 million square feet compared to 131 million square feet at mid-year 2023. The pipeline is beginning to slow with 19.1 million square feet of space halfway through this year compared to 38.4 million square feet of space at mid-year 2023, down 19.2 million square feet.

Asked about the pipeline beyond 2025, Bruso said he does not expect to see much if any groundbreakings in the next 18 to 24 months. He added it would be hard to envision speculative projects breaking ground unless they have a great location, sponsor and infrastructure.

“There will be one-offs of build-to-suits for flagship biopharmas that come out of the ground, but those will be limited to the most long-established submarkets. Otherwise, developers, investors and lenders will want to see definitive evidence of supply coming in check before there is an appetite again for speculative development,” Bruso said. “Beyond that it is difficult to say, but we will not be seeing anything even remotely approaching the scale of development of the past few years for the rest of this decade.”

AI impacts on life science

The report notes venture capital funding, critical to predicting future demand for lab space, has shifted over the past year. The first half of 2024 saw a 34 percent increase in total venture investment in the U.S. life science sector, but VC firms have been focusing more on mature, later-stage clinical assets, which creates challenges for the smaller, early-stage biotechs. Those firms are seeing deal flow cut in half compared to 2019.

Venture funding has also morphed into what JLL calls “mega-rounds” of more than $100 million. Those represent 60 percent of venture funding inflows compared to 40 percent in 2023. JLL also noted 12 percent of all sector VC dollars are heading to artificial intelligence/machine learning companies. That level of funding is already higher than all of 2023.

Bruso said as the costs to develop new therapies have skyrocketed, biopharma companies have been levering AI and machine learning technology for years. Use of this technology in the drug discovery phase can help companies identify the most promising molecules and cut down on the time and cost to get a drug to market.

With the growing influence of AI, JLL added a new ranking to its annual report. Top markets for talent were also added this year.

The San Francisco Bay Area was ranked as the top market for AI and accounts for half of all AI/ML biopharma venture funding since January 2023. Boston, which received one-fifth of AI/ML biopharma venture funding was ranked second. Los Angeles (3), San Diego (4) and Chicago (5) rounded out the top five markets. When it came to assessing market strengths for AI investments, the concentration of talent and funding were big indicators of trailblazers in the emerging space.

Top life science clusters

When determining the top overall life science clusters, JLL Research analyzed key fundamentals and drivers that differentiate markets, including growth, density and momentum across talent, funding and real estate fundamentals.

Not surprisingly, Boston (1), San Francisco Bay Area (2) and San Diego (3) continue to be the top three markets for life science commercial real estate in the U.S. They are mature clusters have been at the apex of life science activity for years with an established talent and funding base and the real estate infrastructure to support activity.

The rest of the top 10 life science clusters as ranked by JLL are: Greater D.C. and Baltimore (4), Raleigh-Durham, N.C., (5), Los Angeles (6), New Jersey (7), Philadelphia (8), New York City (9) and Seattle (10).

For the second year, JLL Research also ranked the top five markets for medtech and biomanufacturing. In the medtech list, Los Angeles placed first followed by Minneapolis (2), San Francisco Bay Area (3), Boston (4) and Salt Lake City (5).

This year, Boston took the top biomanufacturing spot from Raleigh-Durham, which placed third. Other markets were New Jersey (2), Greater D.C. and Baltimore (4) and the San Francisco Bay Area (5).

You must be logged in to post a comment.