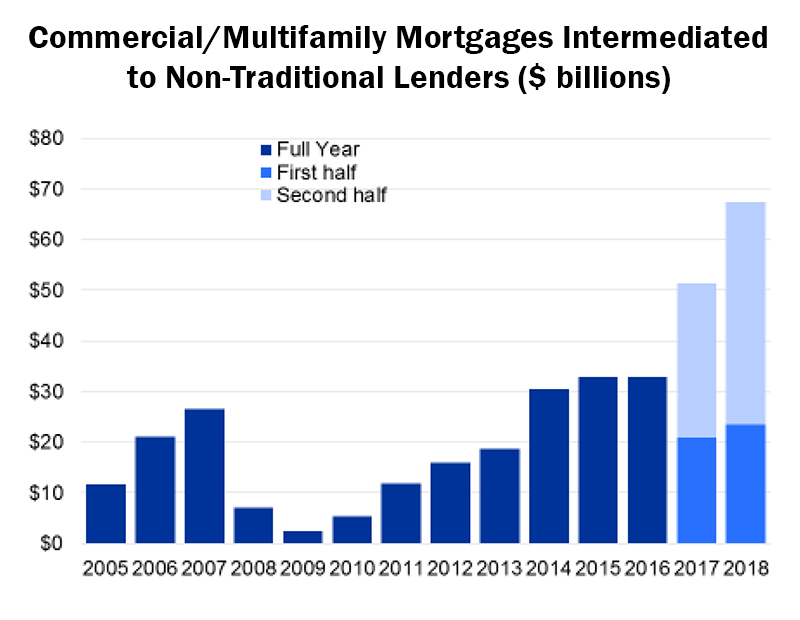

Loans Originated for Non-Traditional Lenders Up 50% Since 2016

Private funds, mortgage REITs and other investor-driven debt providers accounted for nearly 13 percent of intermediated mortgages last year.

Source: Mortgage Bankers Association CREF Database and Originator Rankings

Commercial and multifamily mortgage lending has been at or near record levels the last two years. Part of that strength comes from strong appetites from traditional lenders like banks, life companies, Fannie Mae, Freddie Mac, FHA and the commercial mortgage-backed securities market. Another source is the growth of other lenders.

MBA’s preliminary estimates suggest approximately $67 billion in commercial and multifamily mortgages were intermediated for debt funds, mortgage REITs and other investor-driven lenders in 2018. That’s an increase from $52 billion in 2017, and more than double the amount in 2016 ($32 billion).

MBA expects mortgage origination volume to hold steady in 2019 to around $530 billion ($526 billion in 2018), with non-traditional lenders poised to have another active year.

You must be logged in to post a comment.