Manufactured Home REITs Out In Front

At the end of May, this sector was clearly outperforming its peers. On an individual basis, however, the best results came from an office company followed by an industrial company, according to S&P Global.

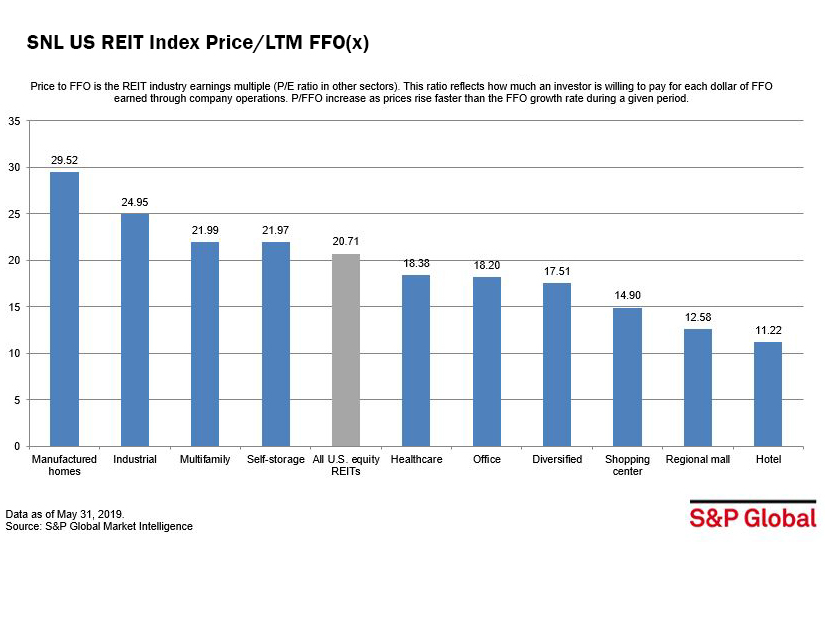

As of May 31, 2019, the manufactured homes sector led all publicly traded U.S. equity REIT sectors in terms of the last 12 months funds from operations multiple. The sector posted a 29.5x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 8.8 percentage points. The industrial and multifamily REIT sectors followed with multiples of 24.95x and 21.99x, respectively. The hotel sector ranked last with a 101.22x price to LTM FFO.

As of May 31, 2019, the manufactured homes sector led all publicly traded U.S. equity REIT sectors in terms of the last 12 months funds from operations multiple. The sector posted a 29.5x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 8.8 percentage points. The industrial and multifamily REIT sectors followed with multiples of 24.95x and 21.99x, respectively. The hotel sector ranked last with a 101.22x price to LTM FFO.

Among the REITs focused on manufactured homes, UMH Properties Inc. had the highest multiple of 49.3x, and ended May with a share price of $13.31.

CIM Commercial Trust Corp., an office REIT, had a 61.8 LTM FFO multiple, the highest among the publicly traded U.S. equity REITs and traded at $21 per share as of May 31. Innovative Industrial Properties followed with a 60.9x price to LTM FFO while trading at $84.03 per share.

Carter Phillips is an analyst in the real estate client operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.