Los Angeles Regional Food Bank Buys Industrial Asset for $52M

Newmark Knight Frank advised the nonprofit in its challenging search for a warehouse in the metro’s competitive market.

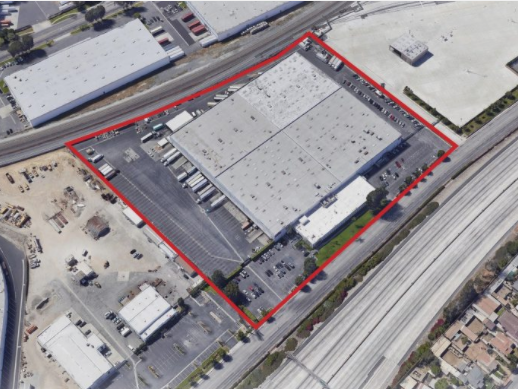

The Los Angeles Regional Food Bank has just acquired the industrial building at 2300 Pellissier Place in the City of Industry, a suburb of Los Angeles, from Haralambos Leasing Co. in a transaction valued at $52.1 million. The purchase of the approximately 255,900-square-foot warehouse wraps up a decade-long search for a suitable property, with Newmark Knight Frank having guided the nonprofit organization on the lengthy and challenging quest.

READ ALSO: Industrial Real Estate Faces Short-Term Decline in NAIOP Report

The closing of the 2300 Pellissier transaction comes at a vital time for the area’s Food Bank, as residents in the Los Angeles area grapple with COVID-19-induced food insecurity. Originally developed in 1969, 2300 Pellissier sits in the San Gabriel Valley region, roughly 15 miles east of the Food Bank’s downtown Los Angeles-area headquarters. The property occupies more than 11 acres and features ample parking, truck and trailer storage and nearly 25,000 square feet of high-end mezzanine office space.

With its large size and desirable quality, 2300 Pellissier is the type of asset that had consistently eluded the Food Bank in the highly competitive metropolitan Los Angeles industrial market, which has long held the title of one of the tightest—if not the tightest—industrial markets in the U.S. And the COVID-19 health crisis hasn’t had much of an impact on the market’s status. “While negative absorption is likely this year, Los Angeles is perhaps the most resilient industrial market in the country,” according to a second quarter 2020 report by NKF.

Industrial market resilience

If there’s a question as to whether the global pandemic has dampened the investment community’s robust appetite for the Los Angeles industrial market, well, John McMillan, vice chairman with Newmark Knight Frank, told Commercial Property Executive, “It hasn’t.” McMillan and colleagues Jeff Sanita, Danny Williams and Greg Stumm represented the Los Angeles Regional Food Bank in the 2300 Pellissier transaction, while Lee & Associates’ Peter Bacci and Jack Kline stood in for the seller.

“After a very brief pause from mid-March to early April, [investment activity] picked up right where it left off, and the appetite for industrial is arguably even larger than before now, as it has performed better than any other asset class through the pandemic,” McMillan continued. “We’ve been getting calls from institutional office and retail landlords a few times a week for the past few months too. They’re trying to get their arms around the industrial sector, given they still have significant funds to invest, and are considering diversifying. If some or all of those groups start to enter the market, it will get even more competitive to acquire quality industrial assets, especially in the infill markets.”

You must be logged in to post a comment.