Market Turmoil Dampens Mood at CREFC

Panelists weigh in on the future of commercial property transaction activity.

Commercial property transaction activity is set to tumble due to economic uncertainty and rising interest rates that have produced a sharp rise in mortgage rates, according to panelists at the CRE Finance Council’s annual conference this week.

The conference took place as turmoil roiled the financial markets. The Federal Reserve raised policy rates by 75 basis points, the biggest one-day jump in 28 years, in a bid to cool surging inflation. The consumer price index rose to 8.6 percent year-over-year in May, led by spiraling housing and energy costs.

READ ALSO: What Rising Interest Rates Mean for Net Lease Investors

After peaking at 36,585 in early January, the Dow Jones Industrial Index has dipped more than 20 percent and was under 30,000 this week. And more critically to commercial real estate, the 10-year Treasury yield has increased nearly 200 basis points and topped 3.40 percent this week, its highest level since January 2011.

Although commercial property fundamentals remain healthy in most sectors, the worrisome economic news increases the likelihood of a recession in coming quarters and is likely to put the industry in a holding pattern. “It’s been a while since we last discussed stagflation,” said CREFC executive director Lisa Pendergast. “No doubt, rising rates will impact mortgage and cap rates negatively, and recession can have a deleterious effect on property-level cash flows.”

Weakening capital markets

The commercial real estate market started the year on a high note, as transaction volume and property values hit all-time highs in 2021, a trend that continued into the first quarter of 2022. But the persistent nature of inflation prompted a re-evaluation of the Fed’s policy. Not only are rates rising but risk spreads are widening, as well.

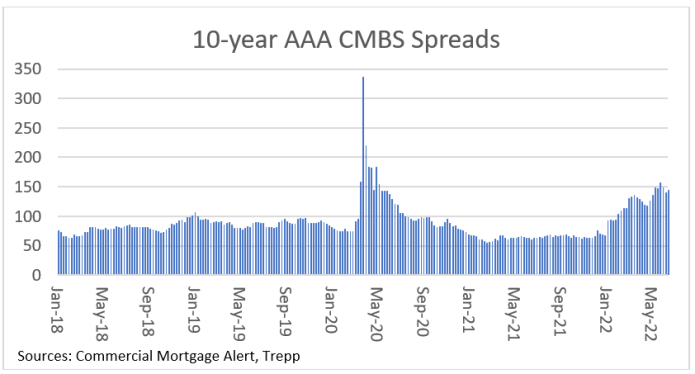

For example, the spread of senior 10-year triple-A CMBS has increased by more than 80 basis points over the past year, with that class priced to yield 145 basis points over Treasuries in a deal issued this week. The combination of rising rates and higher-risk spreads has increased the cost of mortgage debt by 200 to 250 basis points since the beginning of the year. That creates ripple effects throughout the industry, including:

- Increased acquisition yields, which erodes pricing. The average multifamily cap rate in 2021 was about 4.5 percent, but now mortgage rates for most properties are 5.5 percent or higher. Even assuming rents will rise as they have in some property segments, there are few deals that make sense when debt costs are higher than cap rates. Anecdotally, property values are down 10 to 15 percent, but the decline could extend further if the capital markets continue to erode.

- Transaction activity will plunge. Many institutions have stopped bidding, and buyers are pulling out of deals if they can. Sellers that do not want to accept the new lower price environment are taking properties off the market. “The market is going to slow while people digest what’s going on in the world,” said one CREFC panelist.

- Mortgage activity will drop. The cost of both fixed-rate and floating-rate debt has increased dramatically in a short time. “Borrowers that don’t have to borrow will be on the sidelines,” said a CREFC panelist. Said another: “All-in rates have gone up so much so fast that borrowers are looking at the rate (offered) and saying, “No, thank you.’”

- The increase in rates has the biggest impact on securitization programs, because their origination quotes are directly tied to bond spreads. Not only have CMBS and collateralized loan obligation (CLO) spreads widened but investors are increasingly picky about the property types in the collateral. Many investors are avoiding asset classes such as office, retail and hotel that have long-term demand questions. “Investors don’t want to be in a position where they buy a bond and the next day spreads are wider,” said one CREFC speaker.

- There will also be a deleterious effect on refinancing maturing loans that were originated when rates were lower. Although operating income has generally risen in recent years due to strong rent growth, borrowers may be refinancing with less leverage and higher rates. That could lead to an increase in defaults and/or maturity extensions.

Temporary blip or start of a downturn?

The new capital markets environment has even impacted government-sponsored enterprises Fannie Mae and Freddie Mac, which have raised rates and “are not as competitive as other capital sources,” according to multifamily loan executives. For the first time in many years, the GSEs are in danger of not meeting their full annual allocations, which were set by the Federal Housing Finance Agency at $78 billion in 2022.

Not every source of mortgage debt will be on the sidelines. Portfolio lenders do not have the same mark-to-market constraints and hedging risks of securitized lenders, so they will continue to originate on deals that meet their quality and return requirements. However, debt sources that are still originating loans are implementing a new focus on debt-service coverage and exit cap rate assumptions. Strong debt-service coverage means that loans must have enough cash flow to make payments even if the income deteriorates. Conservative exit cap rate assumptions reduce the overly optimistic growth assumptions that have led to aggressive lending in past cycles.

Many of the participants at the CREFC event—which hit an all-time high attendance record of 1,424—forecast that market activity will slow dramatically at least through the end of the summer. Whether the dip extends beyond then will depend on how the economy performs in the second half of the year and whether the Fed successfully manages to slow inflation without creating a sharp recession.

You must be logged in to post a comment.