March Pricing Remains Flat

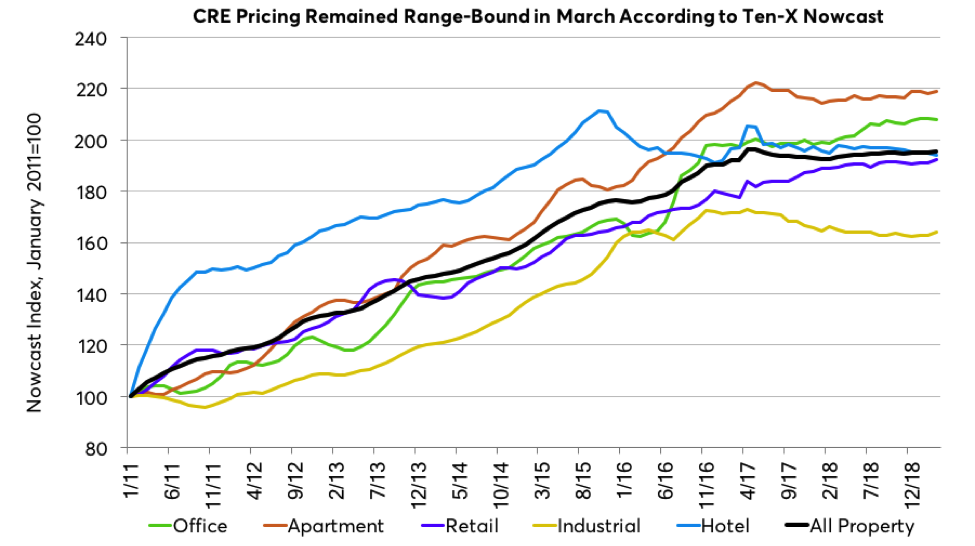

The Ten-X Commercial All Property Index increased 0.2 percent from February, but the year-over-year momentum in price continued to slow, to 1 percent.

The Ten-X Commercial Nowcast for March shows a continuation of the general flat trend for CRE pricing. The Ten-X Commercial All Property Index increased 0.2 percent in March from February, but the year-over-year momentum in price continued to slow, to 1 percent. As has been the case in recent months, pricing was mixed across the property segments on a month-by-month basis but the overall picture remains one of fairly flat pricing across all the segments.

The Ten-X Commercial Office Nowcast, which has demonstrated the most relative strength in recent months, dipped 0.2 percent in March, slowing the annual price gain in the segment to 4 percent. Office pricing weakness was evident across the country, with only the Southwast posting a monthly gain.

Hotel property pricing also slipped in March, falling 0.4 percent according to the Ten-X Commercial Nowcast. This leaves pricing down 2 percent from a year ago. Hotel operating conditions have softened: occupancies remain stable at a very high level, but room rate growth has slowed, bringing RevPAR growth with it, while costs are being squeezed by rapidly increasing labor costs. Weakness was also evident on all regions save the Northeast, but even there, a 0.4 percent monthly gain left hotel pricing in the region down 1.4 percent year over year.

The Ten-X Commercial Industrial Nowcast broke a negative trend that has been in place since mid-2018 in March, rising 0.7 percent. This left the index down 0.7 percent from a year ago, an improvement from the 2 percent to 5 percent annual declines that we had been seeing. Nevertheless, industrial segment fundamentals have softened, with vacancies edging up and rent growth slowing as supply has picked up, so this dovetails with the generally soft property pricing for the segment. Pricing was particularly strong in the Northeast, which saw an over 3 percent jump in a month. The Southeast also posted a modest gain while all other regions saw pricing ebb slightly lower.

Retail pricing was up 0.6 percent in March according to the Ten-X Nowcast, but property pricing growth remains subdued overall, up just 1.6 percent year over year. Retail property pricing actually increased in all regions in March, with the strongest gains in the Midwest and Southeast.

Apartment price growth also remains subdued according to the Ten-X Nowcast. A 0.4 percent increase in March brought pricing up 1.6 percent from the same time last year. Apartment vacancies have been edging up, approaching 5 percent after an extended run at a very low level near 4 percent. This primarily reflects increased supply, as demand has continued to be healthy. Rent growth remains strong, however, given the still-low vacancy rate. Pricing was up modestly in all regions save the Southeast in the month.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.