Market Snapshot: Los Angeles Shines Bright–and Not Because of the ‘Stars’

Los Angeles seems to be very much in tune with larger national expectations in 2015.

By Alex Girda, Associate Editor

With the construction of residential units hitting new highs–around 300,000 new units are set to come online this year–around 300,000 new units are set to come online this year, according to Pierce-Eislen—the Los Angeles multifamily market seems to be very much in tune with larger national expectations in 2015. Downtown carries a lot of the upcoming new inventory, so the area will be tested in terms of the growing appeal it has created with the younger demographic which is currently looking for more urban living.

According to recent market data from Marcus & Millichap, new developments will increase the city’s housing stock by 0.8 percent, a total of 8,500 units being scheduled for completion this year. This will mark a dip compared to the 10,200 residential units that were added to the inventory during 2014. However, vacancy rates are set to continue their descent by around 40 basis points in 2015, bringing the average vacancy rate in Los Angeles to approximately 3 percent.

In terms of transactions, sellers are expected to continue to have the upper hand, although multiple bidder situations will no longer be as frequent as they were in 2014. Upward pressure on interest rates will drive interest towards alternative investment opportunities, although the balance of power is not set to completely shift in 2015. Los Angeles County will remain a strong market for multifamily investors with best-in-class properties in the coastal areas carrying four percent cap rates or lower, with the eastern parts of the county seeing average cap rates of around six percent.

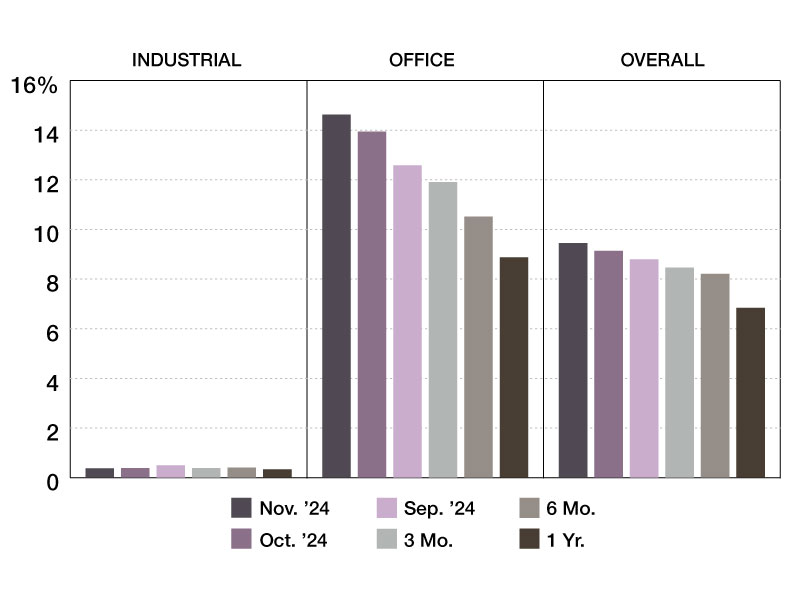

Chart courtesy of Marcus & Millichap

You must be logged in to post a comment.