Manufacturing’s Comeback Gains Ground

Federal legislation and the quest for resiliency have boosted the construction and leasing of production facilities. Will the momentum continue?

Next to e-commerce and data centers, the biggest thing to happen in industrial real estate over the past few years has been the return of manufacturing. Some U.S. manufacturers are bringing their production facilities home or to nearby Mexico, while new manufacturing operations for products ranging from health-care equipment to high-tech components are growing by leaps and bounds. Once again, the manufacturing sector is providing good-paying jobs, along with a boom in development.

The significant increase in manufacturing since the COVID-19 pandemic is partially due to producers looking to “de-risk” their supply chains by building capacity near the American consumer, as well as new federal subsidies via the Chips and Science Act and Inflation Reduction Act, said Seth Martindale, senior managing director for Americas Consulting at CBRE.

READ ALSO: The Yin and Yang of Interest Rate Cuts

According to JLL, 450 major U.S. manufacturing projects have been announced since 2020 thanks to federal grants, tax credits and other incentives enacted under the Biden Administration, as well as state incentives, according to Greg Matter, JLL executive managing director & leader of JLL’s Advanced Manufacturing team.

“States/regions at the intersection of people, power and place have been the recipient of most announcements,” said Matter, noting these have the labor availability, reliable and sufficient power, site characteristics and business-friendly environments that manufacturers seek.

Sweetening the deal

The Chips and Science Act, which focuses on increasing U.S. semiconductor production established: an Advanced Manufacturing Investment Tax Credit equal to 25 percent of the qualified investment for the taxable year, provided facility construction begins prior to Jan. 1, 2027; the CHIPS for America Fund, which provides grants up to $49.5 billion to develop such facilities; and the CHIPS for America Workforce and Education Fund, which provides $200 million in loans and loan-guarantee funding for workforce development activities.

The IRA, which focuses on climate-related sustainability, provides both grants and tax incentives for investment in facilities that manufacture products and provide services that have a positive impact on reducing CO2 or conserving natural resources, as well as facilities that produce or store alternative energy.

State tax grants, discretionary incentives, tax credits, exemptions and abatements may also be available for the same investments, resulting in significant additional value to projects when combined with incentives provided under the IRA or CHIPS Act, noted a report from Deloitte.

While federal incentives are focused on promoting certain types of product manufacturing, regional incentives may have strings attached, Matter warned. “Manufacturers must remain eyes wide open when accepting a government incentive for their new location, as these incentives are often designed to promote development in economically challenged areas, and many are in rural locations with inadequate labor,” he said.

The benefits of regionalizing

The U.S. move toward protectionism is not just an American phenomenon, according to Chicago-based Adam Roth, executive vice president at NAI Hiffman. Concerns about supply-chain risk, economic and national security, and climate change are ushering in a new era of protectionist policies globally, which means more tariffs are on the horizon, he contended.

When the international supply-chain was shattered by the pandemic, Roth said, companies no longer viewed off-shoring as economical or efficient. Now corporations are being forced to reassess their network to reduce their length-of-haul and risk, even though it will cost them more, he added. They also are embracing the sustainable benefits of regionalizing production.

While manufacturing growth is occurring across a range of industries, innovative, future-oriented segments of the manufacturing sector have emerged as the focus of most new investment, with electric vehicles, EV batteries, semiconductors, clean energy and biomanufacturing capturing 90 percent of investment in manufacturing facilities, according to Newmark Vice Chairman Adam Faulk.

However, defense, microelectronics and life sciences manufacturing are the most critical industries to reshore for national security, Matter said. The Department of Defense, for example, has identified kinetic capabilities (missiles); energy storage and batteries, including raw materials; casting and forging metals and composites; and microelectronics, primarily semiconductors, as critical to national security.

READ ALSO: Challenges and Solutions for Expanding EV Manufacturing

Construction spending on manufacturing projects during July 2024 was estimated at a seasonally adjusted annual rate of $237 billion, according to the U.S. Census. Matter noted that since 2021, there has been over 78.4 million square feet of planned greenfield development for EV and EV battery facilities alone, 43.2 million square feet of which is currently under construction.

Investment in manufacturing facilities completed, underway or planned over the past four years totaled more than $530 billion and comprised about 270 million square feet in new manufacturing space, according to Faulk.

The surge in new manufacturing development is generating other types of industrial development to house suppliers, assemblers and warehousing. For example, the Tennessee Department of Economic and Community Development estimates that besides the $11.4 billion invested in EV and EV battery factories at BlueOval City in Stanton, Tenn., another $5.2 billion in capital will be invested in support facilities, such as suppliers and warehousing.

What is going where?

Nationally, manufacturing represented 21 percent of 4Q 2023 of industrial leasing activity tracked by Newmark. Demand was particularly strong around new manufacturing ecosystems in the Texas Triangle and Southeast portion of “the Battery Belt,” which includes the Carolinas, Georgia, Tennessee and Kentucky, while the Southeast and Midwest are dynamic markets for EV production, forming the so-called “Battery Belt,” Faulk said. “This is a significant uptick from even the previous 4Q period (3Q22 to 2Q23), when the manufacturing leasing share was 15 percent.”

On the East Coast, for example, Georgia has been an early winner of manufacturing development, though there are constraints on labor and power in light of influx of demand.

In the West, Phoenix has been favorable for the same reasons, including proximity to many R&D functions based in California, and is the winner in semiconductors, with “almost 5 million square feet under construction between TSMC Arizona and Intel,” Matter continued. Phoenix also leads all markets in terms of the number of major manufacturing investments and job announcements. But he noted that Arizona, Texas and Ohio are significant hubs for semiconductor manufacturing.

Midwestern states are popular manufacturing destinations due to the existing ecosystem and concentration of skilled manufacturing labor, although unionization rates have driven some companies to consider Sun Belt states like the Carolinas, Matter said.

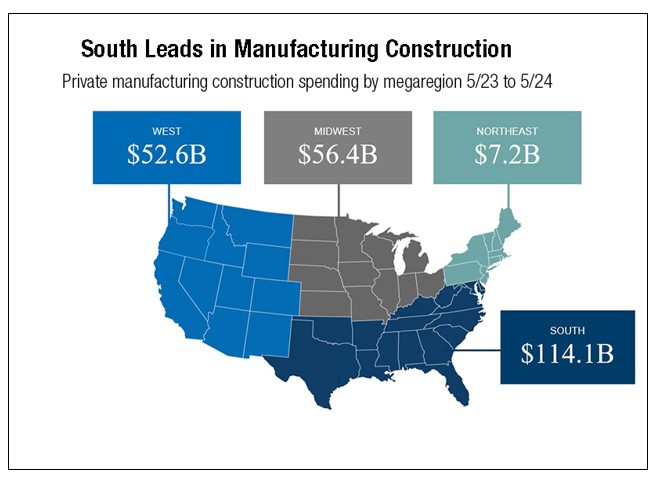

“But in terms of megaregions, the South is ascendant,” Faulk said, noting that between May 2023 and May 2024, $114 billion in spending on manufacturing construction was in the south, nearly as much as the rest of the country. (See chart)

A partnership of Houston-based Hines and New York-based Galesi Group, for example, is developing 1.7 million square feet of logistics and industrial space on a 150-acre site in Austin in proximity to Samsung’s new $17 billion semiconductor factory on the edge of Austin and a nearby Tesla Gigafactory. The first phase of this master-planned business park includes three Class A industrial warehouses totaling 315,000 square feet to accommodate tenants with a need for 30,000 to 150,000 square feet.

According to Matter, EV and EV battery manufacturers have 22.4 million square feet under construction in the Midwest, 16.8 million square feet in the Southeast, and 12.5 million square feet in the West. Popular destinations for EV facilities are Michigan, Arizona and Georgia, which had announcements of 22.1 million square feet alone.

Matter contended, however, “Full-scale production jobs are likely to be located in the Rust Belt due to the depth and experience of machine operators and assembler talent.” Additionally, for research and development, proximity to engineering talent and access to capital partners is key.

“For ‘pilot-line’ production (producing small quantities of a new product or technology on a pre-commercial basis), the first step in commercialization and design iterations are necessary and timelines are critical,” he continued, noting that advanced manufacturers try to balance proximity for engineers traveling from an R&D facility (same-day travel) with quality and cost-effective technicians running the pilot facility. Arizona and Colorado in the West and Georgia and North Carolina in the East are popular destinations for this type of manufacturing, Matter said.

At scale, Matter also noted, access to broad, lower-cost talent in business-friendly markets is preferable to keep operating costs low to maximize profitability, but at full-scale, manufacturers are competing for the same labor, regardless of the industry. “Although some markets have their specializations (Silicon Valley for hardware, Raleigh for biotech or Houston for energy), manufacturers need access to assemblers, fabricators and machine operators at scale,” he explained. These skills are transferrable across industries, so even biomanufacturers will be competing with a gigafactory for the same production labor.

Manufacturing by-products

A recent update to an initial survey of manufacturing projects conducted in early 2023, revealed that numerous projects that were expected to qualify for grants have been delayed, curtailed or outright canceled because they did not actually meet the qualifications. However, other new projects have been announced in the same markets, Faulk said.

He noted that some have been replaced by even bigger projects. For example, when domestic chipmaker SkyWater Technologies canceled its $1.8 billion facility in West Lafayette, Ind., South Korean chipmaker SK Hynix announced that it planned to build a $3.87 billion chip packaging facility in the same region, and Eli Lilly announced an additional $5.3 billion investment to expand the size of its 1 million-square-foot manufacturing campus underway in nearby Lebanon, Ind.

The challenges of home-shoring

Starting up new U.S. manufacturing facilities is easier said than done. Experts say the chief barriers to manufacturing development are the availability of: skilled labor; critical infrastructure, such as transportation access (served by rail, port or major highway), water, and power capacity and reliability; and large swaths of land. Top concerns are also cost of construction; governmental limitations, such as zoning changes and time to secure entitlements and permits; and climate-related issues.

“In addition, NIMBYism is becoming increasingly more prevalent across business-friendly states/cities, given the level of near-term growth that has occurred,” added Martindale. “Finding a business-friendly state/city that has an available site with adequate infrastructure, ample labor and a supportive community is increasingly difficult.”

But increasingly, the biggest constraint is access to power, Faulk stressed, as manufacturing projects compete with more energy-intensive and AI-driven data center projects. “Power cost, access, reliability and sustainability (i.e., green power) can make or break a project,” he continued. A 25MW power requirement, for example, could mean a difference of millions of dollars in cost from one region to the next, and there are a limited number of sites today that can accommodate this requirement.

Site selection is difficult because there are a limited number of places that can support a large manufacturing plant, Roth noted. “If I’m going to develop something that’s going to be over $50 million to a couple billion dollars, it’s going to have the critical infrastructure for my production, and climate is part of the site selection process,” he said.

Roth cited the Chicago region, for example, as an ideal location for manufacturing because it has all the attributes required: plenty of water with the Great Lakes on its doorstep, lots of large parcels available for development, a large population of experienced manufacturing talent, low climate change impact and a business-friendly environment. Additionally, the State of Illinois has an excess of power as the national leader in nuclear power production, and offers a variety of tax credits and other incentives for manufacturing development.

Further, companies that haven’t developed projects recently experience “sticker shock” when informed of today’s construction costs, noted Chris Jardis, managing director & industry leader for Industrials, JLL Project and Development Services.

He also pointed out that skilled construction labor may cost more when developing large-scale projects in rural areas, as the pool of proximate, talented, competent subcontractors often falls short of what is needed and companies have to pay craftsmen higher than usual wages to travel to remote worksites.

In addition, Jardis said that while governmental lead times have eased for many assets from their peak during the pandemic, lead times to secure large power distribution equipment continue to be a challenge for many developments, often extending beyond one year.

What’s on deck for onshoring?

Onshoring is poised to reshape the U.S. industrial landscape, suggested Faulk. “As more projects move forward, it will continue to create significant opportunities in real estate, job creation, and economic growth, though managing challenges like skilled labor shortages and energy constraints will be critical to sustaining momentum,” he said.

However, with uncertainty about what changes might be enacted to existing federal programs following the 2024 election, some firms are being cautious about making capital expenditures right now due to the potential for new or countermanded policies or macroeconomic fluctuations when a new administration takes over. “With massive federal incentive programs, the risk of wasting money and time is significant, and some projects may be mired in delay or end in failure,” Faulk said.

He is optimistic, however: “Messaging and policies may shift and evolve, yet bolstering U.S. manufacturing and repatriating domestic supply chains is fundamentally a bipartisan issue, and it’s likely that federal carrots and/or sticks will continue to drive this monumental manufacturing shift into the next administration.”

Manufacturing jobs nearly doubled under the first two years of the Biden-Harris Administration compared to the first two years of the Trump-Pence Administration, with 754,000 new manufacturing jobs created under President Biden, compared to 462,000 new manufacturing jobs created under Mr. Trump, 50,000 jobs of which were lost prior to the pandemic—7,000 in 2016 and 43,000 in 2019, according to Factcheck.com. And thanks in part to Biden-era legislation, 3.8 million more manufacturing jobs are forecast to come online between 2024 and 2033, according to another Deloitte report.

You must be logged in to post a comment.