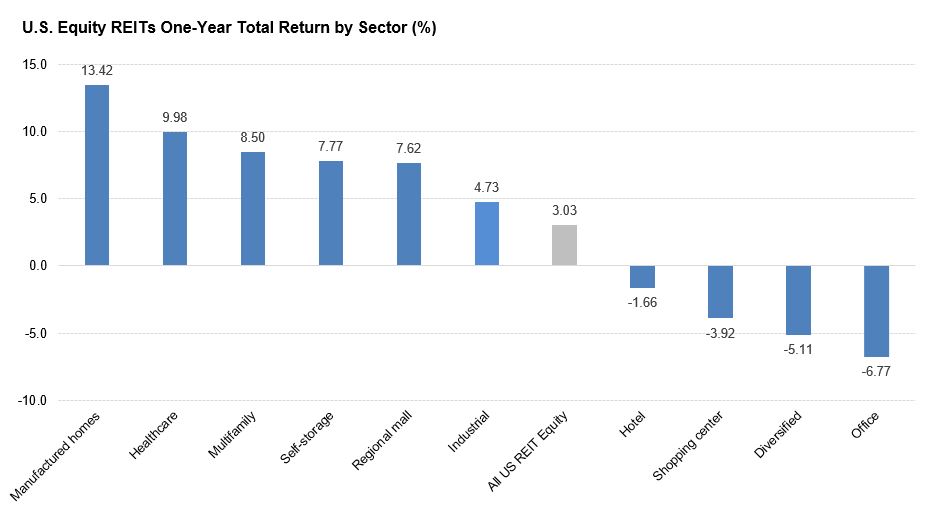

Manufactured Home Sector Beats U.S. Equity REIT Index

S&P Global Market Intelligence reports positive one-year total returns across property sectors, with the notable exception of office and retail.

By Raph Canillas

Note: Data as of Nov. 30, 2018.

Source: S&P Global Market Intelligence.

As of November 30, publicly traded U.S. equity REITs posted a 3.03 percent one-year total return.

The manufactured home REIT sector lead the industry with a 13.42 percent total return, beating the broader U.S. equity REIT index by 10.39 percentage points. Health-care and multifamily REIT sectors followed with 9.98 percent and 8.50 percent one-year total returns, respectively.

On the other end of the spectrum, the office REIT sector reported a negative 6.77 percent one-year total return, as of November 30. Diversified and shopping center REIT sectors trailed closely reporting negative 5.11 percent and 3.92 percent one-year total return, respectively.

You must be logged in to post a comment.