Manhattan Office Report – Spring 2019

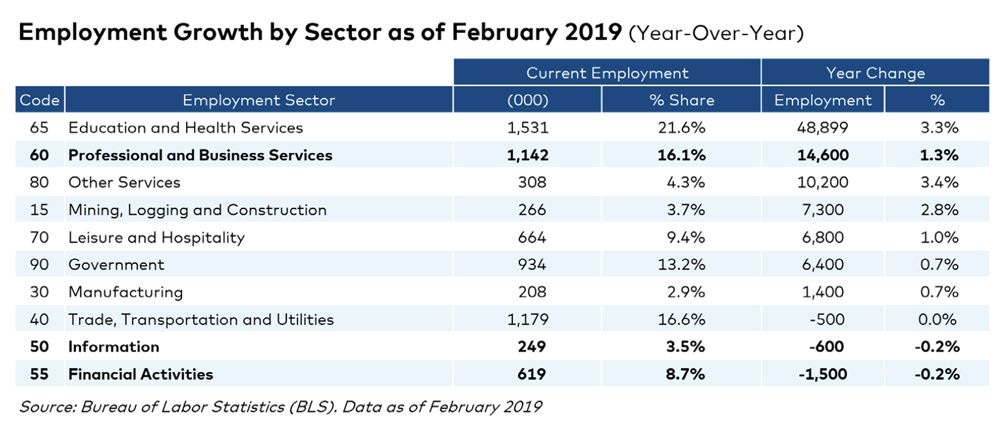

Although more than 14,600 professional and business services jobs were added in the metro, the financial activities sector lost 1,500 positions due to industry restructuring and business consolidations.

Manhattan’s robust economy, dynamic business environment and sustained job growth have been paving the way for a favorable office market. Mayor de Blasio’s New York Works plans, along with million-dollar private funding, will fuel the next generation of innovation in the metro, encouraging economic and job growth. With Facebook’s planned expansion and Google’s new Hudson Square campus, as well as major flexible workspace provider expansions and government and nonprofit leases, the metro’s office market is well-positioned for the next economic downturn.

READ THE FULL YARDI MATRIX REPORT

The professional and business services sector led the way in job growth, with more than 14,600 positions added in the 12 months ending in February. The financial activities sector lost 1,500 jobs due to industry restructuring and business consolidations. However, long-term headquarters commitments by Google, Deutsche Bank and the Walt Disney Co. are projected to add thousands of office-using jobs in the coming quarters.

Following the opening of the first phase of the Hudson Yards megaproject, office vacancy was highest in Lower Manhattan’s World Trade Center (18.2 percent at the end of March). The available blocks of space are rapidly filled in, as most of Manhattan’s up-and-coming space is pre-leased. Coworking is adding value to the existing inventory. The development pipeline comprises more than 22 million square feet of office space, with development activity concentrated in Chelsea (10.7 million square feet underway).

You must be logged in to post a comment.