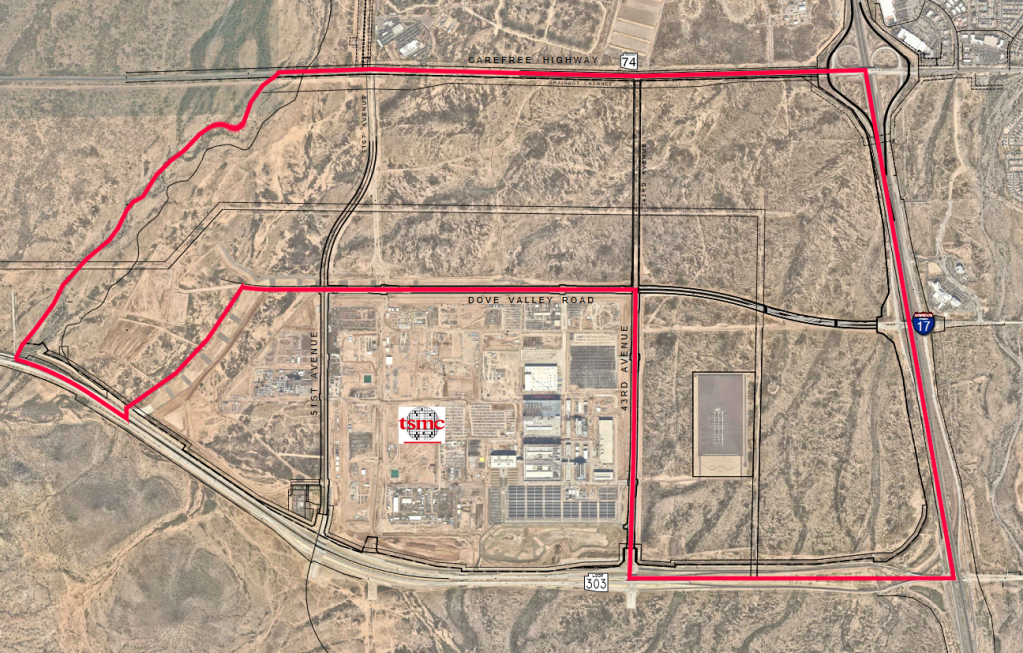

Mack Real Estate to Develop 2,300 Acres Near Phoenix

Plans call for a $7 billion master-planned development in the North Valley.

An affiliate of New York-based Mack Real Estate Group has won the rights to develop more than 2,300 acres of fully entitled land adjacent to the Taiwan Semiconductor Manufacturing Corp.’s semiconductor fabrication campus in Phoenix’s North Valley that could result in a $7 billion master-planned mixed-use development built over many years. McCourt Partners will be making a significant investment in the project through a joint venture with MREG.

Biscuit Flats Dev LLC was the only bidder at Tuesday’s land auction held by the Arizona State Land Department for the right to lead the development of what could be more than 28 million square feet surrounding the TSMC campus. TSMC has already committed $65 billion in its rapidly growing facilities with significant further investment expected.

The Phoenix Business Journal reported MREG spent more than $56 million to win the auction for the land surrounding the 1,100-acre TSMC site that will be known as Sonoran Oasis Science and Technology Park. Three semiconductor fabs are already under construction by TSMC and another three fabs are planned for a potential total investment of $120 billion. TSMC’s Arizona subsidiary has recently received as much as $6.6 billion in grants through the federal CHIPS Act toward construction of the third Phoenix fab. The company may also benefit from subsidies included in the federal Inflation Reduction Act.

READ ALSO: Mastering Supply Chain Challenges

The company is expected to be a huge economic and employment driver in the region with at least 10,000 permanent jobs created by TSMC and up to 80,000 jobs created in the Phoenix MSA by the TSMC business ecosystem. The influx of workers will drive demand for commercial and residential development across a variety of sectors including industrial, retail, office and residential.

Control of the site

Under an agreement with ASLD, the MREG and McCourt partnership will control land sales within the 2,300-plus-acre site, which will take place in stages over several years. The partners will also oversee the necessary infrastructure improvements, which PBJ stated could reach $1 billion. The joint venture will also have the right to develop approximately 600 acres across multiple uses.

MREG estimates up to 8,960 residential units will be built along with industrial, retail and office space. There are no specific plans outlined at this time for any of the projects, but PBJ reported MREG can develop or sell parcels to other developers once it meets certain requirements, including the infrastructure improvements. Infrastructure work could start as soon as 2025. Industrial uses are expected to be built on the western portion of the site that is situated on the northwest corner of Loop 303 and I-17 with mixed-uses like multifamily, retail and office space developed on the eastern section of the site closer to the interstate.

Phoenix footprint

MREG, a national real estate investment and development firm, already has a strong Phoenix presence. The firm is currently building more than 4 million square feet of industrial space across Mack Innovation Park Deer Valley. In October 2022, MREG selected Stream Realty to be the leasing agent for the master-planned industrial development located within 10 minutes of TSMC. MREG is also building an industrial development on 124.7 acres in North Scottsdale known as Mack Innovation Park.

Additionally, MREG’s multifamily portfolio in Phoenix consists of more than 900 units owned or under development. Since 1987, Mack-related entities have invested in or developed more than 10 million square feet of industrial, office, retail, and multifamily properties in Phoenix.

You must be logged in to post a comment.