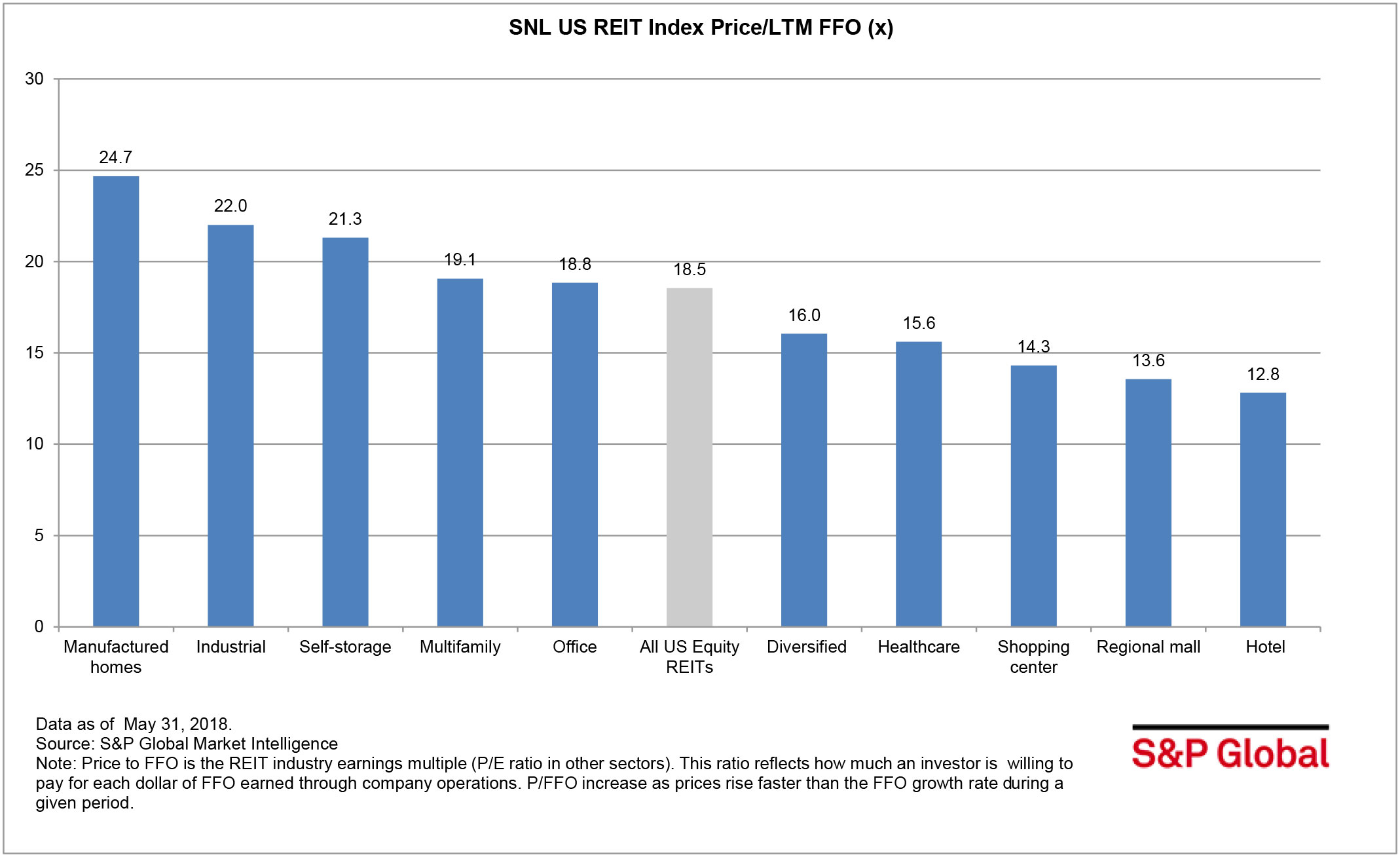

Manufactured Home REITs Outperform Market

The sector had the largest last-12-months funds from operations multiple of all publicly traded U.S. equity REITs, at 24.7x, according to S&P Global Market Intelligence data.

By Khamile Armhynn Sabas

As of May 31, the manufactured homes sector led all publicly traded U.S. equity REIT sectors with the largest last-12-months funds from operations (LTM FFO) multiple, at 24.7x, outperforming the SNL US REIT Equity Index by 6.12 points. The industrial and self-storage REIT sectors followed, with multiples of 22.0x and 21.3x, respectively. The hotel sector ranked last with a 12.8x price to LTM FFO.

Among the manufactured homes-focused REITs, Equity LifeStyle Properties had the highest multiple, at 25.3x, and ended May with a $90.90 price per share.

Equity Commonwealth, an office REIT, had a 43.8x LTM FFO multiple, the highest among the publicly traded U.S. equity REITs, and its common stock closed at $31.11 price per share as of May 31. Safety, Income & Growth Inc., a diversified REIT, followed with a 35.4x price to LTM FFO, while closing the month at $19.18 price per share.

– Khamile Armhynn Sabas is a senior analyst in the real estate client operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.