Lincoln Property JV Lands $74M for Spec Logistics Project

The company has teamed up with One Investment Management to develop the property.

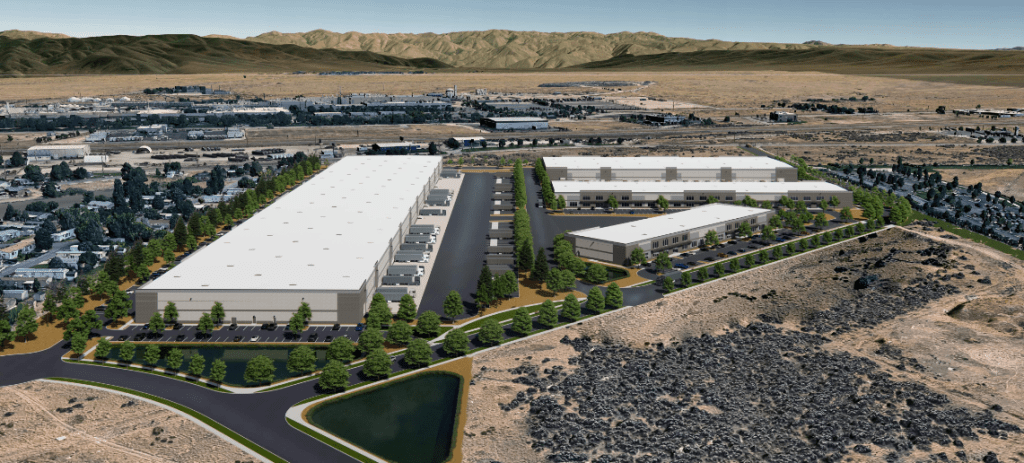

Affinius Capital LLC has originated a $74.2 million loan to finance the construction and lease-up of Eastport Logistics, a four-building, 681,920-square-foot industrial project in Boise, Idaho.

The developer is a joint venture of Lincoln Property Co. and global alternative investment management firm One Investment Management. OneIM was founded in 2022 and currently manages about $8 billion in assets from offices in New York City, Abu Dhabi, London and Tokyo.

The project will be developed on a 78.4-acre site only 5 miles from the Boise Airport and directly across from semiconductor giant Micron Technology’s local facility, which is just east of I-84 and just south of Hwy. 21. Micron reportedly is investing $15 billion to expand its Boise campus with a new enhanced fabrication plant and increased R&D space.

READ ALSO: What Trump’s Tariffs Could Mean for CRE

The four buildings at Eastport Logistics will feature clear heights up to 32 feet, 175 dock doors, 10 drive-in doors, 88 trailer parking stalls and 795 car parking spaces. Building sizes will range from about 52,000 to 379,000 square feet, capable of being configured for both smaller tenant spaces and users with larger requirements.

Cushman & Wakefield acted as the joint venture’s exclusive capital advisor in securing the loan.

In a company statement, Affinius Capital Managing Director Tom Burns remarked that the project is likely to attract both tenants affiliated with Micron, as well as complementary businesses seeking strategic proximity.

Increasingly, more than potatoes

Just last month and based on CommercialEdge data, Commercial Property Executive profiled the nation’s top emerging industrial markets, among which is Boise. Driving factors there include population growth and corporate relocations, which induced a 1.2 million-square-foot construction pipeline at the end of 2024, amounting to 2.6 percent of the industrial inventory.

In January, Tractor Supply Co. announced plans to develop an 865,000-square-foot distribution center in Nampa, Idaho, about 20 miles west of Boise.

In late March, Affinius funded a $133 million refinancing loan for the second phase of Park303, a 2.4 million-square-foot industrial park in Glendale, Ariz., in metro Phoenix. The developer is a joint venture between Lincoln Property Co. and Goldman Sachs Alternatives.

You must be logged in to post a comment.